By Matthias Grossmann, Business Development Manager, Viridis.iQ GmbH

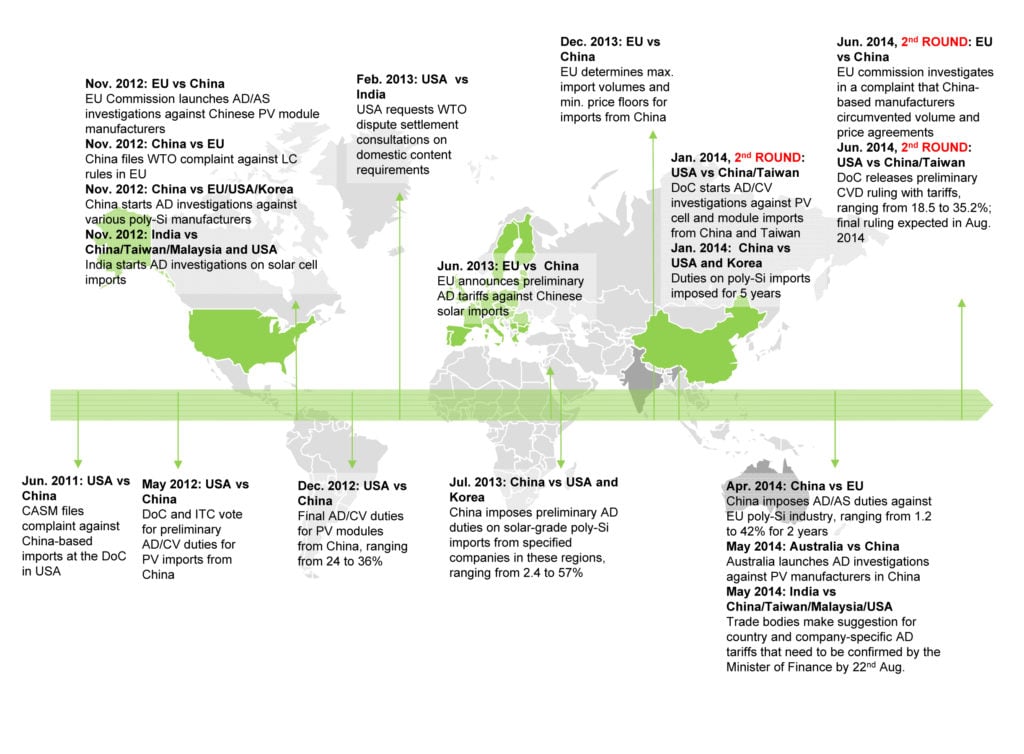

The latest rounds of formal complaints against alleged breaches of trade agreements, the initiation of circumvention investigations, and preliminary announcements and rulings in various countries and trading zones all demonstrate that the multidimensional trade conflict in global PV markets is far from being resolved and is still simmering. The trade dispute is largely focused on the import of downstream products (c-Si wafer, cell and module) in current and prospective high-volume markets, such as the EU, the USA and potentially India. These

nations or trading zones have implemented, or have proposed to implement, anti-dumping and countervailing duties, predominantly targeted against Chinese downstream producers. New rounds of investigations might lead to existing tariffs being extended to Taiwanese manufacturers that directly or indirectly import into the USA, while the EU might scrap a previous quota and minimum price system and revert to tariffs. This paper gives a brief historical review of the global PV trade dispute, and analyses the formal and legal grounding of anticircumvention actions, which in general increase the complexities of business planning. Because more than 70% of the global downstream manufacturing capacity is located in China and Taiwan, the manufacturers in these regions have no choice but to embrace an internationalization strategy that consists of production offshoring. The paper concludes with the introduction of potential strategies and recommendations which take account of

increased complexities and uncertainties in business planning that arise from shifting trade barriers.