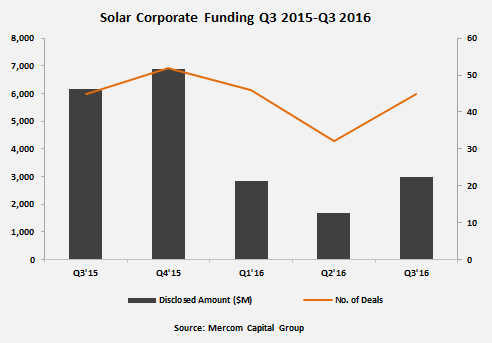

Global clean energy communications and consulting firm Mercom Capital Group released its report on funding and merger and acquisition (M&A) moves for the PV market in the third quarter of 2016.

Total corporate funding, including venture capital, public market and debt financing into the solar sector in Q3 2016 was up to about US$3 billion in 45 deals — compared to US$1.7 billion in 32 deals in Q2 2016.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Raj Prabhu, CEO and co-founder of Mercom Capital Group, said: “Funding levels bounced back across the board compared to a weak Q2, but they are still well below last year’s totals. The combination of slower than expected US demand, the overcapacity situation coming out of China, and global hyper-competitive auctions leading to lower margins has affected the entire supply chain and most of the solar equities are in the red year-to-date. The exception has been the rebound of some of the yieldcos.”

Global VC funding — including private equity — for the PV sector nearly doubled in Q3 2016 with US$342 million through 16 deals when compared to the US$174 million raised in the same number of deals in Q2 2016.

PV downstream companies raised US$273 million in eight deals when compared to US$112 million in seven deals in Q2 2016. The largest share came from US$220 million raised by Solar Mosaic — a provider of residential solar loans — from Warburg Pincus, Core Innovation Capital and Obvious Ventures.

Other major VC transactions from this quarter includes US$47 million raised by Heliatek, US$20 million raised by BBOXX, US$15 million raised by d.light, and the US$10 million each raised by Morgan Solar and Off-Grid Electric.

Solar public market financing in Q3 2016 amounted to US$880 million in five deals, including one IPO, compared to $179 million in four deals in Q2 2016. In Q3 of 2015, public market financing totaled $1.8 billion.

The first solar IPO this year was recorded by BCPG, a solar downstream company for US$166 million. Debt financing was listed at US$1.8 billion in 24 deals in Q3 2016 compared to 12 deals in Q2 2016 for US$1.3 billion. Year-over-year, US$4.1 billion was raised in 22 deals in Q3 2015.

The top large-scale project funding agreement this quarter was Magnetar Capital’s raise of US$397 million to refinance its 135MW solar projects portfolio in the UK. Sinogreenergy raised US$200 million to develop a portfolio of up to 550MW of PV installations in Taiwan. SunPower obtained a US$199.7 million syndicated loan for its 100MW Pelican Solar Project in Chile. Gunkul Engineering secured US$115.8 million in a syndicated loan for the construction of the 31.75MW Sendai Okura solar project in Japan. Fotowatio Renewable Ventures received $103.4 million in project financing for the 50 MW solar PV project in northern Jordan.

Residential and commercial solar finances raised in Q3 2016 amounted out to US$1.1 billion in five deals compared to US$1.36 billion in 11 deals in Q2 2016. Of the US$1.1 billion announced this quarter, US$760 million was diverted towards lease and US$333 million went to loan funds. So far this year, around US$3.5 billion has been utilised in 22 deals. During the same period last year, more than US$5 billion was raised in 21 deals.

In total, there were 55 large-scale PV project acquisitions (24 disclosed for US$1.3 billion) this quarter, as compared to Q2 2016 — which had 38 deals (13 disclosed for US$1.9 billion).

Solar Media is hosting the third Solar Finance & Investment USA conference in New York on 25-26 October 2016.