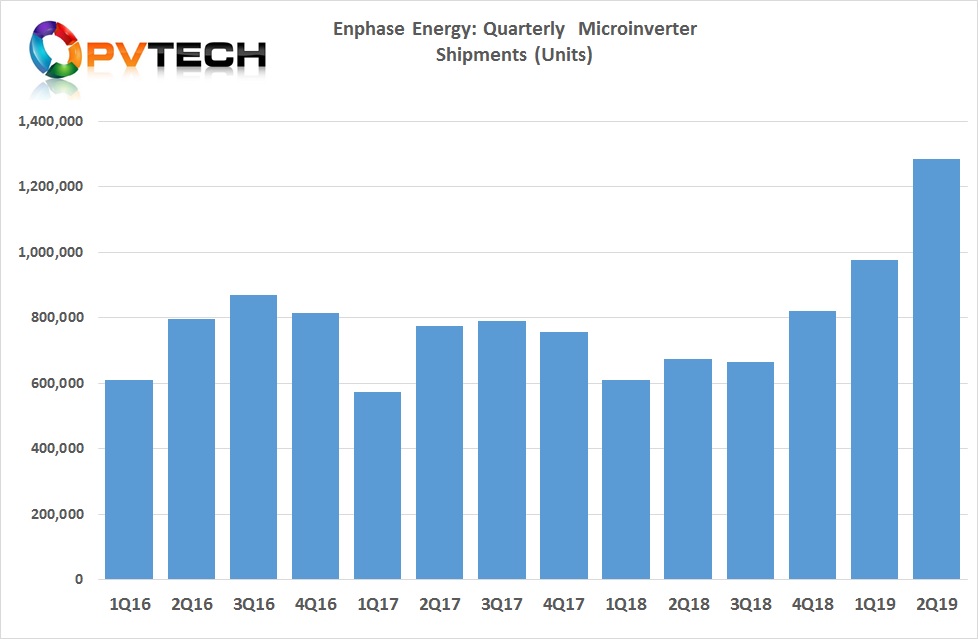

Leading microinverter supplier, Enphase Energy shipped over 1.2 million units in the second quarter of 2019, with its latest IQ 7 model accounting for around 98% of shipment total.

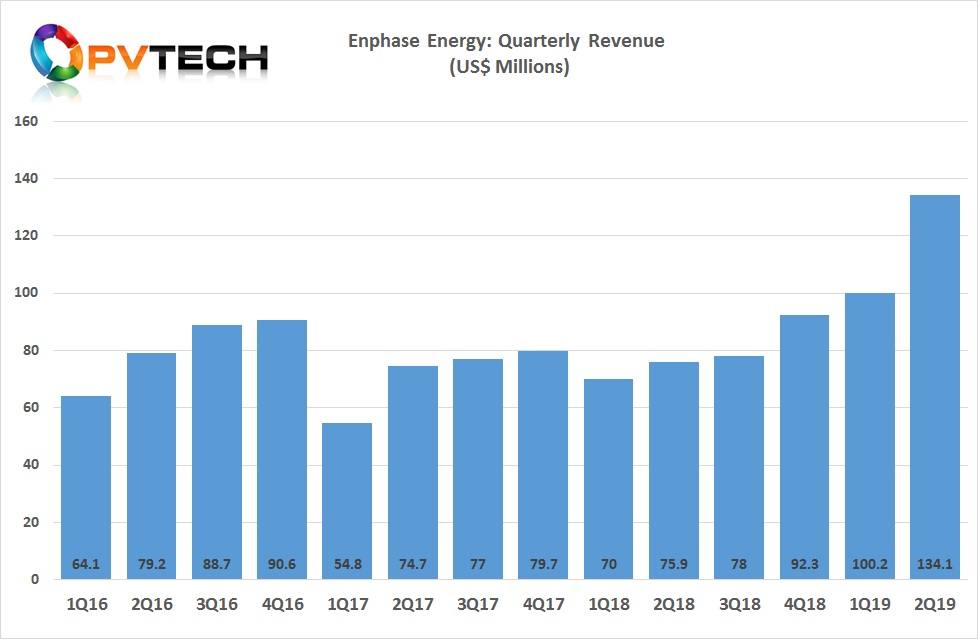

Easing of constraints, as both component supply and outsourced manufacturing improved during the reporting period, led to Enphase increasing revenue 34%, sequentially and 77%, year-on-year to US$134.1 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Microinverter shipments in the second quarter of 2019 stood at 1.283 million, with IQ 7 model shipments accounting for around 98% of the total.

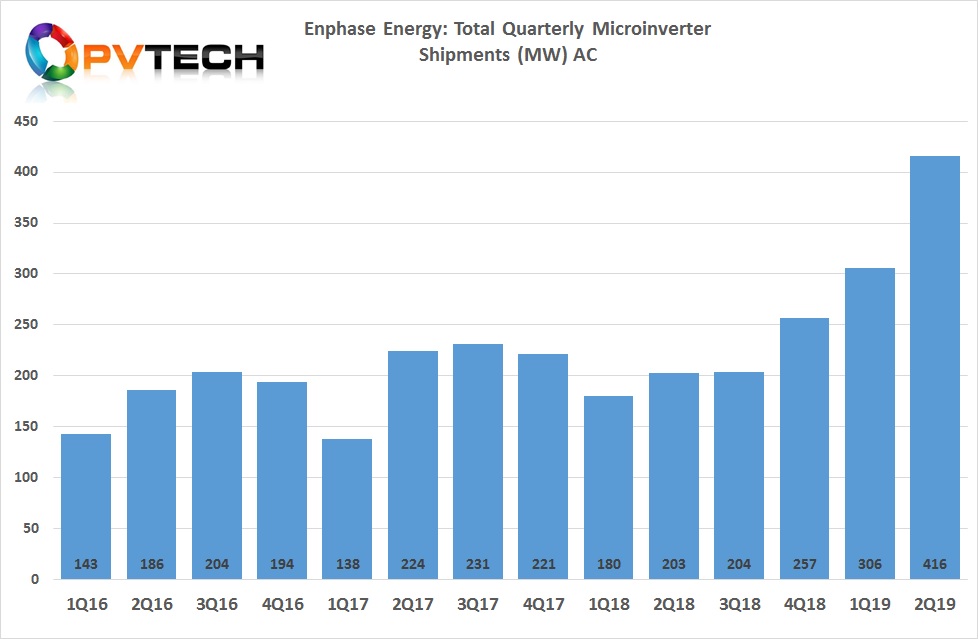

On a megawatt basis, shipments totalled 416MW, a 36% increase from the previous quarter and up 105% from the prior year period when the company was in the middle of a major restructuring, which is expected to be completed in 2019.

Key to the renewed growth has been the US market, traditionally the largest market for Enphase’s microinverters within the residential rooftop segment.

In the reporting period, US revenue increased 29% from the previous quarter, while revenue increased 107% from the prior year period. A key contributor was supplying SunPower installers with its IQ 7AS microinverters as SunPower reported US residential deployments of 70MW in the second quarter of 2019, up from 51MW in the previous quarter.

The European market, which is undergoing a significant resurgence with residential markets in France, Germany and The Netherlands of note, Enphase reported a 71% increase in revenue from the region, compared to the previous quarter and 46% higher than in the prior year period. This was boosted by greater product availability.

However, although the APAC region revenue in the reporting period increased 29%, revenue was down 23%, year-on-year. This was due primarily to ongoing restructuring efforts of its business in Australia.

Revenue from Latin America was down 7% from the previous quarter. However, revenue increased by 27%, year-on-year.

Management noted in the earnings call that it was on track to ramp new manufacturing capacity of microinverters to around 2 million units and beyond in the fourth quarter of 2019.

Despite easing of manufacturing constraints, the increased demand has meant inventory levels remain below the target of 30 days of inventory. Management noted in the earnings call that it ended June, 2019 with only 21 days of inventory, although higher than the 18 days of inventory at the end of March, 2019.

Enphase reported GAAP operating income of US$17.4 million in the second quarter of 2019 and a GAAP gross margin of 33.8%.

Guidance

Enphase guided third quarter 2019 revenue to be within a range of US$170 million to US$180 million, including a range of US$6 million to US$10 million for ITC safe harbour. Management noted that it was technically sold out for the third quarter.