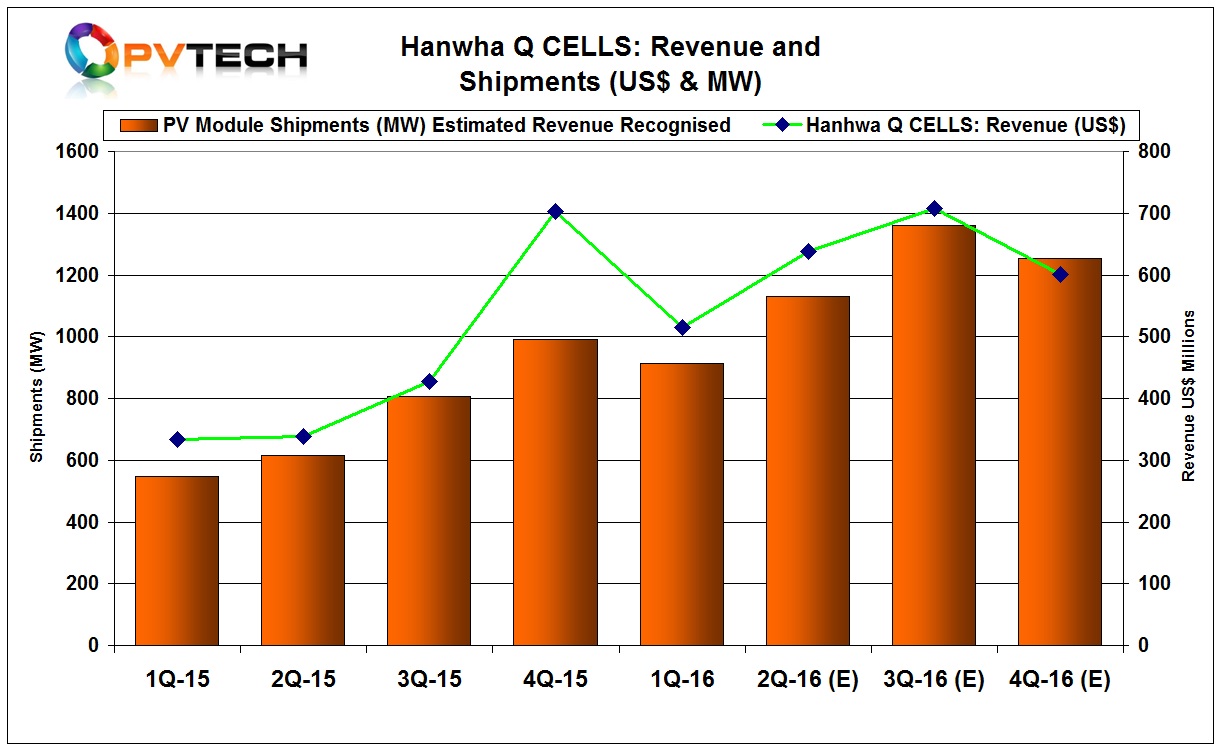

‘Silicon Module Super League’ (SMSL) member Hanwha Q CELLS said that previously upwardly revised shipment guidance would be retained for the full-year after reporting a 10.9% increase in revenue for the third quarter of 2016.

Hanwha Q CELLS continued to provide limited PV module shipment insight having stopped providing quarterly shipment figures and regional sales and or shipment figures after the first quarter of the year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Adding to the growing opaqueness of its business, management gave only the minimal commentary about market conditions and even less in respect to 2017.

Seong-woo Nam, Chairman and CEO of Hanwha Q CELLS stated: “Our industry is undergoing challenging time with elevated macro uncertainties.”

In its earnings call, management only said that the company had “good visibility” into the first half of 2017 and “lower” visibility in the second half of the year.

Financials

Hanwha Q CELLS reported relatively strong third quarter revenue of US$707.8 million, up 10.9% from US$638.0 million in the second quarter of 2016.

Based on revenue guidance for the fourth quarter of 2016, third quarter revenue is expected to be the highpoint in the year.

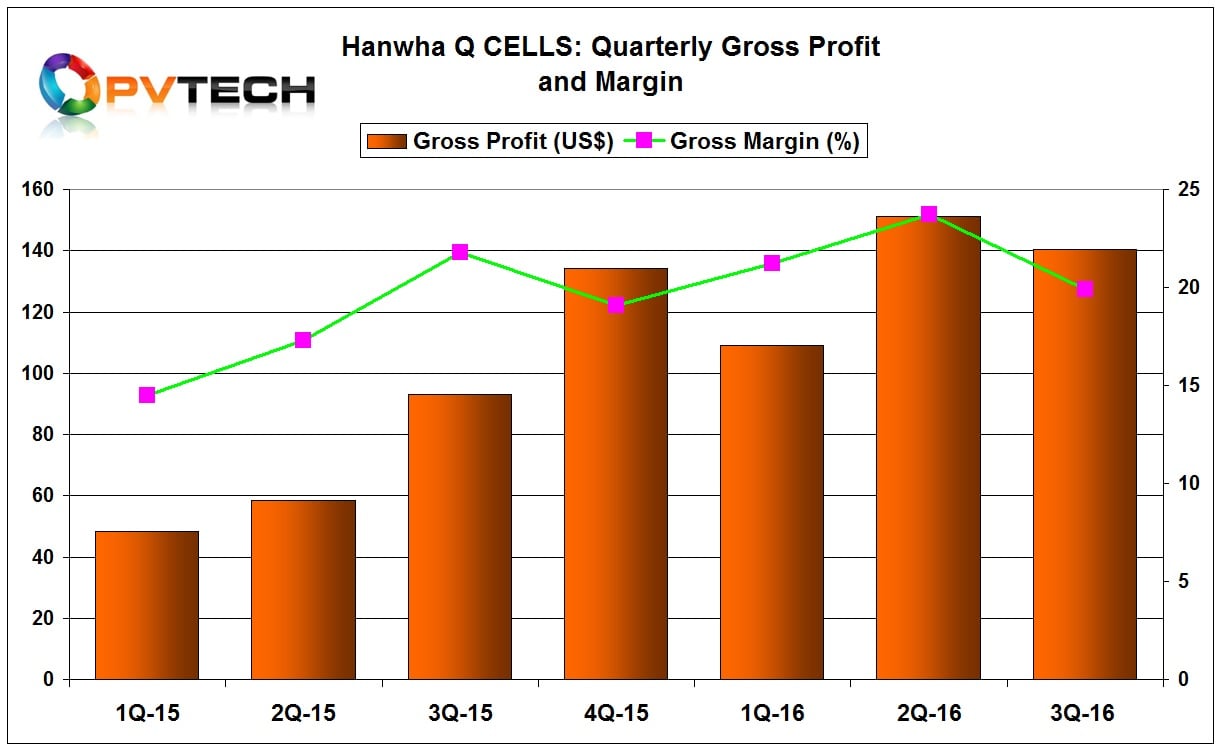

The company reported a gross profit of US$140.5 million, compared with US$151.2 million in the second quarter of 2016 and a gross margin of 19.9%, compared with 23.7% in the second quarter of 2016.

Operating income was US$72.4 million, compared with US$84.5 million in the second quarter of 2016. The lower profit, margins and operating income indicate ASP pressure.

“We will continue to focus implementing disciplined financial and operational management as we navigate current market environments, yet further strengthening our industry leadership in technology, quality and customer services for stable long-term growth,” noted Nam in the company’s financial release.

However, Hanwha Q CELLS reported operating expenses of US$68.1 million in the third quarter of 2016, up 2.1% from US$66.7 million in the second quarter of 2016 and up 29.2% from US$52.7 million in the third quarter of 2015.

This trend continued with selling and marketing expenses up 10.0% to US$36.4 million in the quarter, from US$33.1 million in the second quarter of 2016 and up 59.6% from US$22.8 million in the third quarter of 2015. Net interest expense was US$12.4 million in the third quarter of 2016, compared with US$9.3 million in the second quarter of 2016

Only general and administrative expenses were flat at US$19.7 million in the third quarter, up 0.1% from US$19.6 million in the second quarter of 2016.

Net interest expense was US$12.4 million in the third quarter of 2016, compared with US$9.3 million in the second quarter of 2016 and $11.9 million in the third quarter of 2015.

The company had cash and cash equivalents of US$254.8 million at the end of the third quarter, compared with US$255.4 million at the end of the previous quarter.

Manufacturing update

Hanwha Q CELLS confirmed that it had in-house ingot production capacity of 1,550MW, up 50MW from the previous quarter. Wafer production stood at 950MW at the end of the third quarter, also 50MW higher than at the end of previous quarter.

Solar cell production capacity reached 4,100MW, up 100MW from the previous quarter, while module capacity increased 50MW to 4,050MW.

The company also has available 1,500MW of module from Hanwha Q CELLS Korea Corporation, an affiliate of the company.

Management noted in the earnings call that it expected at least 500MW of monocrystalline PERC-based module production in 2017, although said further details would be provided in the next earnings call. The company had showcased its expected move to offer mono-PERC products at SPI 2016.

Guidance

Hanwha Q CELLS guided revenue in the fourth quarter of 2016 to be in the range of US$600 to US$620 million, indicating full-year revenue to be around US$2.46 billion.

Total module shipments were reiterated to be in the range of 4,800MW to 5,000MW, with revenue-recognized module shipments in the range of 4,600MW to 4,800MW.