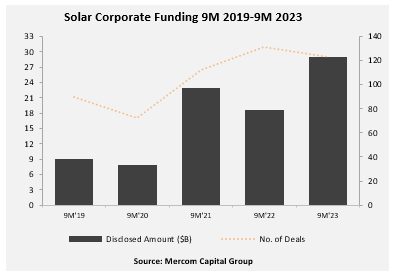

Financing for the solar sector grew 55% in the first nine months of 2023 compared with the equivalent period last year. US$28.9 billion in corporate funding – including venture capital (VC) funding, public market and debt financing – flooded into the sector, up from US$18.7 billion in 2022.

This is despite the overall number of deals falling by 5% year-on-year, from 131 in 2022 to 124 this year. According to Mercom Capital’s Solar Funding and M&A 2023 Nine Month Report, the uptick in financing figures is a symptom of the gathering pace of global decarboisation efforts, as investors and companies look to capitalise on the opportunity at hand, and large policy incentives.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“Despite inflationary challenges, financing in the solar industry has remained robust through the first three quarters of 2023 thanks to a strong global push toward decarbonisation and substantial incentives created by the Inflation Reduction Act,” said Raj Prabhu, CEO of Mercom Capital Group.

Solar debt financing was the segment with the biggest increase YoY, up a 93% to US$16 billion across 54 deals compared with US$8.3 billion in 48 deals last year. This echoes the larger trend that, on average, deals have been larger in 2023 than 2022.

VC funding rose just 4% YoY, from US$5.5 billion to US$5.7 billion, but once again the size of those deals was larger than in 2022; just 51 were signed in Q1-Q3 2023, for more money than the 72 signed in the same period of 2022. Additionally, VC growth has slowed since the start of the year; Mercom’s report on Q1 found that the segment had increased 74% YoY from January-March inclusive, with US$2.1 billion committed in that period alone.

VC capital was concentrated in the downstream solar sector – US$3.8 billion of the US$5.7bn total. However one outlier at the top of the mountain was German PV startup 1Komma5°, which bagged US$471 million in VC funding across two rounds this year, the most VC funding awarded anywhere. This week the company revealed plans for a 5GW tunnel oxide passivated contact (TOPCon) module assembly plant in Germany, to be fully operational by the end of the decade.

The rest of the top performers in VC capital were downstream developers: second was Enfinity with US$428 million, followed by Silicon Ranch with US$375 million.

Public market financing for solar rose 47% to US$7.2 billion in 19 deals.

Prabhu continued: “M&A activity, on the other hand, has faced adverse effects, especially in the realm of project acquisitions, due to increased due diligence, higher costs, delays, and a tight labour market.”

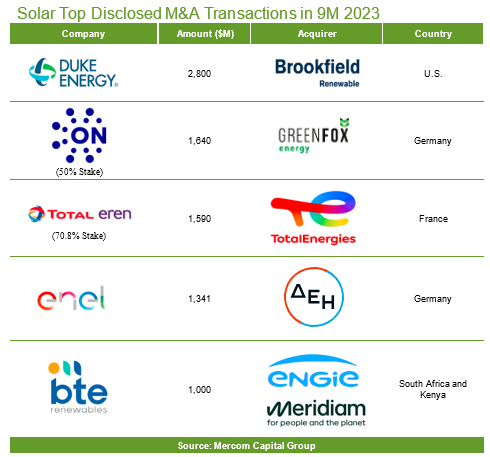

Indeed, Mercom’s research shows that M&A activity has slowed so far in 2023: 75 transactions occurred compared with 90 in the same period 2022, and the capacity of projects acquired dropped dramatically from 52.1GW in Q1-3 2022 to 31.6GW this year.

The largest single acquisition was Brookfield Renewables’ buyout of Southeast US Utility Duke Energy’s renewable energy generation arm for US$2.8 billion. Around 5.9GW of total renewables capacity changed hands in this deal.

Project Developers and Independent Power Producers (IPPs) were the most active acquirers of solar projects in Q3 2023, picking up 2GW, followed by insurance companies, pension funds, energy trading companies, industrial conglomerates, and IT firms with a total of 1.6GW. Investment firms acquired 959MW; electric utilities acquired 877MW; and oil and gas companies acquired 759MW of projects, Mercom said.