The US is forecast to reach between US$55-60 billion in clean energy tax credit monetisation in 2025, according to a report from clean energy financing technology platform Crux.

This would be up from the US$52 billion registered in 2024, while tax equity investments are forecast to rise by 10-20% year-on-year in 2025 with between US$32-35 billion.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Despite many policy changes this year – led by the passing of the “One Big, Beautiful Bill” Act – interest in clean energy financing continued to grow in the first half of 2025.

One key takeaway from the report, The State of Clean Energy Finance: 2025 Mid-Year Market Intelligence Report, is that the total transferable tax credit market grew more than twofold between H1 2024 and H1 2025, to over US$20 billion.

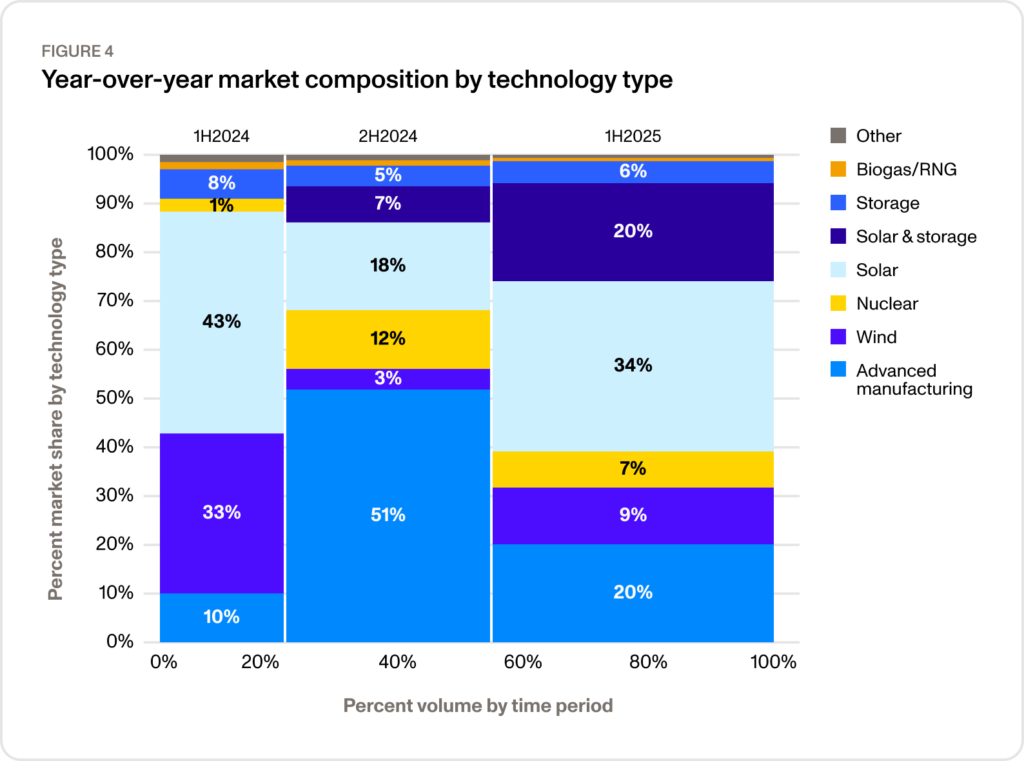

Solar PV accounted for the highest share across all technologies and advanced manufacturing in H1 2025, with 34.4%. Crux estimates that solar PV accounted for more than US$7 billion in tax credits generated in H1 2025, covering credit generation years 2024-2026. Most of the deals where for 2025 solar tax credits with US$4.7 billion, while 2024 tax credits accounted for US$2 billion and forward commitments for 2026 nearly half a billion dollars.

The majority of solar PV deals were for investment tax credits (ITCs), with more than 95%. Even though solar production tax credits (PTCs) continue to represent a small share of the tax credit market, Crux said these are “beginning to transact with greater frequency,” especially in large utility-scale solar projects.

“Sponsors typically opt for PTCs when high-output projects can earn more value through ongoing production credits than a one-time ITC. Additionally, a growing number of investors are now set up to underwrite PTC-based solar, making it easier to access that path of financing than a few years ago,” Crux told PV Tech.

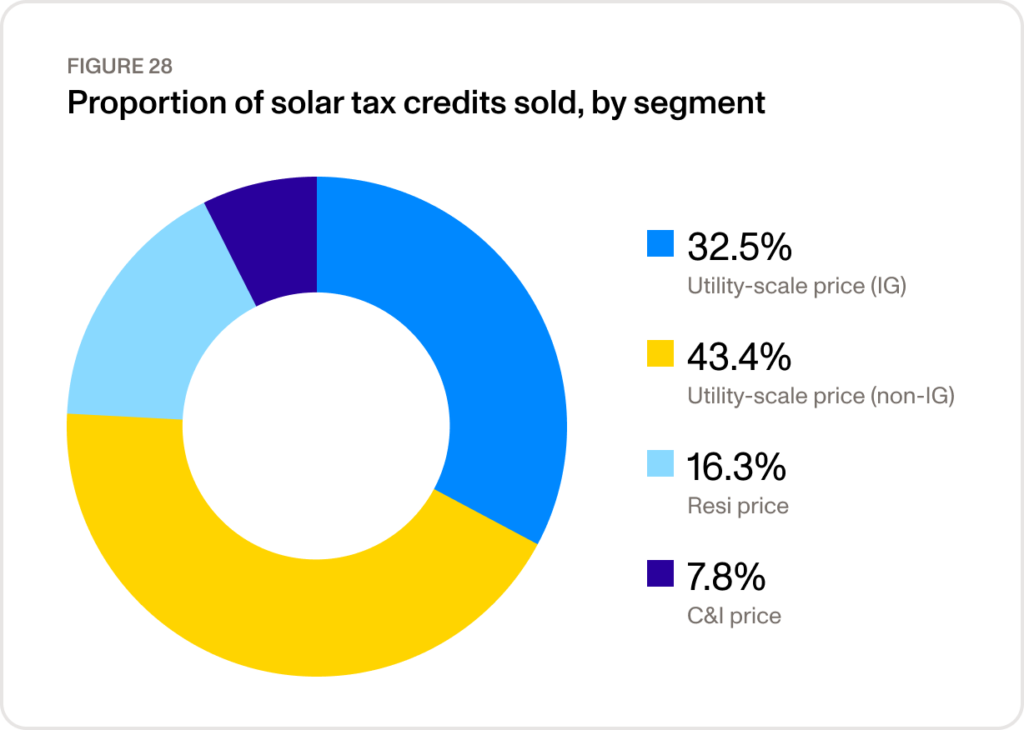

In terms of sectors, utility-scale accounted for the majority of the solar tax credits in H1 2025 with 75.9%, followed by residential solar with 16.3%, while community solar and commercial & industrial (C&I) accounted for 7.8% of all solar tax credits sold.

However, the share of solar PV tax credits in H1 2025 compared with the same period in 2024 dropped, while solar-plus-storage grew quickly in 2025 to 20%.

Hybrid solar-plus-storage and standalone energy storage ITCs accounted for 26% of tax credits sold in H1 2025, when they only made up 9% of the market in H1 2024.

“Massive investments in energy infrastructure are being realised at the very moment the US needs more electricity and manufacturing capacity,” said Alfred Johnson, co-founder and CEO of Crux.

“But the new policy environment is challenging, especially for developers of wind and solar. Transferability helped knit together what were once fragmented financing submarkets into a larger, more dynamic, more integrated market; this integration has opened new opportunities and different strategies across the capital stack.”

Furthermore, the company recently launched its new tax and preferred equity offering. Through the new offering, Crux aims to help developers raise capital, supports investors deploying tax and preferred equity, and connects buyers with quality, vetted tax credit opportunities.

The company’s new offering also aims to fill a gap in the market as tax equity is estimated to be US$28 billion annually, according to Crux. A recent survey from Crux highlighted that 76% of developers shared that tax equity is “not available or only somewhat available” in the market.

“As tax credit policies shift, project developers and investors need clarity, optionality, and execution. Crux now offers access to tax and preferred equity, debt, and transferable tax credits, all in one place,” said Johnson.