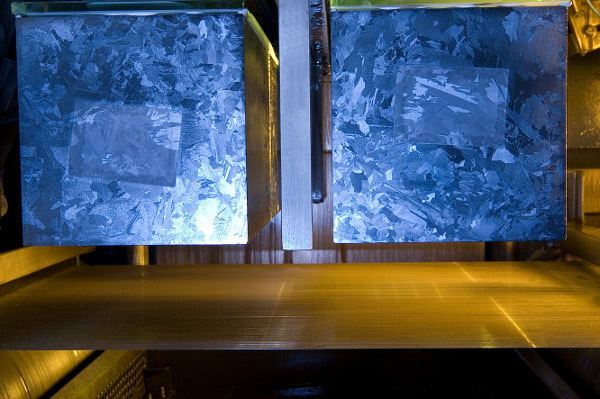

UK-based multicrystalline wafer producer PV Crystalox Solar inferred in a financial statement that it could finally benefit financially from the divergence of polysilicon and wafer prices, after several years of loss making.

PV Crystalox acknowledge what other wafer producers such as Taiwan-based Green Energy Technology (GET) had been saying for months that wafer capacity constraints on the back of continued strong demand had pushed ASPs higher and that global wafer capacity constraints existed.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, due to polysilicon production overcapacity and further new capacity coming on stream in 2016, polysilicon spot prices have fallen to record lows in recent months.

The divergence benefits the likes of PV Crystalox as it sells its wafers on the spot market and with increasing demand could convert more of its stockpiled polysilicon inventory to wafers, rather than limit losses on re-selling its polysilicon on the spot market below its contract purchase prices.

Previously, PV Crystalox had been saddled with fixed-price long-term polysilicon supply contracts but noted that it had concluded obligations under its largest supply contract and took delivery of the final shipment of polysilicon under that contract in December 2015.

The company also noted that shipments under remaining contract were scheduled to continue until late 2018 but the planned quantities were consistent with current production volumes. These contracts were also renegotiated on pricing to reflect significantly lower polysilicon prices.

PV Crystalox noted in August, 2015 that shipments volumes in the first half of 2015 were 104MW.

The company said that it would extend a review on its business in light of recent positive market conditions. The company had previously considered closing down its operations due to market conditions.