As we finalize the agenda for PVCellTech 2017 – to be held in Penang, Malaysia, on 14-15 March 2017 – one of the key goals is to understand how solar cell advances in mass production are driving module availability to the market.

Module powers and types have changed drastically within the PV industry in the past few years. Going back to 2013, the market was flooded with p-type multi modules (60 x 6-inch cells) that had module power ratings (MWp-dc, STC) ranging from 230 to 250W, with some higher performing options getting to 255MW based on using the best wafers and adding busbars to the legacy 2-BB cell type.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Fast-forward to 2016, and modules are increasingly shipping based on p-type mono, PERC, 72-cell designs, 3-4 busbars, and 1,500V operation. In particular, this module type is seeing increased uptick for large-scale solar farms (or categorized as utility).

Other technologies coming from selected cell producers (in particular REC Solar) include the use of half-cut cells. Front-end cell line optimization also for black-silicon texturization on p-type multi cells may also result in performance enhancement (although predominantly a wafer cost issue).

Indeed, one of the leading indicators for utility supply from c-Si producers can be seen in First Solar’s competitive analyses, often discussed at the company’s annual analyst day events. Benchmarking First Solar’s CdTe offerings against c-Si types has been a key factor in increasing CdTe efficiencies for the current Series 4 modules.

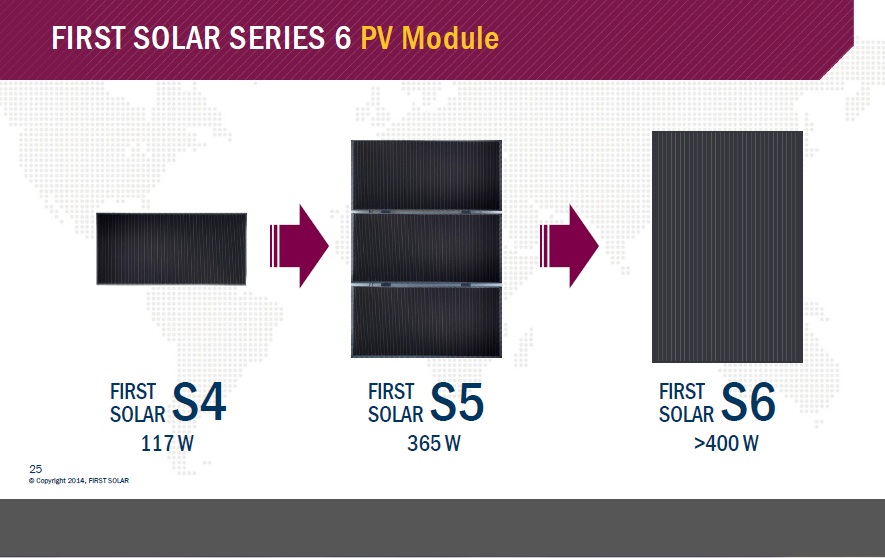

Moreover, First Solar’s recently-announced plans to move to Series 5 and Series 6 options were pitched directly against 72-cell p-type multi availability for utility deployment.

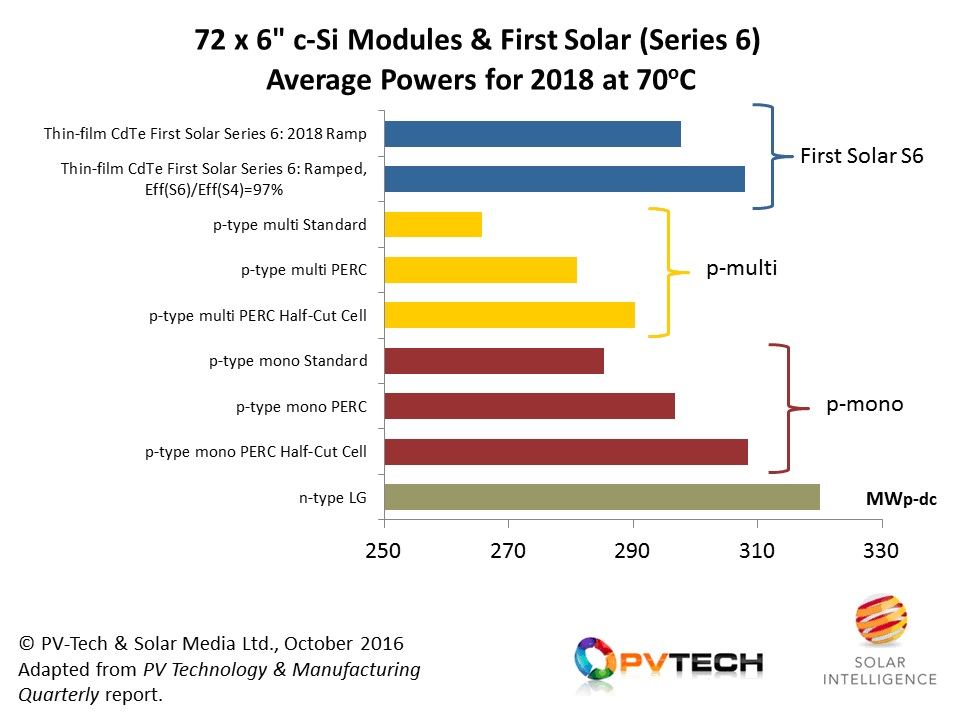

New analysis, undertaken by our in-house research team, and featuring in the next release of our PV Manufacturing & Technology Quarterly report, allows a direct comparison of 72-cell modules in 2018, for a range of different cell types, including n-type and p-type, mono and multi, PERC and half-cut cells.

The conclusions point to a potentially new landscape for module supply to the industry in 2018, and highlight that the competitive threat for First Solar is likely to come, not from p-type multi, but p-type mono PERC supply.

In order to do a meaningful comparison, we have surveyed the typical average power ratings from the industry’s main suppliers, and have factored in the relevant power-related temperature effects for elevated temperature performance (in the graphic below, using 70oC), in addition to average cell efficiencies for 2018.

The graphic below shows the expected average powers for a subset of the technologies/suppliers in 2018, noting that some options still have a wide variance owing to relatively broad yield distributions, or as a result of consolidating across a range of different companies’ production lines.

We show here only 72-cell 6-inch designs for c-Si n-type and p-type cells, and this graphic excludes here the 72 and 96-cell offerings from Panasonic and SunPower. A more detailed direct comparison for utility deployment would certainly see SunPower’s X-Series modules coming out on top, with regards power density. (The more detailed findings are contained in our PV Manufacturing & Technology Quarterly report.)

In order to project out First Solar’s power ratings from its Series 6 technology, we have assumed two scenarios. The first is based on 2018 being a ‘ramp’ phase period, moving from initial production efficiencies that are likely to be lower until fully optimized (12-18 time period, say).

The second scenario shown for First Solar’s Series 6 modules is to assume efficiency performance at 97% of the forecasted Series 4 efficiencies in 2018. It is hard to see how efficiencies from the larger modules will not be a fraction below the fleet averages from Series 4, due simply to the 3X module deposition areas involved.

The graphic shows clearly that, while First Solar’s proposed Series 6 modules (and indeed those from the interim Series 5) will outperform 72-cell p-type multi, the main threat will come from p-type mono arrangements, in particular PERC based cells.

Therefore, one of the key metrics going into 2018 may come back to the production costs and comparison between 72-cell p-type mono PERC modules and First Solar’s Series 5 or Series 6 offerings. In fact, the comparison should really be with Series 6, as this has the scope for cost reduction more so than Series 5 modules (by virtue of being three interconnected Series 4 modules).

However, when doing the comparisons, we need to consider industry supply levels. If 72-cell mono PERC modules start to become the standard for utility projects (replacing the legacy 60-cell multi designs), then it becomes largely immaterial what p-type multi power levels are (unless they are priced so far below p-type mono that the site capex argument wins over plant productivity).

In this respect, while we have shown LG’s flagship 72-cell n-type NeON module in this graphic, the competitive threat from LG here may be less pronounced, owing to the limited supply levels or the company’s strategy on rooftops versus utility market penetration.

The PVCellTech 2017 event is certainly going to address the above issues in detail, in order to get a full understanding of the cost and efficiency projections for the different c-Si technologies, and what can still be eked out of p-type multi lines through black-silicon or 5 busbar designs.

Details on registering for attendance at PVCellTech 2017 can be found here.

Our hugely successful PVCellTech event returns on 14-15 March, Penang, Malaysia. The speaker list includes CTOs and executives from leading solar manufacturing powers including JA Solar, DuPont, GCL Poly, Meyer Burger and Hanwha Q CELLS. Download the agenda now!