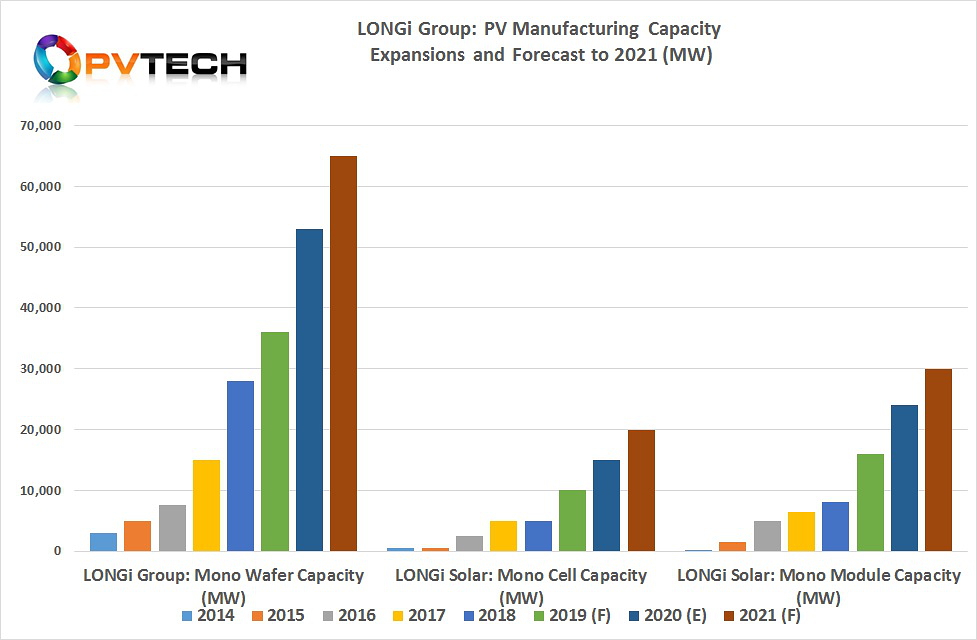

LONGi Green Energy Technology Co, the largest monocrystalline wafer producer, has approved future PV module and solar cell manufacturing plans of 10GW and 5GW, respectively.

LONGi’s Board of Director have approved the investment of approximately RMB 2.021 billion (US$ 286 million) in the construction of a 5GW mono module plant in Zhangzhou, China, dubbed Luzhou Phase II. The project is expected to take around 15 months to complete.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The company also approved another 5GW mono module plant in Xianyang, China in the Xianyang High-tech Industrial Development Zone. The capital expenditure and working capital for the project is expected to be in the region of RMB 1.839 billion (US$ 269.2 million) and take around 15 months to complete.

The third planned investment relates to a new 5GW mono solar cell plant to be located in Xi'an Xincheng City, China at a cost of approximately RMB 2.462 billion (US$ 348.4 million). The project is expected to take around 24 months, according to LONGi.

LONGi did not disclose in documents when the projects were expected to start construction and be completed.

The company has already announced separate plans to take cumulative PV module nameplate capacity to 23GW in 2020.