A land of high energy consumption, reliant on imported fossil fuels, Japan is also globally known as a country where everything from traditional crafts to high-tech industries are always striving to improve and innovate. As the energy market moves towards deregulation and wider competition, the solar PV sector within that bigger picture moves away from the feed-in tariff (FiT) subsidy-driven phase.

Just announced as this edition of PV Tech Power went to press, were FiTs for the 2020 Japanese financial year, which begins in April.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

While small-scale solar of under 10kW capacity continues to receive a fairly generous ¥22 (US$0.20) per kWh, anything between 10kW and 50kW gets ¥13 and 50kW to 250kW gets ¥12; anything larger than that has to compete in auctions.

“The big difference [to previous years] is that anything over 250kW has to enter into a competitive bidding process. It was the case that [only] 500kW capacity projects and over were eligible for auctions but it is now at the 250kW+ threshold,” says Izumi Kaizuka, manager at Tokyo-headquartered analysis firm RTS Corporation.

Of a possible 416MW in a recent auction, only 39.8MW of contracts were handed out by the Ministry of Economy, Trade and Industry (METI) across 27 bids from an initial 72 project proposals, totalling 185.6MW.

Successful bid prices ranged from ¥12.57 (US$0.115)/kWh to just ¥10.99 (US$0.1)/kWh.

“The price was low, but also having spoken to many in the industry, developers are really busy with contracts for projects that are not yet in operation but have been awarded the FiT in previous years; they are working very hard to get these built, rather than being able to focus on new projects,” Kaizuka says.

“Anything awarded up to 2014 needs to be built this year or show evidence of construction by this March, so they are extremely busy and are finding it difficult to even think about new projects.”

Indeed, the first few years of the FiT saw dozens of gigawatts of awarded projects apparently stall, for various and widely reported reasons. So, as our show preview for the upcoming PV Expo in Tokyo demonstrates, activity in the ground-mounted sector focuses to a greater extent on these already-awarded but nowhere near shovel-ready projects.

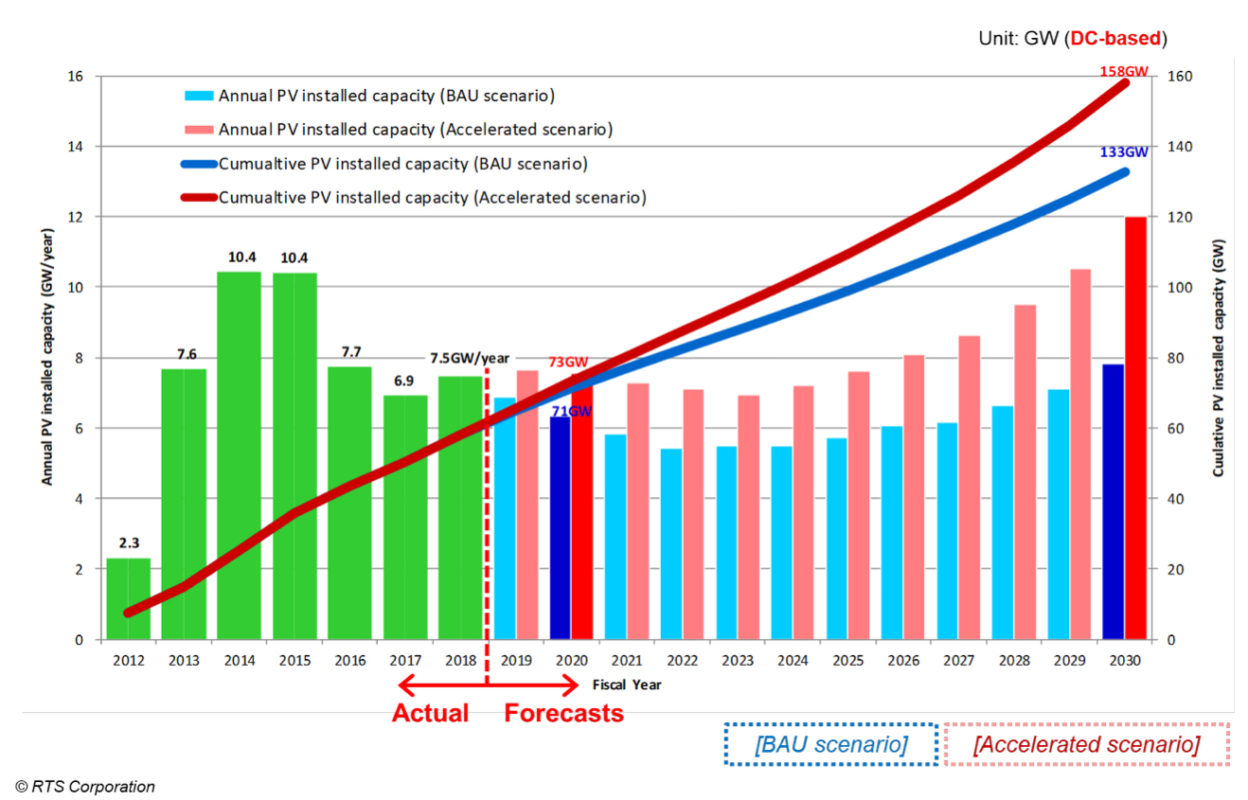

Taken from a different perspective however, the ¥22 per kWh for sub-10kW projects remains fairly generous. Kaizuka says it is also indicative of both a natural market shift and government policy shifting solar away from the fields – and hills and mountains – of Japan and towards domestic, commercial and industrial rooftops. These still-to-come rooftop sites will join Japan’s existing high installed base of ground-mount capacity (installations have ranged from over 6GW to 9GW in years since 2013 with around 10.5GW deployed in 2015, the ‘peak’ year of the FiT). RTS Corporation has modelled various scenarios and found that Japan could potentially find itself host to 150GW of PV generation by 2030. Indeed, the government’s three-year Basic Energy Plan aims for renewables to reach 22-24% of the national energy mix by that year. That would peg solar’s share at around 64GW.

But, as Kaizuka says, nuclear energy isn’t generating anymore in Japan since the Fukushima Daiichi reactor was damaged by the 2011 earthquake and tsunami.

“A small nuclear power plant has restarted operation, but we can’t expect more [restarts]. We thought solar can cover that gap, we studied the energy consumption of households and the commercial sector – and other sectors – and calculated how much electricity solar can replace and add; in total, our analysis that we can install 150GW by 2030 (see below). Of course, we have many restrictions including grid issues, but we believe that there will be major market shifts from the ground-mounted solar to buildings.”

The rest of this feature can be read – amongst many more – in the latest volume of PV Tech Power. Volume 22 of PV Tech Power can be downloaded – free of charge – here.