Tongwei reported a near-trebling of profit in the first half of 2021 as prices rose throughout the solar value chain.

In the first half of 2021 Tongwei recorded operating revenue of RMB26.5 billion (US$4 billion), up nearly 42% year-on-year, with net profit nearly trebling – up 193.5% – to RMB3 billion (US$462.3 million) as the polysilicon and cell producer capitalised on surging average selling prices.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Tongwei’s gross margin reached 69.4% – broadly in line with that of Daqo New Energy, which last week reported a gross margin for Q2 2021 of 68.7% – with the manufacturer attributing its performance to an optimisation of manufacturing indexes which allowed it to achieve capacity utilisation rates upwards of 125%.

The company is now looking to capitalise on its performance in the first half of the year by completing three new polysilicon production facilities, all of which are to come onstream within the next 18 months. Both Leshan II (50,000MT) and Baoshan I (50,000MT) projects are expected to start production before the end of this year, with Baotou II (50,000MT) coming on stream in 2022.

With the first stage of Tongwei’s planned 200,000MT facility in Leshan City, announced earlier this year, set to also come onstream in 2022, the company expects to have polysilicon production capacity of 330,000MT by the end of next year.

Tongwei said the new capacity would allow it to deliver a higher proportion of n-type polysilicon as the solar manufacturing industry’s demands shift alongside a wider migration towards n-type technologies which is forecast to occur over the next three years.

The vertically-integrated manufacturer also noted a concerted shift towards large-format cells in the first half of the year. In June, 37% of the cells shipped by Tongwei were 210mm in size, and Tongwei expects to further solidify its position in the large-format module arena through the phased implementation of a 15GW cell project with Trina Solar.

The first stage of the project, which will have a 7.5GW capacity, will complete this year while the second phase will complete in H! 2022. The project will take Tongwei’s total overall cell capacity beyond the 55GW mark, of which 35GW will be for 210mm cells.

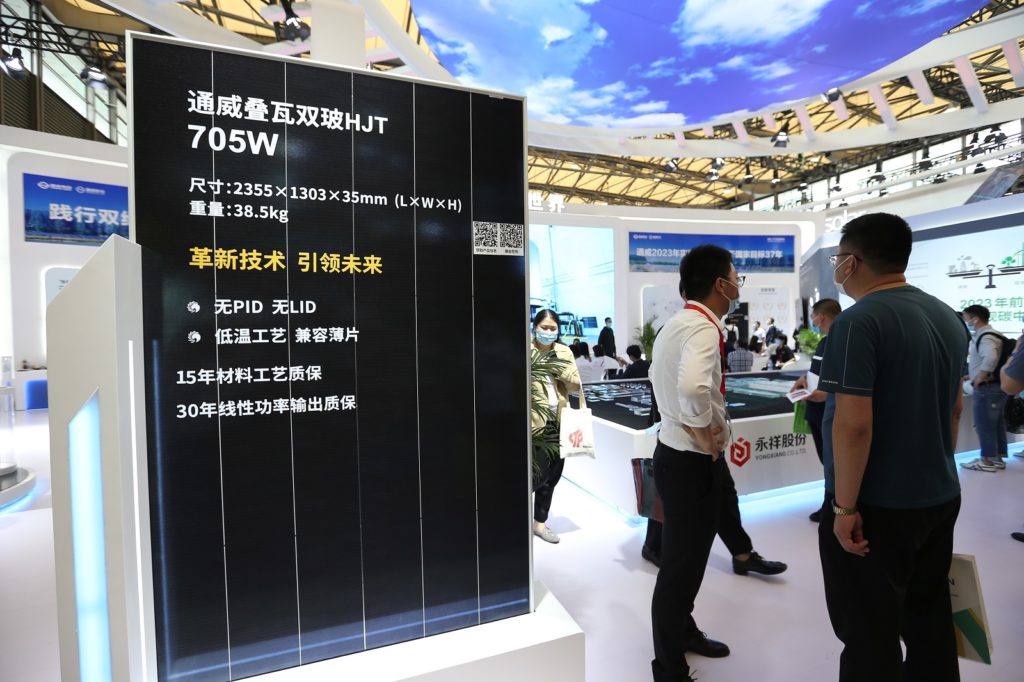

Meanwhile Tongwei is also increasing its standing in heterojunction modules, with a 1GW test production line also brought onstream in the first half of 2021.