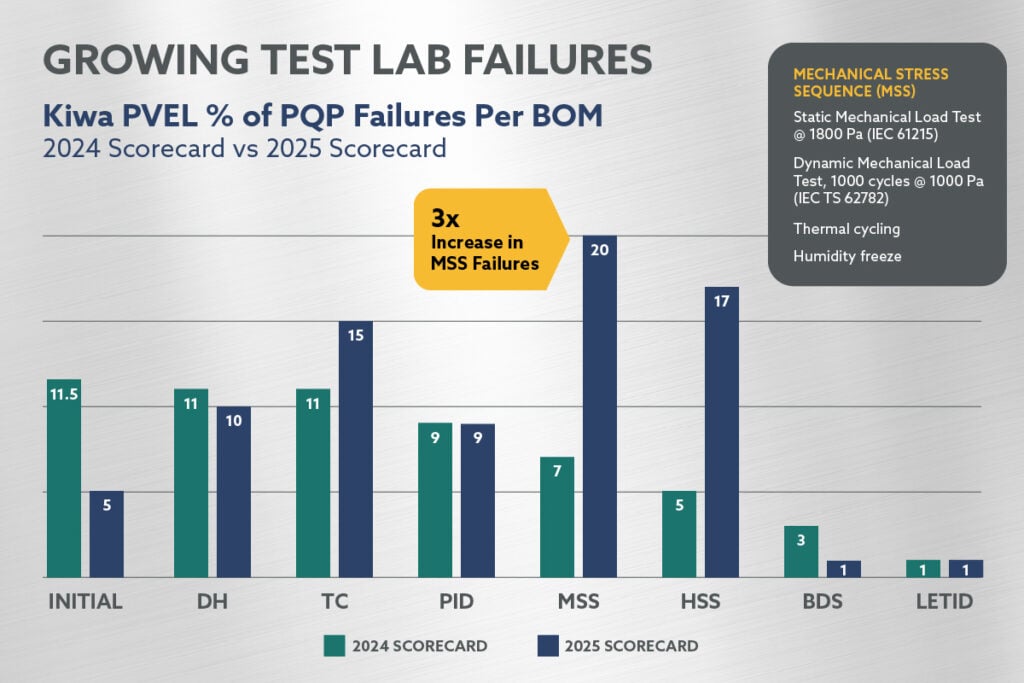

As the solar industry pushes for ever-lower costs, larger module sizes and greater energy output, the structural integrity and long-term performance of modules have become critically compromised. According to the latest research from Kiwa PVEL and CRU, aggressive cost-cutting on module frames has led to poor quality and structural integrity issues. Failure rates in module mechanical stress sequence (MSS) testing are at 20% – up from only 7% a year earlier (see Figure 1). This disturbing trend adds to unplanned project costs, while a decline in testing rigour and lagging standards have increased uncertainty and risk. The combination of quality-impacting module cost reductions and inadequate test standards is simply not sustainable for an industry that depends on predictable costs and power production for profitable growth.

There is an urgent need to improve and increase module ratings and long-term durability, thereby ensuring solar plant reliability and performance. CFV Labs (now part of Groundwork Renewables), a solar testing laboratory, has long been advocating for higher testing standards for PV modules to reverse the trend of decreasing mechanical strength. The solution for module breakage starts with a return to more rigorous performance and certification testing – and stronger materials, which will lead to more meaningful specifications and safety margins. At the same time, transitioning the industry away from aluminium to steel frames will increase module strength, enable further innovations, and unleash a strong domestic supply chain.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Solar module reliability is collapsing

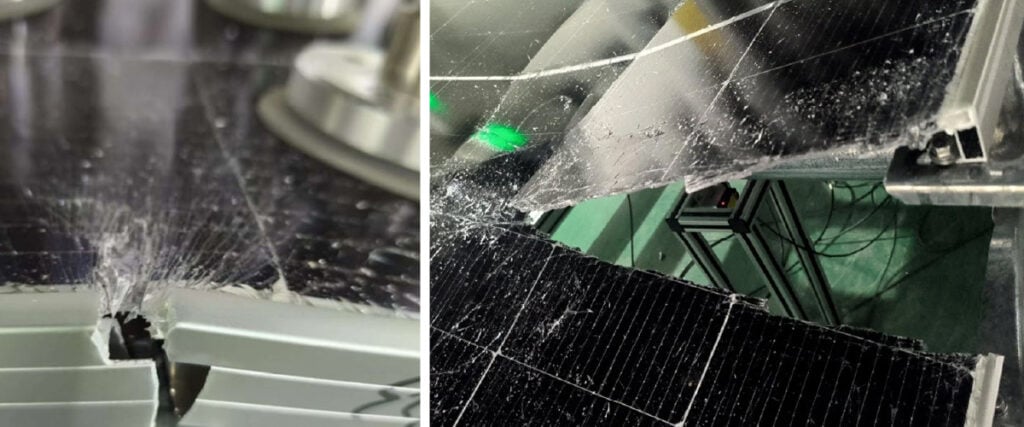

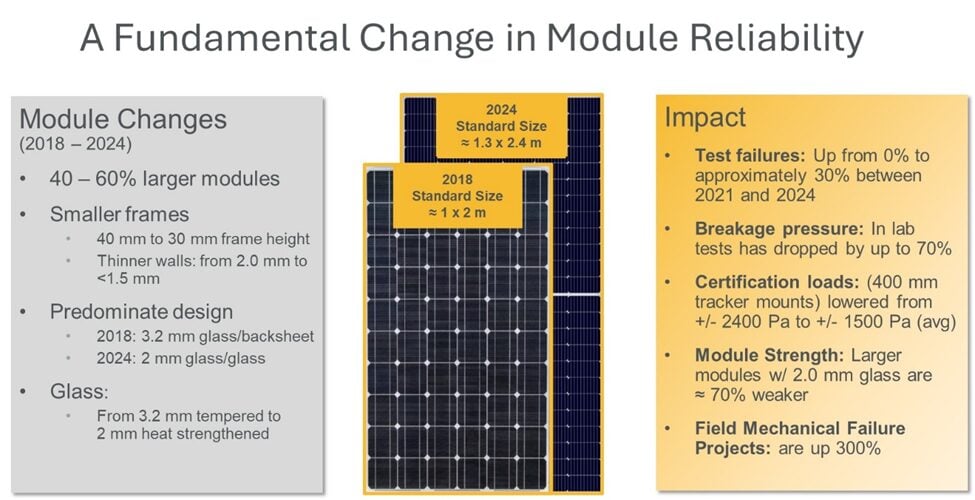

The race to cut costs and increase productivity in solar manufacturing has come at a steep price: reliability. As modules grow larger and manufacturers shave pennies by using weaker aluminium frames and thinner, not fully tempered glass, failure rates are spiking both in the lab and the field (see Figure 2).

In a recent article, Alex Barrows of CRU Group highlights this risk: “…we have been warning subscribers… of the risk to module reliability from this aggressive cost-cutting. Last summer, we highlighted a particular risk from frames; frame manufacturers… had expressed a concern that in some cases module manufacturers were pushing too far with slimming down wall thicknesses and were compromising on quality.”

An IEA PVPS report on field-deployed module performance highlights the scale of the issue, citing a 10% overall failure rate for 2mm glass/glass modules and instances of up to 50% breakage in some 2mm glass modules within nine months. Other reports claim growing instances of “spontaneous” breakage with no identifiable weather event.

To make matters worse, industry test protocols have failed to keep up with industry needs. They typically rely on a single mechanical load test sample that fails to account for module (and particularly glass) variability and proper safety margins and also fails to characterise “spontaneous” breakage risk or other low-level wind vibration through extended dynamic load testing. Load ratings, once a safety benchmark, are lower than ever. This puts pressure on EPCs, developers and asset owners to deploy additional measures to understand module capabilities and site risk.

In the IEEE Journal of Photovoltaics, NREL scientists warn that “current qualification testing is ineffective” at detecting early-life failures, adding to a growing list of industry experts delivering similar warnings.

It’s time to stop accepting diminishing specifications, poor standards and unknown risk factors and start demanding solutions. Stronger frames – specifically steel – offer a clear path to bolster load capabilities and safety margins and better protect module glass and cells from breakage. If the industry wants to scale with assurance and integrity, its materials and testing methods must scale with it.

Redefining module strength: the steel frame advantage

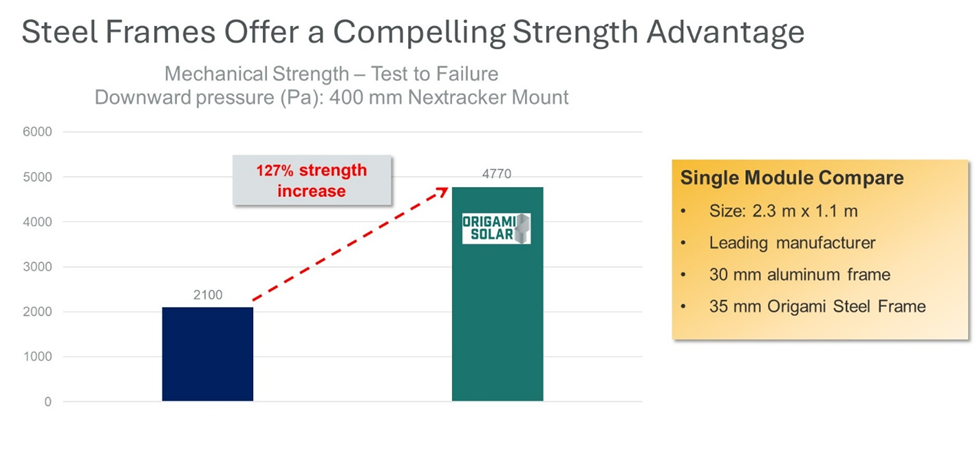

Steel frames represent a critical opportunity for greater innovation and performance in the solar industry. Steel performs significantly better than aluminium in myriad aspects, providing superior protection for module glass and cells from damage during manufacturing, transport, installation and weather events in the field. Steel also accommodates more robust module specifications and safety margins, especially with larger-format modules (see Figure 3).

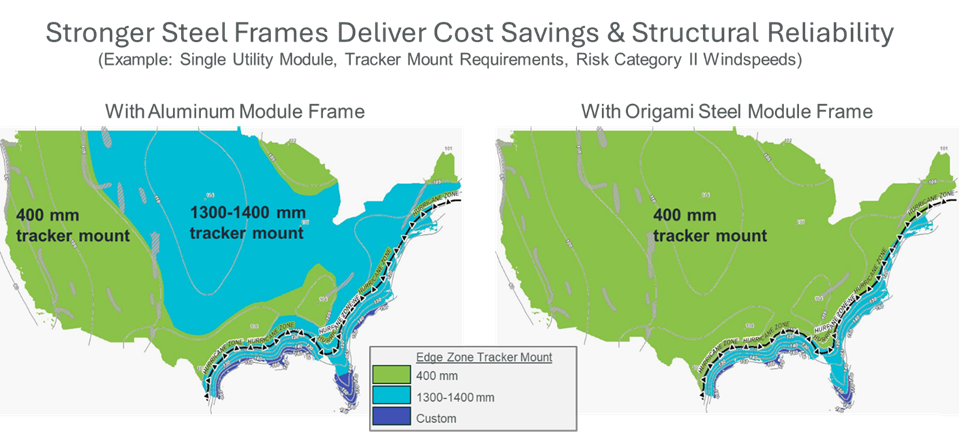

In conjunction with solar tracker mounts (which are also typically made of steel), the added frame strength boosts wind ratings, can save money on tracker mount installation costs and simplifies project design. Steel frames can also meet higher performance expectations with fewer system or PV plant design compromises.

A recent webinar that Origami presented with tracker maker Array Technologies highlighted several key arguments regarding the value of steel frames in combination with trackers.

- Stronger steel frames significantly improve module wind ratings and increase the design flexibility of module + tracker deployments, while enabling trackers to be deployed in geographies with extreme wind loads.

- Steel-framed modules can be supported by shorter tracker mounts (i.e. clamps and rails) in wind-prone areas, simplifying tracker mounts needed for a site, lowering tracker and installation costs, and improving LCOE(see Figure 4). The project case study in the webinar shows an 18% reduction in tracker mount cost by switching from aluminium to steel frames.

- Steel frames are marginally heavier than aluminium, but this most likely has no impact on core tracker components, such as piles, torque tubes and motors, or the total tracker cost.

Steel is not only significantly stronger than aluminium, it’s also cheaper, more abundant and made in the US. Domestic steel is less expensive than domestically produced aluminium, which commands a significant price premium due to limited production. Roll-formed steel frames made locally also reduce freight, packaging, shipping times and inventory holding costs. From a cost perspective, US-made steel module frames currently qualify for up to 8.5% domestic content incentives under the Inflation Reduction Act (IRA).

In addition to greater structural integrity, steel frames offer excellent durability to ensure industry-standard operating life. High-performance anti-corrosion coatings (e.g. zinc-aluminium-magnesium) have been validated across the construction and automotive industries over the last 25 years. The coatings vastly outperform galvanised steel and prbovide a lifetime of corrosion protection for solar modules and projects.

Raising the bar: collaborative innovation for next-gen module standards

At Origami, our focus is to provide iterative R&D-driven testing of steel-framed modules in conjunction with module maker customers. This enables us to fully understand and characterise specifications and failure points by testing to failure. Our domestic test facility can offer frame design, analysis and validation, enabling faster innovation and problem-solving. We can do this for module and tracker manufacturers, developers, insurance firms, bankers and other stakeholders, prior to third-party lab certification.

Testing labs such as CFV/Groundwork, Kiwa PVEL, TUV Rhineland, UL Solutions and CEA Intertek are the acknowledged experts in module qualification and certification. Origami’s role in the process is to pre-qualify steel-framed modules across a variety of tracker and other rack mounting approaches. We conduct iterative testing to failure under a range of scenarios, leveraging our equipment and computer modelling to predict field performance, improve specifications and optimise safety margins. We can thus confer a level of confidence to module makers and others across the value chain and provide insights and data to outside labs for their certification testing.

Origami steel module frames have been conclusively proven to be mechanically superior and better performing. Origami is ready to work closely with module makers, their customers and other key stakeholders to iterate and optimise the performance and mounting of steel-framed modules. As the leading innovator in steel module frames, we are committed to accelerating the transition to steel by ensuring testing confidence and collaborating with test labs to establish new and more meaningful industry standards.

A stronger industry starts with smarter design and testing

Frames have long been the overlooked element of PV modules and an area ripe for innovation. As the market has moved toward larger module sizes and weaker aluminium content, the industry has been impacted. The outlook is worrisome. The solution is to expand test processes and workflows, combining pre-certification evaluations with formal lab testing; establish more robust standards and safety margins; and transition to higher-performance steel frames.

As the solar industry continues to scale, module reliability must be engineered into every aspect of product development – from materials and mechanics to testing and certification. The mounting evidence of increasing module fragility points to an urgent need to modernise both structural components and testing protocols. The shift to steel frames is not just a material upgrade, but a foundational rethinking of how the industry approaches durability, safety and cost-effectiveness. With greater strength, domestic availability and compatibility with next-generation module sizes, roll-formed steel offers the structural performance necessary to support larger, more powerful PV modules while boosting reliability.

The path forward is clear: by embracing stronger materials and smarter testing workflows, the solar industry can secure the reliability and performance it needs to thrive in an era of exponential growth and rising expectations. As standards evolve and federal incentives align with these innovations, steel frames are poised to become the new backbone of utility-scale solar reliability.

Eric Hafter is the founder of Origami Solar