The latest levelised cost of electricity (LCOE) report from US financial analyst Lazard notes that, while renewable energy technologies continue to have some of the lowest LCOE figures in the US, fossil fuel will still have a role to play as “diverse generation fleets will be required” to meet energy demand.

The main takeaway from the report, for the solar industry, is that solar remains one of the cheapest sources of power generation, with utility-scale PV having an LCOE range of US$29-92/MWh. This is the second-cheapest figure, behind only onshore wind (US$27-73/MWh), and is significantly lower than many fossil fuel sources, such as gas peaking (US$110-228/MWh) and coal (US$69-168/MWh).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

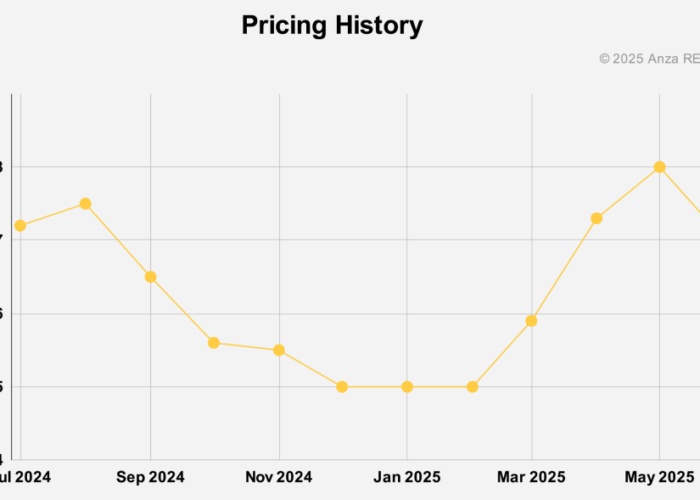

Utility-scale solar has also experienced the greatest decline in average LCOE, according to Lazard’s figures, with an 83% decline in LCOE since 2009, as shown in the graph below.

The graph above also makes clear the slight increase in the LCOE for many forms of power generation after 2022, following Russia’s invasion of Ukraine and the subsequent uncertainties regarding meeting power demand around the world.

There is similar variation in the cost of different forms of solar power, with rooftop residential solar having a sizable LCOE range of US$122-284/MWh. This US$284/MWh figure is the highest among all power sources, including renewable power and fossil fuels, and demonstrates how the falling LCOE in the solar industry is largely contained to the utility-scale sector.

Similarly, community and commercial and industrial-scale solar projects had an LCOE range of US$54-191/MWh, while utility-scale solar-plus-storage projects had an LCOE range of US$60-210/MWh.

Impacts of the IRA

The higher ends of these solar figures is also notably higher than wind, the other renewable technology profiled in depth by Lazard, which saw its LCOE range from a low of US$27/MWh for onshore projects to a high of US$139/MWh for offshore projects.

Wind is also thought to be a greater beneficiary of federal tax subsidies in the US, with the production tax credit (PTC) driving the cost of onshore wind as low as US$0/MWh. Solar also benefits from favourable US regulations – with utility-scale projects supported by the PTC seeing an LCOE range of US$19-78/MWh, while even the LCOE scale of rooftop residential solar is lowered to US$75-228/MWh under the investment tax credit (ITC) – albeit to a lesser extent than wind.

The report’s findings demonstrate that the ITC and PTC are fulfilling their intended purpose. The credits were implemented as part of the wide-ranging Inflation Reduction Act (IRA), which has sought to onshore renewable energy manufacturing, and the presence of these credits has encouraged the development of new solar projects in the US, such as one developed by Ørsted that closed financing last month.

Narrowing LCOE ranges across the power sector

Notably, the range for many forms of power generation has tightened compared to Lazard’s analysis last year. Utility-scale solar, for instance, saw its LCOE range shift from US$24-96/MWh in 2023 to US$29-92/MWh, and the report’s authors noted that the lower end of many LCOE ranges had increased “for the first time ever”.

A similar phenomenon was observed in onshore wind, which saw its LCOE ranges shrink from US$24-75/MWh in 2023 to US$27-73/MWh in 2024.

However, there are two striking exceptions to this trend. One is the LCOE range for utility-scale solar-plus-storage projects, which saw its figures grow considerably from US$46-102/MWh last year to US$60-210/MWh this year.

According to the report: “The decline on the low end was, in part, driven by a noticeable decline in cell prices resulting from increased manufacturing capacity in China and decreased mineral pricing. However, this was offset by significant increases in engineering, procurement and construction (EPC) pricing driven, in part, by high demand, increased timeline scrutiny, skilled labour shortages and prevailing wage requirements.”

Secondly, gas saw its LCOE range grow, with the LCOE range of peaking projects increasing from US$115-221/MWh in 2023 to US$110-228/MWh in 2024. This could reflect uncertainty regarding the future of gas plants in the US, with other Lazard figures suggesting that continuing to operate existing gas projects has a comparable LCOE to building both subsidised and unsubsidised renewable power projects.

The report notes that the LCOE of continuing to operating existing gas plants ranges from US$39-130/MWh, a figure comparable to the US$45-133/MWh range for unsubsidised onshore wind-plus-storage projects. The LCOE range of existing gas plants is also much narrower, and its top end is much lower, than the subsidised LCO of new utility-scale solar-plus-storage projects, which ranges from US$38-171/MWh.