Monocrystalline silicon wafer producer, Tianjin Zhonghuan Semiconductor (TZS) is continuing to expand wafer capacity and implement Industry 4.0 strategies as supply remains tight as the solar industry migrates to p-Type and n-Type technologies in 2019.

TZS ended 2018 with over 25GW of mono-wafer production capacity for the solar and semiconductor industries, combined.

The company had also completed and started ramping a 10GW diamond wire, ultra-thin wafer project at a facility in Jiangsu, China and development of a diamond wire cutting and an ultra-thin wafer plant in Tianjin, China. Total mono-wafer production is expected to reach 30GW in 2019.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

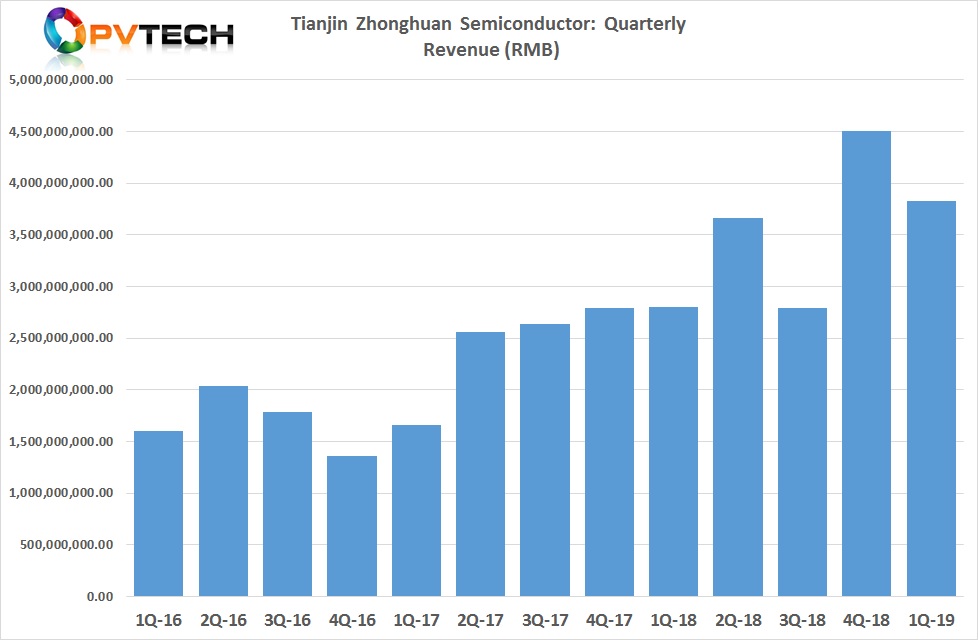

The company recently reported first quarter 2019 revenue of RMB 3.882 billion (US$552.5 million), down from US$650.8 million in the previous quarter but 36.45% higher than in the prior year period as capacity and demand increased.

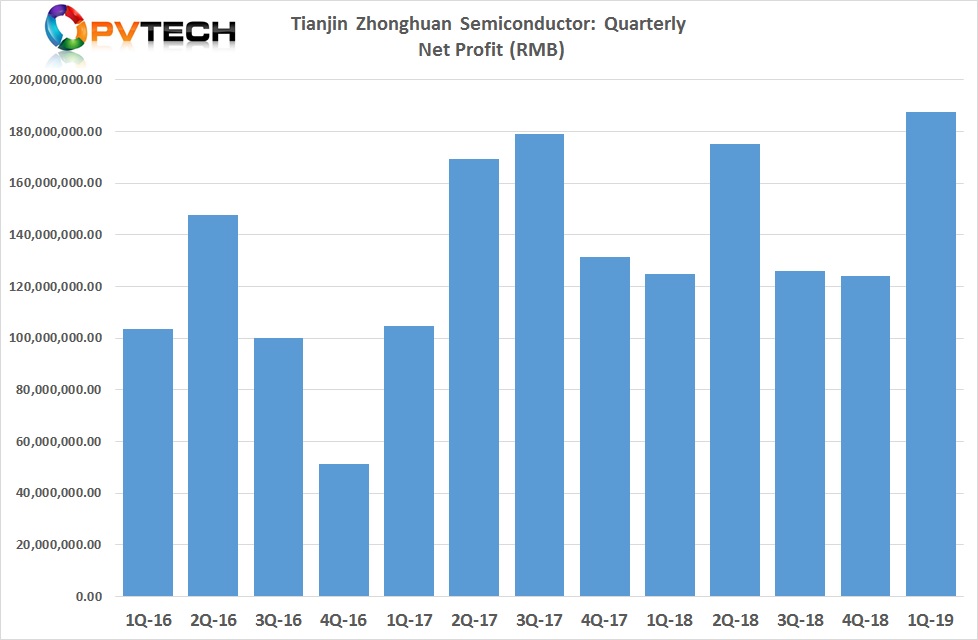

However, TZS reported a record net profit of RMB 187.6 million (US$27.1 million) in record first quarter 2019, which is believed to be due to production costs and various smart manufacturing initiatives in 2018.

During the reporting period, operating income increased by 36.45%, compared with the prior year period, mainly due to the increase in production and sales as well as receiving PV power plant electricity FIT payments.

TSZ is a key supplier to SunPower Corp for p-Type mono wafers used in the JV with DZS and TZS for its p-Type mono PERC cells and modules for its P-Series product range.