New federal policies in the US will “cloud” the country’s renewable energy sector, with significant effects on the battery storage and solar industries in particular.

This is according to the latest analysis from Wood Mackenzie, which hosted a webinar titled ‘Power at a price: navigating equipment delays, market shifts & supply chain shocks in 2025’ last week. Many of the key conclusions are in line with growing uncertainty in the US renewables space, with market analyst Clean Energy Associates (CEA) suggesting earlier this year that the new policy landscape could trigger the loss of 60GW of planned capacity in the next five years.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A presentation published during the webinar highlights that the phaseout of production tax credits (PTCs) and investment tax credits (ITCs) by the Trump administration will “hinder” renewable project development, and the elimination of the Section 25D solar and storage tax credits will raise costs for homeowners and “slow” the adoption of these technologies in the residential sector.

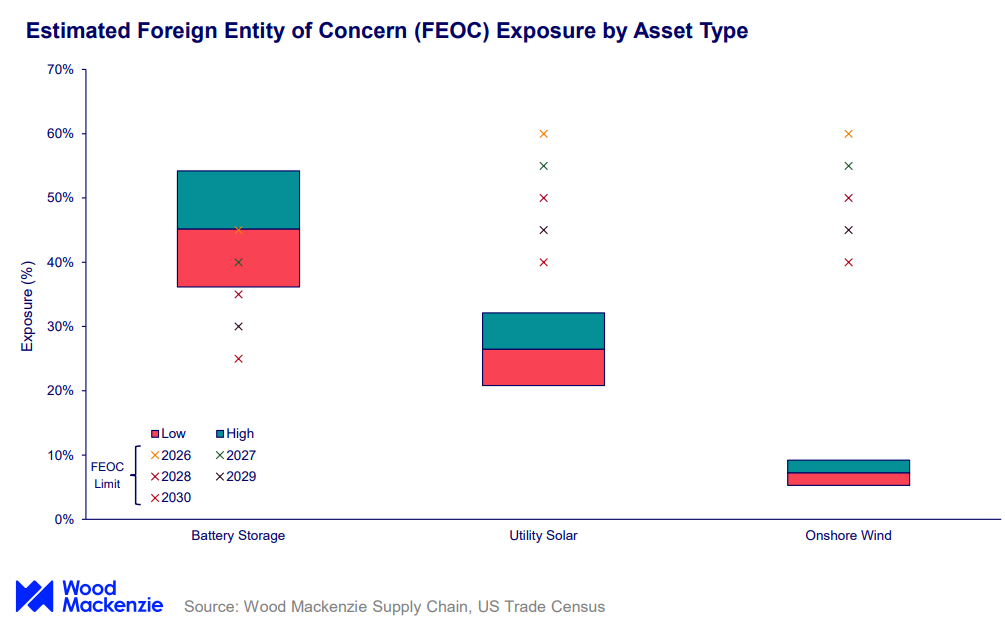

The presentation also notes that foreign policy will have a significant impact on clean energy deployments, particularly tighter Foreign Entity of Concern (FEOC) rules, widely considered to refer to China. With China leading much of the world’s production of components necessary for solar modules, such as ingots, cells and wafers, further barriers to the use of Chinese-made products in the US will negatively impact renewable power deployment in the US.

Wood Mackenzie argues, however, that it is the battery sector that will be most significantly affected by the new FEOC rules, estimating that more than half of US battery energy storage system (BESS) supply chains could be exposed to changes in FEOC policy. This compares to just over 30% of US utility-scale solar supply chains that would be vulnerable to such new policies, and less than 10% for the onshore wind sector, as shown in the graph above.

The same phenomenon is likely to be true with regard to tariffs. While uncertainty remains over a number of key tariffs, most notably the Section 232 polysilicon tariffs, president Trump’s escalation of tariffs around the world, and for a number of commodities, has significantly disrupted many US supply chains. The Wood Mackenzie presentation notes that the average effective tariff rate, across all countries and commodities, increased to over 20% between June and August of this year.

There have also been significant tariff increases on products from Taiwan (to over 20%), Indonesia (to around 20%) and South Korea (to around 15%) as the government looks to crack down on imports of products from Southeast Asia, which has long supplied components to the US solar sector. Wood Mackenzie notes that the current tariff environment has raised storage project costs by 13.7%, utility-scale solar costs by 10.4% and wind costs by 8.5%.

The presentation sets out three scenarios for the future of US tariffs: a ‘low’ best-case scenario that would see tariffs reduced to 0% for some countries and commodity tariffs of 50% remaining on copper, steel and aluminium; the ‘base’ expected scenario, which includes the tariffs imposed on 7 August and the baseline 10% tariff added to all markets; and the ‘high’ scenario, which includes worsening trade relations and tariffs as high as 75% on Chinese and Brazilian products. The average cost of a solar project is expected to increase by 4.2% in the low scenario, 11.3% in the base scenario and 12.8% in the high scenario.

There is significantly more disruption for the storage sector, again, with the presentation forecasting a 4.9% cost increase for BESS in the low scenario, 13.8% in the base scenario and 22.7% in the high scenario. Perhaps most strikingly, all electricity generation technologies—including fossil fuels—and power transmission infrastructure see an increase in costs across all three scenarios, suggesting that even a reversal of tariff policy would not translate to a reduction in US energy generation and infrastructure costs in the near future.

Project planning ‘rollercoaster’

The result of this combination of uncertainty and expected cost increases is driving what the presentation calls a “rollercoaster” for project planning, with the sudden and significant shifts to US tariff policy making it more difficult to plan for projects in the future.

The presentation includes six examples of tariff changes since January that have significantly impacted the cost of power generation in the US, with BESS, once again, the most affected. The cost of building battery projects increased by more than 40% in April, after the passage of the so-called ‘Liberation Day’ tariffs, and while these costs fell again to around 12% a month later, once tariffs on Chia were lowered to 30%, BESS costs have not recovered to pre-April levels since.

This constant uncertainty is making is more challenging to secure project finance in the US, particularly as many financiers are already looking to invest in solar-plus-storage projects, which bring more technical complications than either kind of standalone project.

Last week, Ronak Maheshwari, director of US renewable energy investment bank CRC-IB, told PV Tech Premium that “project finance structuring is going to change drastically” in this environment, raising questions as to the future of the US clean energy transition as demand for new renewable energy projects grows just as investors lose confidence in some of the financial mechanisms used to deliver those projects.

Maheshwari will speak at the 12th edition of the Solar & Storage Finance USA event on 21-22 October 2025 in New York, hosted by PV Tech publisher Solar Media. Panellists will discuss the fate of US solar and storage in a post-subsidy world, the evolving economics of standalone BESS and de-risking solar and storage supply chains.

All are encouraged to respond to an anonymous survey on the US solar and storage sector, that will shape discussions at the summit. Tickets for the event are available on the official website.