Chinese solar manufacturers continue to dominate the solar industry, with Wood Mackenzie’s latest module manufacturer rankings including nine Chinese companies among the top 12 manufacturers.

In Wood Mackenzie’s top ten solar PV module manufacturer ranking, JA Solar tops the list with the score of 82.9 out of 100, followed by Trina Solar (81.7), JinkoSolar (80.8) and Canadian Solar (78.5).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Both LONGi (78) and Risen Energy (78) are ranked fifth as they shared the same score. Tongwei (77.6), Astronergy (76.3) and Hanwha Q-cells (75.8) take the sixth, seventh and eighth places. The remaining solar companies on the list include DMEGC Solar (74.1), Elite Solar (71.4) and Boviet Solar (71.4).

Wood Mackenzie said both fifth and tenth place are awarded to two companies each due to close scores.. This ranking is limited only to crystalline silicon solar manufacturers, according to Wood MacKenzie.

Breaking the 100GW threshold

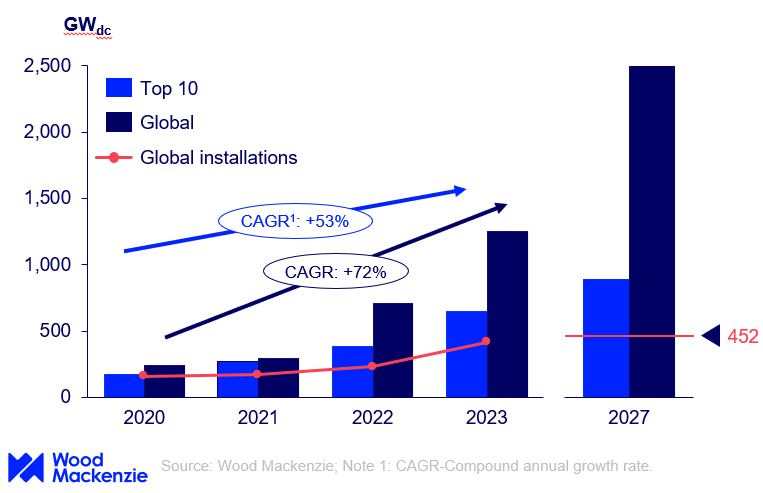

Seven out of the 12 ranked manufacturers are each expected to exceed 100GW of module production capacity by 2027. Additionally, the total capacity of wafers and cells of the top ten ranked companies is expected to reach 830GW in the next three years, enough to satisfy global demand twice.

Regarding capacity and growth rate, ten out of the 12 manufacturers saw their manufacturing capacity increase by over 100% in the past four years.

Eight out of the 12 ranked module manufacturers are self-sufficient in cell capacity, but Tongwei and Risen New Energy are the only manufacturers that are fully vertically integrated with a supply chain from polysilicon to module.

Meanwhile, the compound annual growth rate (CAGR) of module capacity among top 12 module manufacturers was 53% between 2020 and 2023, lower than the CAGR of all manufacturers, which stood at 72%.

Looking ahead, Wood Mackenzie said the top solar manufacturers are expected to continue their expansion against the backdrop of the oversupply of manufacturing capacity. At the same time, manufacturers are focused on becoming more vertically integrated.

Lastly, Wood Mackenzie added that the top manufacturers have several strengths in common, including more than ten years of module manufacturing experience, vertical integration and high capacity utilisation.

This article is amended on 26 June for clarity.