Updated: There were a number of key factors at play in the first quarter of 2020 that either positively or negatively impacted financial results for five public listed PV inverter manufacturers in the quarter.

The five public listed companies under review are SolarEdge, SMA Solar, Sungrow, Enphase and Ginlong.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

With three Western-based and two China-based manufacturers in the analysis, the first quarter financials can be impacted by seasonal factors such as lower PV installations in key markets in the Northern Hemisphere, as well as a rush to complete projects at year-end, lowering demand.

A shift in the China market for PV project completion dates in 2019 led to a completion rush at the end of the year, unlike previous years. Domestic demand is also lowered during China’s New Year period, often distorting Q1 financial results.

The major potential change across all regions in Q1 2020 was the emergence of the COVID-19 pandemic.

PV Tech has been extensively covering the impact of COVID-19 across the PV supply chain and clearly there have been major disruptions to downstream residential markets around the world.

This impacts all five PV inverter manufacturers under review, but not all equally. Enphase, SolarEdge, Ginlong and SMA Solar are at higher risk to residential market disruption than Sungrow.

Yet with many key components and complete systems manufactured in China, the lockdowns and travel restrictions did delay some manufacturers restarting production ramps and returning to high production utilisation rates.

Unlike PV module supply chains, some key PV inverter components can be sourced in Europe and therefore could create supply chain issues, triggered by lockdowns in Europe just as China was easing restrictions. It was therefore a very complex environment for PV inverter manufacturers in Q1.

SolarEdge Technologies

There had been signs in the fourth quarter financials of SolarEdge that its meteoric revenue growth was slowing, having achieved a second consecutive year of over 50% revenue growth as quarterly and annual sales continued to break company records. However, revenue in Q4 2020 was only 2% higher than the previous quarter.

SolarEdge reported Q1 2020 revenue of US$431.2 million, still up 58.6% year-on-year and a slightly better quarter-on-quarter increase of 3.1%.

SolarEdge noted that its continued growth in Q1 was driven by revenue growth in some key markets, notably in the US, which accounted for over 60% of quarterly revenue (US$246 million), helped by US$54.1 million attributed to customer ‘safe harbor’ needs for the ITC reductions at year end.

Revenues from Europe stood at US$122.3 million, equivalent to 30% of its Q1 revenue. The company also benefited from growing demand in Australia, which accounted for 9.7% of solar specific revenue for Q1, a new regional record.

SolarEdge said it had shipped 926MW to the US in Q1. European shipments totalled 641MW and ROW shipments were 283MW. The product market split in Q1 was 56% residential and 44% for the commercial market.

Total inverter shipments in Q1 were 1,850MW, indicating demand growth had remained strong in Q1 despite COVID-19. The lower revenue growth was partially due to higher sales in Europe but weaker exchange rates.

Enphase Energy

Unlike its listed rivals, Enphase is heavily sales-weighted to the US market, notably the residential and commercial rooftop markets. The company ended 2019 with 92% of sales within the US and 8% for all international markets its serves. Historically, this has been a few specific countries in Europe, as well as India and Australia. Therefore, seasonality issues have typically played a part in Enphase’s Q1 financials.

The company reported Q1 revenue (US$205.5 million) that was only down 2% quarter-on-quarter and more than double (105%) the prior year period, reiterating its business transformation through 2019 and momentum that has continued in Q1 2020.

However, like SolarEdge, safe harbor revenue in the US was meaningful at US$44.5 million. Excluding safe harbor revenue, Q1 revenue decreased 7%, quarter-on-quarter and was up 51% year-on-year.

The impact on demand from the COVID-19 pandemic in the US did not translate until March and with some European markets having limited impact, Enphase was able to limit the overall impact from the pandemic in Q1.

Enphase shipped approximately 643MW of inverters in Q1, down from 677MW in the previous quarter. The company expects revenue in Q2 to be within a range of US$115 million to US$130 million.

Sungrow Power Supply

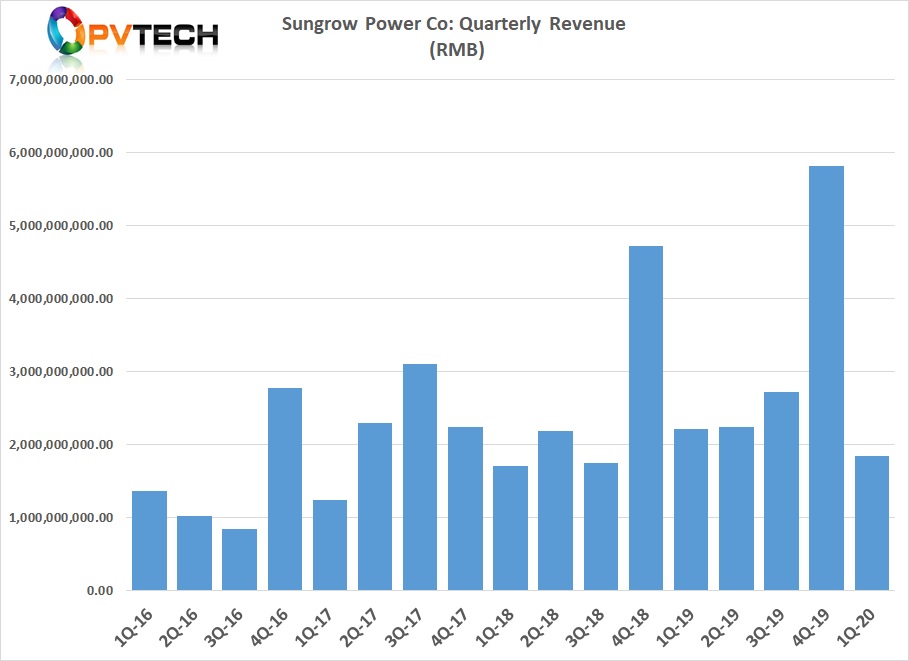

There is a lot going on with Sungrow’s revenue figures in Q1. The company reported total revenue down 16.78% from the prior year period. In 2019, well over 60% of Sungrow’s total revenue came from EPC related activities, notably in China, and PV inverter sales was around 30% of the total.

The company noted in reporting Q1 2020 results that its overall business had been greatly affected by COVID-19, confirming delays in restarting manufacturing operations as well as PV projects. Both business aspects only started to improve in the last month of the quarter.

Total Q1 revenue was approximately US$265 million, compared to around US$821 million in the previous quarter.

As Sungrow does not breakout quarterly PV inverter sales, shipments or figures on a regional basis, PV Tech takes the average percentage of sales attributed to inverters from the previous year (30%). This provides an estimate for Q1 inverter sales of around US$78 million in Q1, compared to US$101 million in the prior year period and around US$265 million actual sales in the previous quarter.

With EPC (system integration) sales down and accounting for over 60% of revenue, PV inverter sales could prove to be different than our estimates at this time.

International PV inverter shipments were the highlight for this Sungrow division in 2019, claiming overseas shipments increased by 87.5%, compared to 2018. The company also surpassed the 100GW cumulative shipment milestone in 2019. However, total inverter revenue estimates indicate only a small increase year-on-year as China demand waned. The company is primarily in the central inverter market for utility-scale projects and the commercial markets with string inverters.

As the total revenue chart shows, Sungrow has become increasingly dependent on both EPC and inverter revenue in the fourth quarter of the year. A weaker start to 2020 should not be seen as indicative of full-year figures or any drastic change in its business at this point.

Ginlong Solis Technologies

Since going public, Ginlong has rapidly expanded its product range and sales and marketing in a growing number of regions and countries with operating income increasing 37% in 2019 to around US$160 million, compared to US$117 million in 2018.

The company reported Q1 2020 sales of US$39.64 million, a 75.49% increase over the prior year period and down from US$51.37 million in the previous quarter. The net profit was US$8.23 million, an increase of 766.54% over the same period last year.

The main reason for the quarterly sales decline was a combination of seasonal slowdown, coupled to the extended Chinese New Year and a slower return to full production than expected, due to COVID-19.

Increased purchases of electronic components in the quarter was said to improve manufacturing operations and buffer against possible supply chain issues overseas, due to COVID-19.

Ginlong is also doubling manufacturing capacity to around 20GW.

SMA Solar Technology

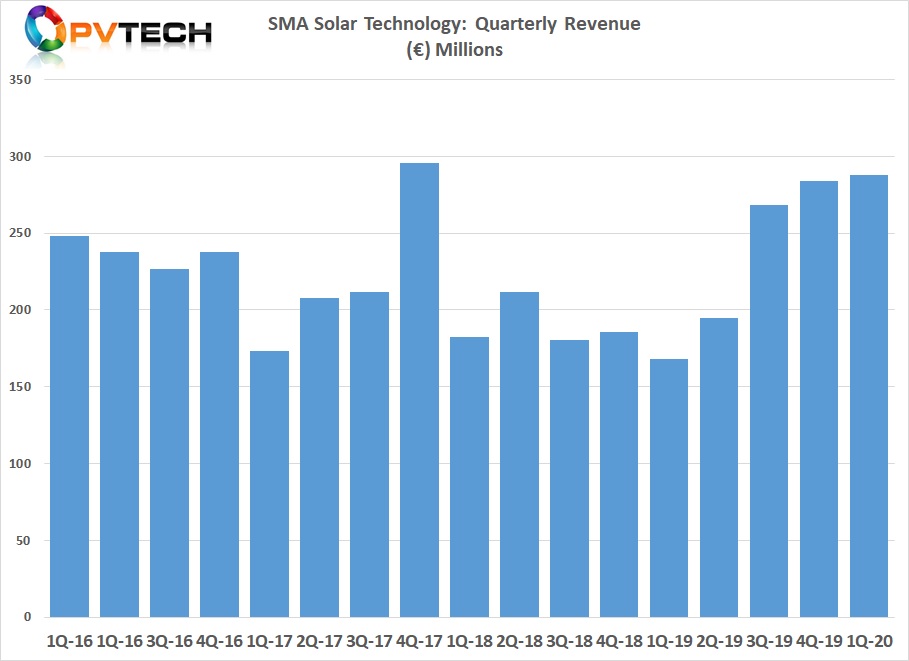

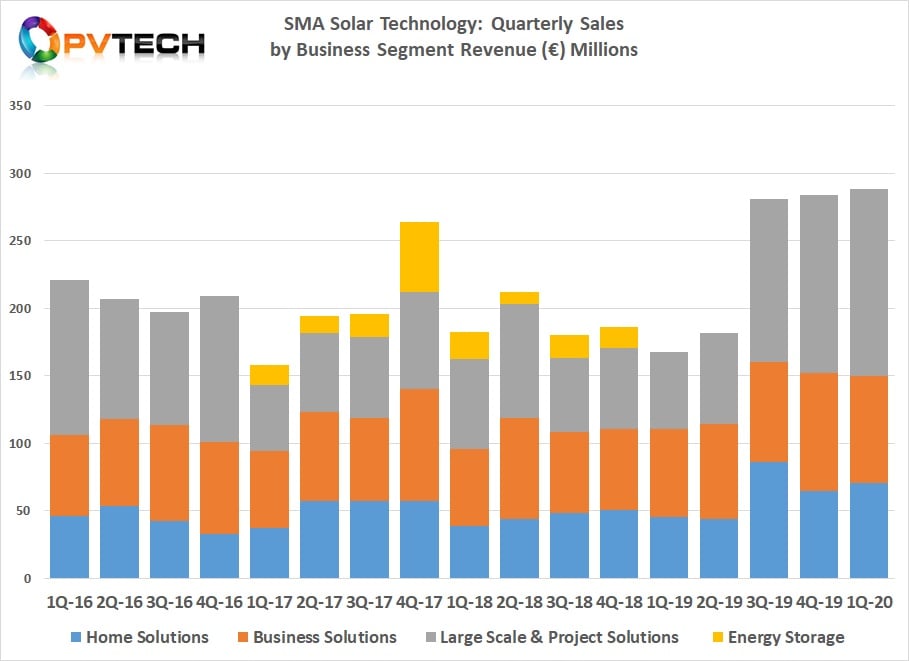

SMA Solar had a strong Q1 2020, taking advantage of its sales footprint and product offerings across residential, commercial, and utility-scale segments in major markets such as the US and Europe.

Revenue in Q1 was US$311 million, almost identical (US$311.1 million) to the previous quarter, continuing momentum that kick-started in the second quarter of 2019. Despite seasonal issues, SMA Solar would seem to have navigated any supply chain issues in the quarter and like SolarEdge and Enphase, has not seen the full impacts of the pandemic that may impact Q2 results.

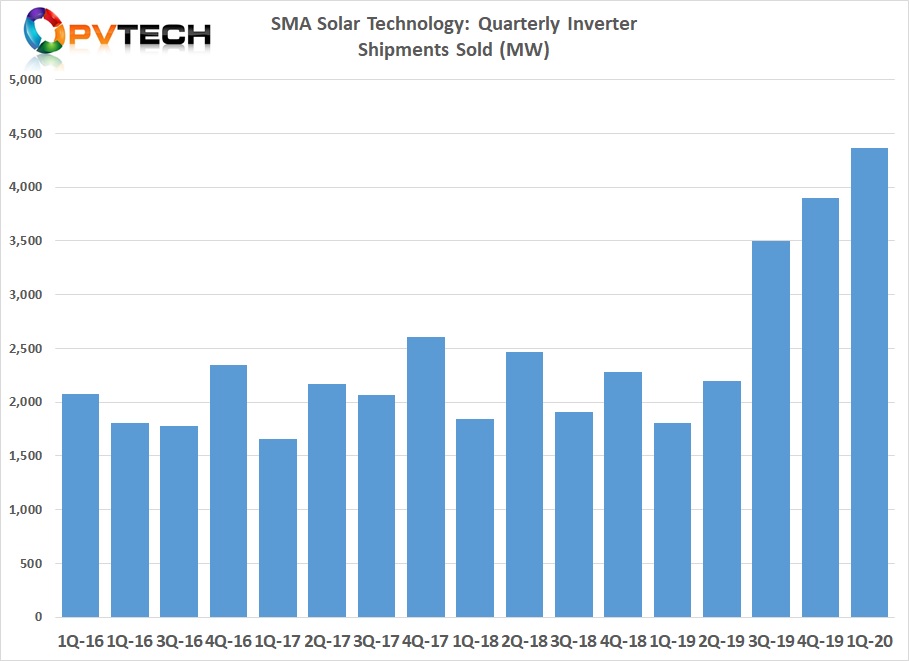

The strong revenue figures in Q1 were backed up with equally strong shipment figures. Total PV inverter shipments were 4,367MW, up from 3,900MW in the previous quarter, setting three sequential quarters of record shipments.

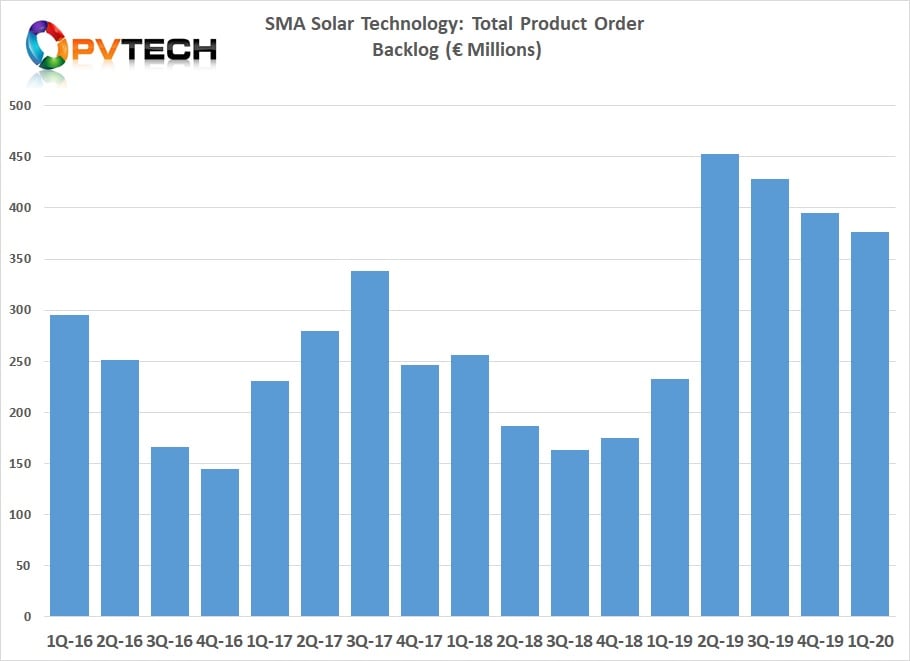

As previously noted, the turnaround kicked-off in Q2 2019. Looking at SMA Solar’s PV inverter product order backlog figures (see chart below), clearly highlights where subsequent revenue and shipments have come from.

There was a significant increase in SMA Solar’s product order backlog booked in Q2 2019, compared to any quarter shown in the chart. The order backlog in Q1 2019 was €233 million, yet almost doubled to over €453 million in Q2.

It does not seem coincidental that at the end of Q2 2019, leading global PV inverter manufacturer,Huawei confirmed it was effectively exiting the US PV inverter market, due to the US government targeting the company in respect to 5G communications technology and claimed national security risks.

In SMA Solar’s Q1 financial report, the company noted that 42.8% of total sales came from the Americas region. In 2019 the Americas region accounted for 23.4% of total sales. Europe accounted for around 50% of total sales in 2019.

The Large Scale & Project Solutions business unit reported the biggest sales growth in Q1 2020, accounting for 49.7% of total sales, compared to 34.2% in the prior year period.

SMA Solar also noted in its Q1 financial report that Large Scale & Project Solutions business unit sales, due to large-scale PV projects in the US were primarily behind the €138 million in unit sales in Q1, a 140% increase over the prior year period.

The Q1 2020 sales and product-related order backlog was said by the company to have already covered at least 60% of is full-year 2020 financial guidance, which put sales within a range of €1.0 billion to €1.1 billion.

As previously noted, sales could take a more significant hit in the Q2 period, as COVID-19 travel and gathering restrictions reached a peak.

Q1 rival analysis

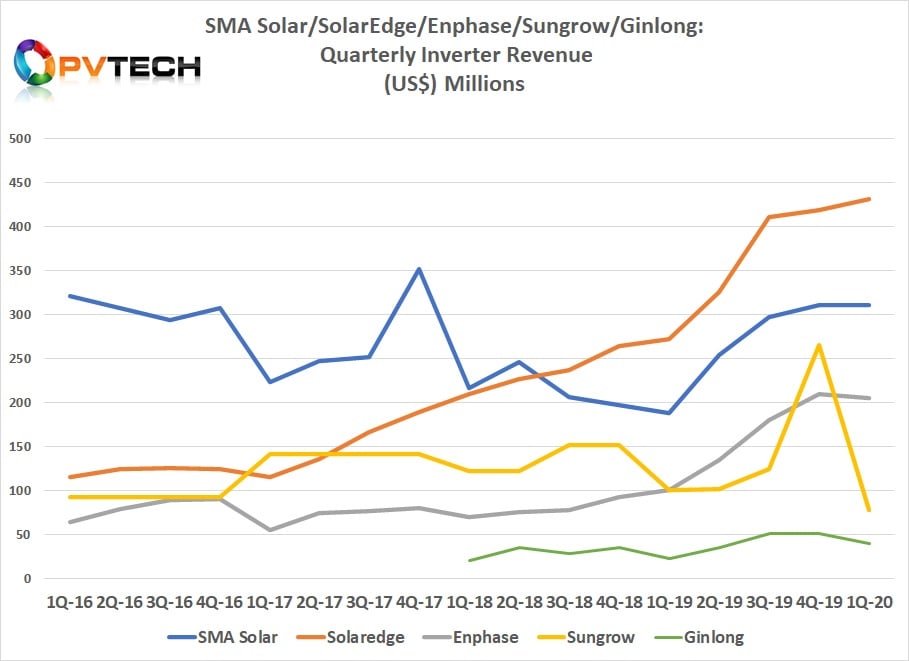

As shown in the chart below, revenue of five listed PV inverter manufacturers diverged in Q1.

SolarEdge’s sales growth increased slightly from the previous two quarters and was the only company covered in this analysis to increase sales in Q1. As a result, SolarEdge has clearly re-opened the gap between its nearest rival, SMA Solar.

SMA Solar held sales at recent highs in Q1, despite a significant increase in product megawatt shipments. Driven by strong US sales into the utility-scale market and continued strong markets within Europe, its key market region, historically.

Enphase experienced a small quarter-on-quarter decline as did Ginglong in Q1. The challenge for Enphase will be the COVID-19 impact on the US residential market and its ability to shift sales to its expanding European customer base.

Ginlong may benefit from China’s residential market and other key markets it has expanded into in the last year, perhaps limiting the potential sales decline or even post increase sales in Q2.

The biggest decline was clearly that of Sungrow after a significant leap in sales in Q4 2019. Should sales trend the same way as last year, Sungrow will gradually increase sales in the next two quarters having a growing international footprint, not least because of its existing presence in the utility and commercial US markets.

Updated: Technical issues meant the Q1 update on Ginlong had not viewed online at time of posting. This has now been corrected.