‘Silicon Module Super League’ (SMSL) member Canadian Solar has made further revisions to its planned manufacturing capacity expansion plans for 2016, while reiterating previously guided PV module shipments for the year.

In November, 2015 Canadian Solar announced a major expansion of solar cell capacity after falling to below 50% of in-house module assembly capacity. The driver was to reduce manufacturing costs as OEM prices were on the rise for multicrystalline cells as wafer ASPs increased on tight supply, while monocrystalline wafer and cell prices had been falling on overcapacity issues. The company was highly dependent on multi c-Si than mono.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

First wave of expansions

From a recap perspective, Canadian Solar announced in November last year that it would increase in-house wafer production from 400MW to 1GW by mid-2016, while solar cell capacity would be expanded from 2.5GW currently to 3.4GW by the end of 2016, a 900MW increase.

However, the biggest capacity increase would be in PV module production, which would be expanded from 4.33GW at the end of 2015, to 5.63GW by the end of 2016, a 1.3GW increase.

Canadian Solar specifically noted at the time that its wafer manufacturing capacity at its plant in Luoyang, Henan Province was expected to reach 1.0GW by June of 2016, while its cell manufacturing capacity at its plant in Suzhou, Jiangsu Province, was expected to reach 2.0GW by the end of 2016. Cell manufacturing capacity at its Funning plant in Jiangsu Province is expected to reach 1.0GW by July of 2016.

Canadian Solar also said at the time that a new 400MW cell manufacturing plant was to be located in Southeast Asia. The plant would be commissioned in the second half of 2016, according to the company.

Total solar cell capacity would therefore reach around 3.4GW by the end of 2016, subject to any further capacity expansion announcements in subsequent quarters.

The company also said at the time that new module assembly plants would be established in Vietnam (300MW), Indonesia 30MW and in Brazil 300MW.

Second wave of expansions

However, fast forward to the first quarter of 2016 when Canadian Solar announced fourth quarter and full-year results for the previous year when the company made further tweaks to the previously announced plans.

Overall, the company expected module assembly capacity to reach 4.63GW by the end of June, 2016 and 5.7GW by year-end, compared to previous guidance of 5.63GW, a 1,370MW increase.

On the solar cell side, overall capacity increased 200MW to 2,700MW in the fourth quarter of 2015 and would remain unchanged at 2.7GW through to the end of June, 2016, but capacity would reach 3.9GW at year-end, compared to previous guidance of 3.4GW by the end of 2016. Total cell capacity expansions since Q3 2015 through end of 2016 were targeted at 1.4GW.

Digging deeper, the subtle changes include its new solar cell plant in South East Asia would be ramped to 700MW beginning in the third quarter of 2016, compared to 400MW previously announced.

The new solar cell plant in South East Asia would also ramp higher in 2016. The company noted that the new plant would ramp to 500MW, rather than the previously planned 400MW.

Canadian Solar said that it expected total module shipments in 2016 to be in the range of approximately 5.4GW to 5.5GW

A total of US$297.0 million would be allocated to the expansions in 2016, according to the company.

Third wave of expansions

In reporting its first quarter 2016 financial results on May 11, Canadian Solar reiterated previously guided module shipments for the year.

However, the company noted that in May, 2016 its Suzhou and Funing plants, in Jiangsu Province, currently totalled 2.2 GW and 500 MW, respectively, yet the Funing plant would have added a further 500MW of capacity by July. This would push total cell capacity to 3.2GW. Although not an accretive to the cell expansions, it highlights the pace of expansions being undertaken.

What is accretive is the fact that its new solar cell plant in South East Asia would be commissioned in the second half of 2016, but with a nameplate capacity of 700MW, compared to the previously upwardly revised 500MW.

The Company's new 700 MW cell manufacturing plant, located in South East Asia, is expected to be commissioned in the second half of 2016.

Therefore, by the end of 2016, Canadian Solar is expected to have an in-house solar cell nameplate capacity of 3.9GW.

Also included in the third wave of expansions is further module assembly nameplate capacity.

The company said that its module capacity was expected to reach 6.43GW by the end of 2016, compared to the 5.63GW, previously guided, a further 800MW expansion.

A total of 4.7GW of module assembly capacity would be located in China by year-end, which included 3GW in Changshu and 600MW in Suzhou, Jiangsu Province, and 1.1GW in Luoyang, Henan Province.

However, Canadian Solar said in its first quarter earnings call that it took the opportunity of acquiring a former local solar cell facility that recently closed that was very close to one of its existing facilities in China, which would be converted to 500MW of extra module capacity.

There were no changes to the first wave module assembly capacity expansions located outside China in regards to the 500MW expansion in Canada, the 300MW in Vietnam and the 30MW in Indonesia and the 300MW planned in Brazil.

The difference was the new module assembly plant in South East Asia, which would have 600MW of capacity, compared to the previous 400MW, initially announced. The company would therefore reach module assembly capacity at existing and new locations outside China totalling 1.73GW at the end of 2016.

In summary, module assembly capacity under the third wave of expansions for 2016 would be expanded by around 700MW. Total module assembly nameplate capacity is therefore going to be in the range of 6.4GW to 6.6GW at year-end.

With total module shipment guidance reiterated at 5.4GW to 5.5GW in 2016, Canadian Solar said that the extra module capacity would provide flexibility to any peak monthly and quarter module demand, significantly reducing its need for purchasing modules form other producers. This would lower costs and reduce quality control issues, according to the company. Due to demand in 2015, Canadian Solar accessed around 500MW of OEM module supply.

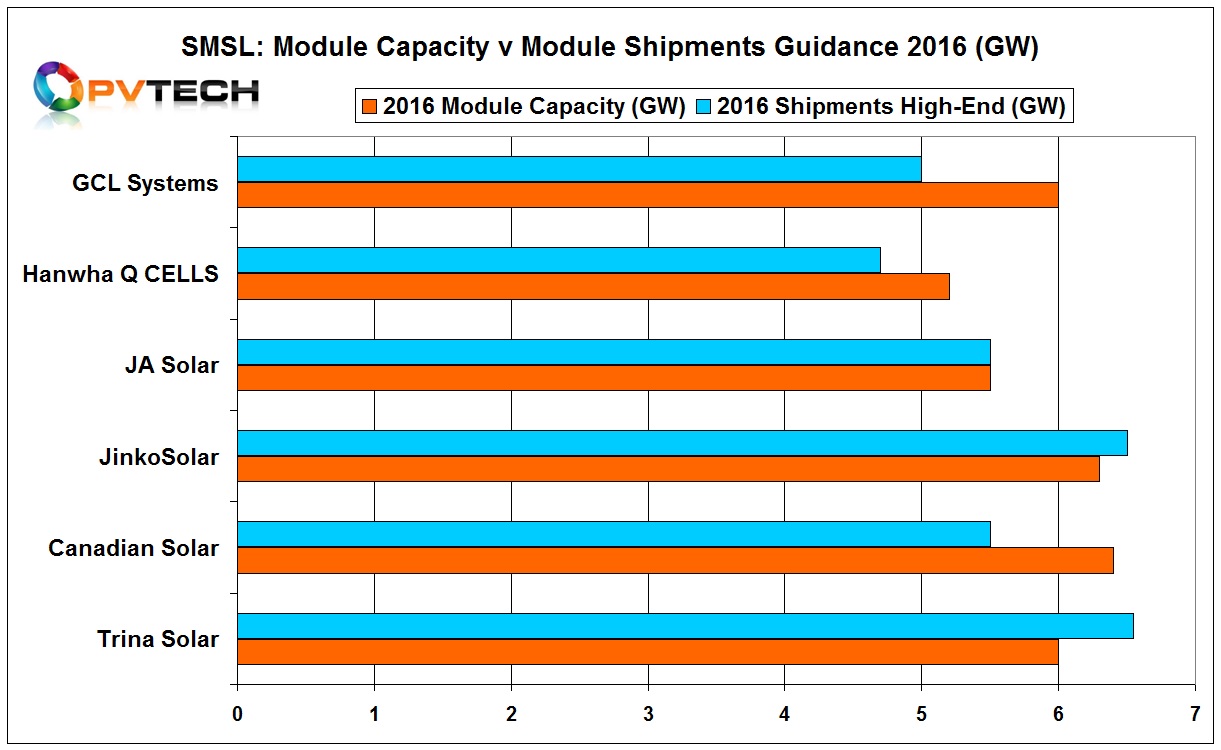

As the second largest (by module shipments) SMSL member in 2015, Canadian Solar was at threat of being surpassed by both JinkoSolar and JA Solar in 2016, based on shipment guidance and module nameplate capacities by year end.

With Canadian Solar’s third wave, its module capacity equals plans by JinkoSolar and JA Solar as well as leading SMSL, Trina Solar. Having flexibility in module capacity is one thing, yet it also says Canadian Solar could raise shipment guidance in future quarters at will, without a module margin hit and retain its market position.