String inverter maker Ginlong marked its best quarter since its founding in 2005, bringing in $52 million during its third quarter alone — more revenue than the Chinese company recorded during 2014, 2015, and 2016 combined.

As the only publicly-traded company focused exclusively on PV string inverters, Ginlong’s performance speaks to the growth of its global operations and its key role within the string inverter category in the PV market. These results attest to the growing market share enjoyed by Ginlong’s Solis string inverters.

Highlights from today’s reported results for the third quarter ended August 31, 2019 include:

Third Quarter Year-Over-Year and 2019 Year-to-Date

Q3 2019 Performance

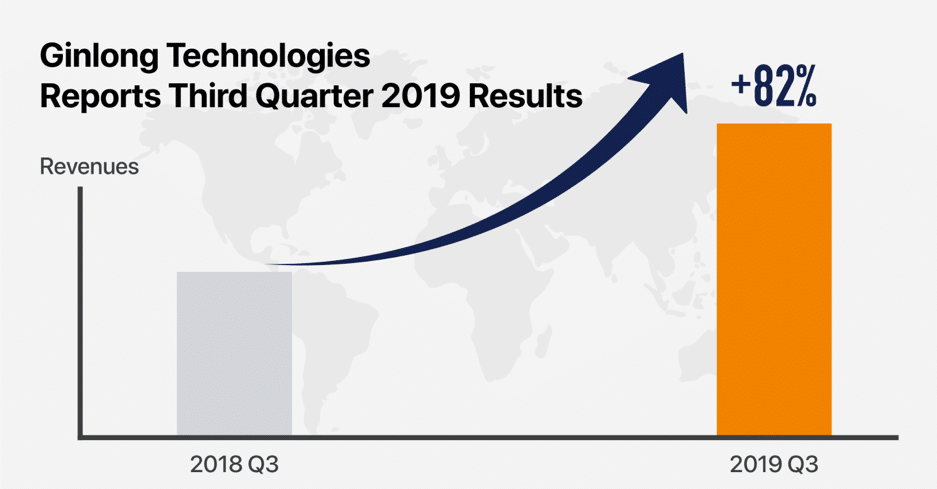

Revenues grew to $52 million, representing an 82% increase year-over-year

Net income of $6.8 million was up 53% over 2018

Year-to-Date 2019 Performance

Revenue of $111 million is up 32% from the same period in 2018

Net income of $11 million is up 6.3% over 2018 results

According to the financial report, Ginlong’s total assets were $196 million, while cash flows from operating activities came in at $7.7 million. Sales and management expenses reached $ 12.9 and $ 6.6 million respectively.

Ginlong credits its revenue and profit achievements this year to both its market development operations and orders for inverters and other products. In addition to ramping up its production capabilities and marketing efforts, Ginlong also revamped accounts receivable collection, boosting net cash flow generated by operating activities by nearly 230%.

A Long History Laying the Foundation for Growth

Ginlong has built its core business around string inverters from Day One. The company’s founders began pursuing inverter technology R&D in the United Kingdom in 2003 when the global PV market was in its infancy. In 2005, they returned to China to establish Ginlong’s industrial base in Ningbo. Fourteen years later, inverters account for more than 95% of Ginlong’s total revenue.

Investing in People and Innovation

Ginlong’s public debut on the Shenzhen Stock Exchange in March gave it the funds and net cash flow needed to finance an increase in production capacity, optimize manufacturing processes, and boost global sales and marketing. As the world’s only publicly-traded company focused exclusively on string Inverters, Ginlong used this influx of funds to further its competitive advantage.

This financial expansion has helped the company attract talented new R&D engineers, as well as offer more training to core team members and young recruits who one day will form the company’s backbone.

Dedicated to innovation, Ginlong continues to invest in the evolution of its Solis inverter line, adding a new energy storage system to its portfolio in 2017. Currently selling in Europe,Austrial,Asia, and etc. the intelligent hybrid PV inverter brings industry-defining reliability to solar-plus-battery systems. Designed for flexibility and performance, the storage inverter — soon available in the U.S. — allows residential customers to maximize self-consumption while boosting efficiency and overall returns. The storage solution received strong market acceptance in Asia with revenues increasing 100 times from 0.02% in 2018 to 2% this year, and received the 2019 Best PCS Supplier Award in China.

Entering Utility-Scale Project Development in China

Expanding beyond its high-performing, ultra-reliable Solis core business, Ginlong recently invested $8.6 million to create a wholly-owned subsidiary — Ginlong Smart Energy Co., Ltd. — dedicated to PV plant construction, operation, and ownership in China. The investment increases Ginlong’s position in utility-scale assets by 113% year-over-year.

Focused on utility-scale project development as well as engineering, procurement and construction (EPC), the new division represents Ginlong’s forward-looking approach to the Chinese market as it becomes more than a product supplier and moves upstream into utility plant deployment. Entering utility asset construction and ownership in China marks a pivotal shift for Ginlong. The strategy is to leverage its cost-effective, cutting-edge manufacturing capabilities downstream. This plant-level experience will contribute to faster product development of its existing utility-scale string inverter technology.