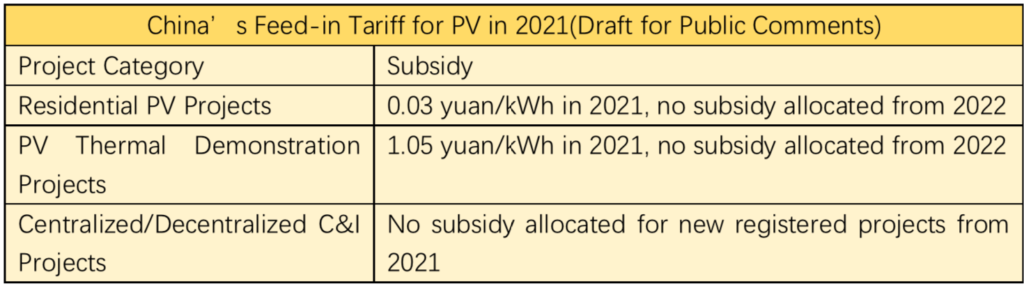

A draft proposal put forward by China’s National Development and Reform Commission could see subsidies for new solar projects phased out, starting this year.

The draft proposal, ‘Notice on Matters Related to the Renewable Power Feed-in Tariff Policy in 2021’, was submitted this week and would, if enacted, mean no further subsidies would be allocated to newly registered centralised solar PV projects or decentralized C&I-scale solar projects approved by China’s central government.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

But tariffs for new projects, or guaranteed power purchase prices, would continue to be set through the combination of guide and competitive prices in whichever province the projects are developed in. These prices are determined by calculating the benchmark coal power price in 2020 as well as the average market price for power per province.

Furthermore, these tariffs will remain set for the purchasing hours determined for each project, with power generated outside of those purchasing hours rewarded with tariffs determined purely by the market price at that time.

The document also details proposed changes to subsidies for residential solar projects, capping the subsidy standard for decentralized PV plants in the 2021 fiscal year to RMB0.03/kWh, which would apply to all power generated by the installation.

From 2022, China’s central government would no longer subsidise new residential solar installations under the proposals.

For national renewable demonstration projects, tariffs would be set depending on the local coal power benchmark price approved by China’s National Energy Administration, however no subsidies will be made available for projects completed after 1 January 2022.

However, the document does open the window for local governments to establish their own policies, encouraging them to introduce more targeted support for solar PV, solar thermal and wind projects.

The National Development and Reform Commission is soliciting for responses to the proposals, which could yet be tweaked.