Green bonds have the potential to unlock vast new sums of capital for the deployment of solar and other low-carbon infrastructure. Katie House looks at how a relatively new concept is rapidly evolving into a potentially major source of clean energy finance, in a feature article which originally appeared in the seventh issue of PV Tech Power. To be emailed every issue of PV Tech Power first, and a host of other benefits, sign-up for a free PV Tech Essential membership today.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

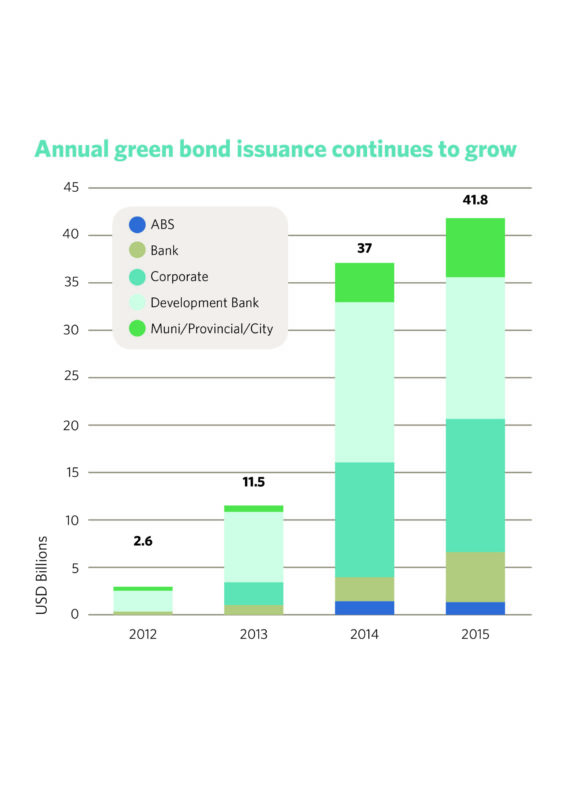

Green bonds first appeared in the market in 2007, with initial issuance from development banks including the European Investment Bank (EIB) and the World Bank. Issuance really began to ramp up from 2012. Some US$2.6 billion was issued in that year, US$11.5 billion in 2013, a tripling to US$37 billion in 2014 and continuing growth with issuance reaching US$41.8 billion in 2015 (Figure 1).

All up, in less than a decade the green bond market has become established. While still small in the context of the US$100 trillion global debt markets, green bonds are firmly on the post-COP21 Paris agenda looking at climate finance options and a vastly increased role for the private sector.

Predictions for what 2016 will bring have come from various market observers; Climate Bonds Initiative forecasts US$100 billion-plus of issuance, Swedish bank and green bond issuer SEB predicts from US$80-100 billion, Moody’s and HSBC weigh in with more conservative estimates of US$70 billion and US$55-80 billion respectively.

Whichever estimate you look at it is clear green bonds are on the up. They have huge potential to help fund the necessary transition to a low carbon economy, be it clean energy, efficient water management, green buildings, climate-friendly transport and other low-carbon infrastructure. Renewable energy, including solar power generation, is an obvious sector to be financed with green bonds.

What are green bonds?

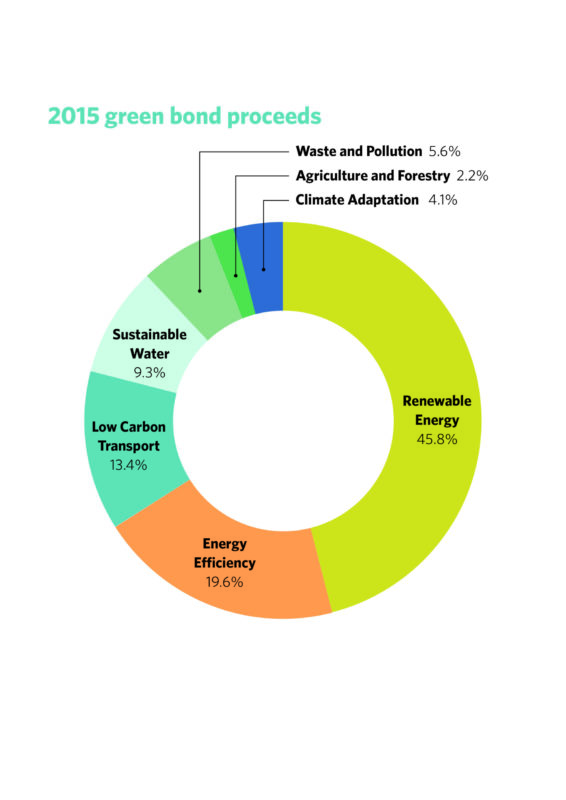

Green bonds are regular bonds that carry a ‘green’ label. Bonds may be labelled green if the proceeds from the issuance are to finance or refinance projects that deliver positive climate benefits. Green bonds are backed by the issuer’s entire balance sheet. Figure 2 demonstrates the variety of project types that green bonds have been issued for. Renewable energy accounted for 45.8% of green bond issuance in 2015 with the bonds predominantly financing or refinancing solar and wind power assets.

The green credentials of a bond are based on the projects or assets linked to its issuance, not the green credentials of the entity issuing the bond. This means that a wide range of issuers can issue green bonds including bonds for solar energy, whether they are a national government, a city or municipality, development bank, commercial bank, or a corporation.

‘Green’ has issuer and investor benefits

The overarching benefit and aim of issuing a green bond is the environmental and climate benefits it delivers. However, there are additional benefits to both the issuer and the investors above what is gained by a regular bond.

Investor diversification: Because of the green label, green bonds attract a more diverse pool of institutional investors than issuers typically gather. The green label is attractive to asset managers who have sustainable mandates from the pension and retirement funds whose investment portfolios they manage. Issuers are often keen to achieve this diversification amongst their bondholders as this can widen their potential pool of capital providers in any future offerings.

Bond oversubscription: Currently, demand for green bonds outstrips supply. Issuers of green bonds are seeing oversubscription for their issuances sometimes resulting in green bonds being upsized.

Increased transparency: With green bonds, investors benefit from heightened transparency on where their money is invested. Issuers are becoming increasingly aware of the need to be accountable on how bond proceeds are used. Annual reporting on how proceeds are allocated is a common feature of green bonds.

Low-cost capital for infrastructure: Green bonds are a useful finance tool for delivering low-cost capital for infrastructure projects. Infrastructure projects are often large scale, requiring upfront capital expenditure, which then generate long-term, relatively stable returns. If the infrastructure has inherent emissions-reduction characteristics, like clean energy or mass transit systems, it can be financed in part by green bonds. If climate resilience and adaptation features are incorporated into the design and build it can become even more attractive.

CSR & PR: A final benefit that green bonds deliver is in terms of social licence. Both issuers and investors can use green bonds to promote the fact that they are acting on climate change and behaving in a socially responsible way.

Climate Bonds Standard & Certification Scheme: Solar Criteria

The Solar Criteria were developed by a technical working group (academics and experts in the field), and an industry working group (organisations and individuals working in the field). The proposed criteria were then submitted for public stakeholder comment before being approved by the Climate Bonds Standard Board. These criteria are now available for certification under the Climate Bonds Standard and several certifications have already been completed.

Eligible projects and assets

Eligible projects and assets relating to solar energy generation are those that operate, or are under construction to operate, in one or more of the following activities:

- Solar electricity generation facilities

- Wholly dedicated transmission infastructure for solar electricity generation facilities

Eligible projects and assets that have activities in solar electricity generation facilities shall have a minimum of 85% of electricity generated from solar energy resources.

Further details on the development process and the specific technical criteria are available on the Climate Bonds Initiative website (www.climatebonds.net).

New standards are part of the story

Green bonds were created to fund projects that have positive environmental or climate benefits. It is up to the issuer to label the bond as green. However, many investors are keen to see some kind of verification that the projects funded are delivering substantial environmental or climate benefits. The Green Bond Principles and the Climate Bonds Standard can provide such assurance.

The Green Bond Principles are voluntary best practice guidelines for labelled green bonds. They focus on transparency of use of proceeds, the process for project evaluation and selection, management of proceeds and reporting on use of proceeds. The principles are governed by a membership secretariat made up of green bond issuers, investors and intermediaries.

The Climate Bonds Standard is an investor-screening tool that assesses and certifies the environmental integrity of green bonds, allowing prioritisation of green bonds with the confidence that the funds are delivering climate change solutions. A suite of sector-specific criteria, solar criteria being one of these, detail what assets are eligible for certification. Third-party verifiers assure that a green bond adheres to the Climate Bonds Standard (see box, left).

Sean Kidney, CEO of Climate Bonds Initiative, explains why solar criteria for green bonds are necessary: “Solar energy seems like a straightforward fixed asset to include in our definition of a low-carbon economy, but we needed to address questions around potential environmental impacts, fossil fuel back-up plants included in some plants, and supply chain manufacturing, to make sure we have all bases covered.”

Solar and green bonds

The International Energy Agency (IEA) forecasts that the sun could be the world’s largest source of electricity by 2050. Solar PV systems could be generating up to 16% of the world’s electricity by 2050 while solar thermal electricity could contribute an additional 11%. Many other analysts predict solar uptake will be even higher as further technological development improves efficiency and lowers costs. Green bonds can finance this increased capacity.

Green bonds can be, and have been, used to finance solar projects in a number of ways. Some examples we have seen to date are:

- Solar pure-play issuance

- Solar asset-backed securities

- Solar within a bigger green bond issuance

Solar pure-play issuance

Organisations that deal only in solar energy are the obvious issuers of solar related green bonds, these organisations can be referred to as solar pure-play issuers; they purely deal in solar. US-based Solar Star Funding LLC is one such issuer. In March 2015 Solar Star issued a US$325 million bond to fund its 579MW solar projects. The bond was upsized by US$10 million due to investor demand. Although Solar Star did not label its bond as ‘green’ it easily could have done.

In addition to labelling bonds green, issuers may choose to get their green bond third-party certified. This provides assurance to the investor that the environmental credentials of the bond are robust.

Belectric, a UK based solar power technology and construction expert, did just this when it issued a £4.6 million (US$6.6 million) certified green bond to refinance the cost of developing and constructing the 3.8MWp Willersey Solar Farm. Bureau Veritas, the global inspection and certification services provider, verified that the green bond complied with the Climate Bonds Standard to provide assurance to investors.

Solar asset-backed securities

Solar projects, especially individual rooftop arrays, are very small-scale projects in infrastructure terms. Asset-backed securities (ABSs) allow aggregation, where individual, small and medium size projects can be pooled or combined to reach the scale for which bond financing is appropriate. Securitisation involves turning receivables from assets like mortgages or equipment leases into bonds. These are sold to investors, who receive the repayments due from the assets.

A recent example of this is Australian company FlexiGroup that issued a certified green asset-backed security for rooftop solar PV. FlexiGroup will refinance existing residential rooftop solar PV systems and other solar equipment accounting for around 19,000 customer contracts.

This security was certified under the Climate Bonds Standard with assets deemed eligible under the Solar Criteria. What was really exciting about this issuance was that the certified green notes closed five basis points lower than non-green notes issued at the same time by FlexiGroup and backed by the same wider pool of consumer receivables.

Commenting at the time Sean Kidney from Climate Bonds alluded to the future possibilities: “Australia already has one of the highest rates of rooftop solar density and a diverse ABS market. There is enormous potential for this green ABS to be the first of many.”

Solar within a bigger green bond

ABN AMRO issued a certified bond in June 2015. Proceeds of the €500 million (US$556 million) bond are being used to finance and refinance mortgage loans for new residential buildings, “green loans”, for financing solar panels installed on residential buildings as well as commercial real estate loans for the construction and financing of energy efficiency buildings.

In another high-profile example, Silicon Valley tech giant Apple issued its first green bond earlier this year. In an issuance of US$1.5 billion proceeds are for mixed uses including financing of green buildings, energy efficiency, renewable energy, energy infrastructure, water efficiency, recycling and pollution reduction. The renewable energy portion will finance solar and wind projects and associated energy storage solutions.

Apple’s green bond was issued to help the company fund measures to reduce the climate impacts of its operations. It is a prime example of a non-solar player issuing a green bond and funding solar energy for its own needs via a diverse pool of low-carbon projects.

Where to for the market?

The green bond market has started to diversify in currencies and ratings; signs of a maturing market. Green bonds have been issued in 23 currencies, several high-yield green bonds have been issued and emerging markets are entering the market.

The growth of green bonds in emerging markets is an important development, as these economies are where most of the low-carbon and climate-resilient infrastructure must be built in the coming decades to meet global climate targets.

Broad standards and definitions as to what constitutes green are an important consideration for institutional investors, particularly as the market grows in size and diversity. Recognition of standards such as those the Climate Bonds Initiative administers and harmonisation between national regulators to ensure market integrity around green definitions will give impetus to issuers and buyers.

More green issuance from corporates would give green bond markets added liquidity and depth. The corporate bond market is enormous, the major source of debt capital. Apple is a prominent example where bond issuance has a solar component. Issuance from other S&P500 companies or leaders amongst the FTSE or Nikkei indices would have a positive ripple effect through international bond markets.

Lastly, the market needs regulatory action from governments that frames and promotes market directions. Broad measures like clean energy targets and carbon pricing to specific incentives are needed to promote clean energy uptake in the built environment, transport and energy-intensive processes. A reduction in fossil fuel subsidies must also be part of the policy agenda.

From helping structure markets, encouraging private sector action and setting the directions, governments and regulators have a vital role.

Are big investors getting serious?

Much of the international discussion since the Paris climate conference has centred around the need for the private sector to dramatically increase climate financing, in part to help nations achieve their stated NDC goals and hold to the 2°C target.

The most credible of the forward energy forecasts recognise that holding warming to this target requires a dramatic scale up of clean energy production over fossil fuels. Within this mix, solar has cost, technology and efficiency gains yet to be realised and will benefit from grid, energy control and storage improvements.

Leading investor bodies realise that the pace of change in solar uptake will not accelerate through market action alone. On Earth Day, global investor associations, the Terrawatt Initiative and the Green Infrastructure Investment Coalition (GIIC), representing over US$60 trillion of assets under management, issued the New York Solar Investor Statement, pledging their support to the objective of the International Solar Alliance (ISA) target of US$1 trillion investment into PV power generation assets in member countries by 2030.

The short-term commitment involves working with the ISA to support the swift mobilisation of US$120 billion of capital in solar investments. The goal is to create investment structures that meet the risk and yield requirements of institutional investors, and the promotion of suitable financial instruments that will accelerate investment in solar to the capital levels outlined above.

In plain language it means working with nations to develop new solar energy opportunities and project pipelines. Green bond financing, solar bonds and new forms of solar securities will be part of the investment mix.

Climate finance and solar

Global green bond markets need to grow into the hundreds of billions in annual issuance, with financing for clean energy comprising a large proportion of these new bonds.

Climate finance success will in part be defined by how quickly we can fund the solar component of the world’s clean energy needs.