Currently, the downstream segment of the PV industry – or at least a portion of the western world – is somewhat in panic mode over having to audit the supply channels of solar module producers, most of whom have been central to their global build-out plans over the past few years.

But while the issue today relates to the Xinjiang region, this is essentially another ‘Made in China’ dilemma that has been under the spotlight several times in the past. Nor will it be the last time the issue comes to the fore.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

This article clarifies just how dominant the Chinese manufacturing sector is today within the PV industry, looking specifically at polysilicon, wafer, cell and module production stages. Also, the latest findings from our in-house PV ModuleTech Bankability Ratings analysis are shown, and discussed in relation to the ongoing made in China issue.

Silicon-based product has become dependent on low-cost manufacturing

Project developers and institutional investors – essential today for utility-scale deployment at the 100GW per annum level – have for years been somewhat source-of-manufacturing agnostic. Minimising build capex has been an obsession, feeding into target yields over the lifetime of an asset (normally a large-scale, ground-mounted solar farm).

As government subsidies and incentives were reduced (or eliminated altogether) and solar started to compete with other forms of renewables in competitive auctions, it almost became an expectation that module prices would decline indefinitely at the ~ 10% annual rate. Until the end of 2020, this indeed was observed.

This of course played directly into the hands of those companies that could maintain operations – and add capacity – by virtue of reporting a cost structure about 10-20% below actual sales prices. Entities with low labour costs, minimal land/buildings commitments, scantily low electricity bills and frugal-looking capex would clearly be the winners in this regard.

With the exception of First Solar (notably not made in China, and not silicon-based), the above summary largely explains why almost all of the module supply (for large-scale projects) is coming from Chinese-run companies. Without duties, or in the absence of any other manufacturing-related carve-out benefit for domestic manufacturing, nobody outside China can realistically come anywhere close to competing with these reported costs.

The only material sanction done before by the PV industry (US 2012 AD/CVD) simply had the effect of Chinese-run companies setting up sites in Southeast Asia. Remove this sanction, and the sites would likely disappear tomorrow.

Today, PV manufacturing – as a global sector – has been decimated. A few module assembly fabs outside China (or their owned assets in Southeast Asia) are in operation, and every now and again an attempt is made to set up cell production. But the industry is dominated by Chinese manufacturing, and a lust for profits by global investors/developers.

Surely this situation cannot continue. Perhaps then the Xinjiang issue (regardless if it manifests itself by way of any specific sanctions) will act as a catalyst, or an awakening, to a broader community than the accountants, that building up a multi-GW solar portfolio is not just about the return on investment but the overall social and economic impact of populating the global assets almost entirely with made in China components.

Knee-jerk audits of supply channels are not the solution

The reaction of many global investors and developers today, following media coverage of the Xinjiang issue, is really quite painful to observe. With so many of the investor vehicles being public-listed – and acutely aware of public-perception and brand equity – it is fair to ask why so many largely ignored the fact that components (inverters, modules, steel) were all coming from China as a whole, or had parts made by Chinese companies producing in Southeast Asia. However, the reality is – did they actually have a choice?

It should be worth saying that this is not having a go at China per se. If any other country had such a stranglehold in PV manufacturing, exactly the same issues would be raised. It just so happens that China – like so many commodity products used globally – is dominating the PV industry today. And there are direct implications being felt throughout the industry as a result of the Xinjiang question.

The problem for many of the investors and developers is not so much doing an audit trail today, it is looking retroactively at owned assets, built over the past decade. Goodness knows how they will get to the bottom of that one if needed, given the way that polysilicon is traded and blended in China, and wafers and cells are sourced from a combination of in-house, outsourced or third-party contracted manufacturing. Good luck!

In the following section, I will look more simply at how much product is made in China today. Before anyone looks at regional segmentation, this is surely the first step in the process.

How much is made in China today?

Removing thin-film module supply (all First Solar for simplicity), all other PV modules are largely similar. Polysilicon is pulled into ingots, these are then sliced into wafers; the wafers are processed into solar cells, and the cells are finally assembled into PV modules. Each step uses various raw materials (glass, silver, etc.); most, if not all, of these raw materials are also produced in China today.

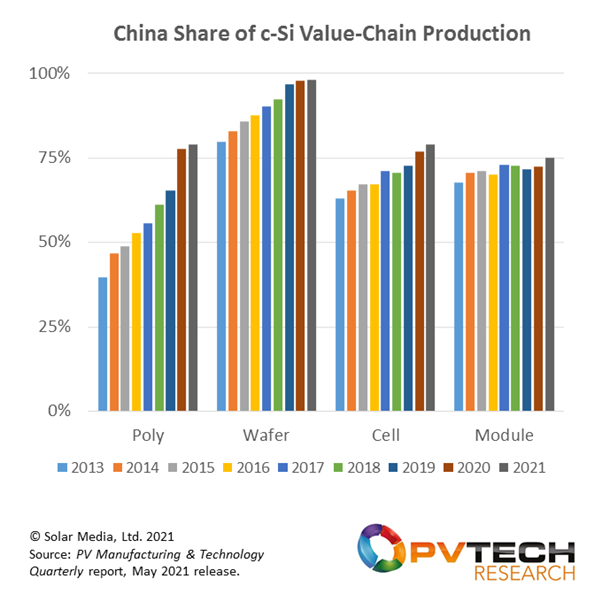

However, the key steps to review now are polysilicon, wafer, cell and module. The figure below shows the percentage of production through the value chain for silicon-based modules, covering the period from 2013 to 2021.

The Xinjiang issue has been linked to polysilicon in particular, where several of the leading Chinese companies have their plants located today. The only suppliers of volume for polysilicon outside of China are Wacker (Germany) and Korean-headquartered OCI (producing in Malaysia). The upward trend of polysilicon from China is set to increase in coming years, with all the expansions and debottlenecking due to come online from the end of 2021.

Wafer production is almost entirely a China segment now. A tiny portion of production is located outside the country, with previous proponents Japan and Korea having exited some time back. Interestingly, wafer production is potentially the ‘quickest’ to fix, in terms of barrier to entry.

Cell and module production have been seeing a somewhat static share from China, driven largely from Chinese companies having to produce cells and modules in Southeast Asia for US shipments. Again, as pointed out above, remove the 2012 CVD/AD and cell/module and production share levels in China would be above 90%.

From the graphic above, it is also clear that the China dominance is not new. Therefore, most solar farms built in the past decade will have various (if not all) module parts made in China, or at least, wafers (and probably polysilicon).

Who are the most bankable module suppliers today?

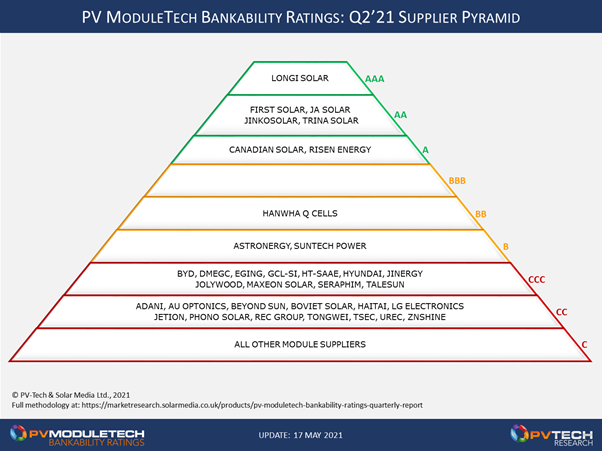

The PV ModuleTech Bankability Ratings analysis has now become the industry’s benchmark, in terms of understanding the financial and manufacturing health of leading module suppliers. It is used routinely by banks, investors, developers and (for benchmarking) module companies.

The latest (Q2 2021) hierarchy pyramid is shown below, with seven suppliers in the A grades. Compared to two years ago, when we launched the methodology, there are far fewer suppliers in the overall AAA-to-CC rating bands; this is coming from the increased shipment volumes from the leading players, and the relative share of the market from companies that have not kept up with market growth. However, there are still about 50 module suppliers to understand today, in order to perform benchmarking properly.

In reference to this article, it can be seen that First Solar and Hanwha Q CELLS are the leading non-Chinese entries. Aside from LONGi (by virtue of its wafering business), most of the leading module suppliers have similar models. JA Solar remains the leader in terms of in-house value chain production: others retain a more informal stance in terms of using third-party producers of components.

How does the manufacturing anomaly get resolved?

Until now – with a few exceptions – built PV assets by global corporates are seen as key to long-term positioning and strategy. However, the ‘global’ aspect of this has only been based on the location of the solar farm, not the global nature of the component manufacturing. This would have to change, going forward, to necessitate manufacturing in different regions globally.

Relying on governments (or policy-makers such as in the EU) to do this is unrealistic. It has to come from the ultimate site owners – those that benefit financially in the long-term, and also meet other internal targets by way of having solar based assets in general.

Failing that, we will see start/stop government or country-to-country politics (e.g. US-China relations) giving short-term jolts, but nothing long-term or driven by any global re-ordering of a one-country dominance in manufacturing.

Somehow, there needs to be a shift in thinking and mentality, not just a mad panic to distance oneself from any media backlash (as is happening today with the Xinjiang issue). Supporting a multi-GW portfolio of build assets needs to have manufacturing ‘diversity’ promoted. Just how this happens is not clear though!

The other option is for some of the leading Chinese players to set up wafer and cell production outside China: without having to be forced into it! What a proactive move this would be, and would almost certainly see investors prioritising this in terms of future contractual module supply volumes. While the tendency can sometimes be to pick on the biggest player (or superpower) and try to impose sanctions to curb global dominance, making the market leaders part of the solution might not be a bad idea.

For now however, the audit trail frenzy is all the rage, and unlikely to have any useful impact. For certain, nothing will change overnight. Solving global manufacturing diversification needs other voices, and following the money to the major global investors in utility solar is probably the best way to go. Whether anything like this will happen is debatable, but one lives in hope!

If you need detailed visibility across the PV manufacturing sector, our PV Manufacturing & Technology Report is an invaluable resource allowing you to track, benchmark and forecast the shifts in the PV market.