Earlier this month, Jinko Solar, LONGi Solar and JA Solar collaborated to host ‘The size 182 module and Systems Technology Forum’ in Shanghai, the first time that the three leading companies have jointly spoken since the release of the M10 silicon wafer size standard in June this year.

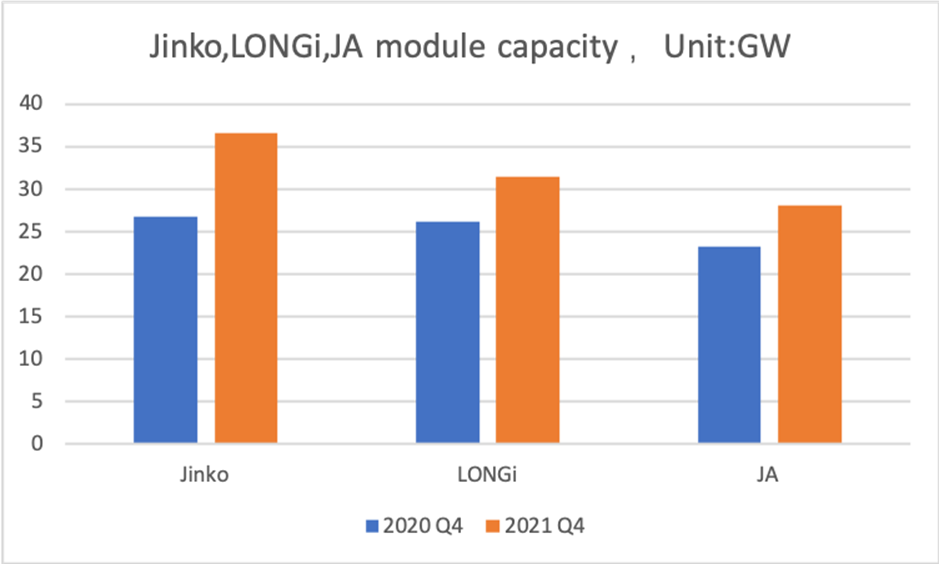

The three companies announced mass production of 182mm modules which, according to previous reports on PV Tech, means that Jinko’s module production capacity will reach 25GW, JA Solar’s will top 23.2GW and LONGi’s will reach 30GW, all by the end of this year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, PV Tech understands that other third parties predict the large-size trend is pushing module suppliers to further expand with Jinko's capacity expected to exceed 30GW by the end of 2021, possibly reaching over 35GW, LONGi’s production capacity also exceeding 30GW and JA’s expected to approach 30GW.

“In 2021, the company's plan will involve two-thirds of production being 182mm modules for the Tiger Pro series,” said Qian Jing, Jinko’s vice president.

Huang Xinming, senior Vice President at JA Technology, predicted that the annual output of JA modules will exceed 20GW in 2021, adding that the company's newly-online capacity will exclusively produce 182mm-size modules. JA had previously joined the 600W+ Innovation Alliance, but judging from the mass production and expansion plans for JA’s 182mm modules, this undoubtedly represents a firm stance taken by JA’s 182 team.

LONGi has historically balanced its capacity planning to meet its 166mm-size commitments but, in an interview, senior Vice President of Global Marketing Dennis She said that next year’s production capacity is expected to swing further toward 182mm-sized modules, with new facilities in Xianyang (5GW) and Jiaxing (7GW) coming onstream.

In summary, preliminary predictions point towards total capacity of 182mm modules for the three companies reaching 54GW in 2021. Jinko and JA Solar have both guided that they will add 20GW each of 182 capacity over the course of next year, while LONGi will add 13.5GW by the end of Q1 2021.

As three of the leading manufacturers in the solar sector, the companies speak with authority and sharing the same stage to provide details of 182mm capacity expansion plans is a clear signal to the market that there will be sufficient supply in the months and years ahead.

It is learned that owners of stations that employ new module products usually choose, on the basis of price and supply, the best solution among project plans prepared by institutions, taking into consideration elements such as cost, power capacity and supply. A module in short supply will not be included in a solution, with investors having already witnessed price volatility this year as a result of supply and demand constraints.

POWERCHINA recently issued a bidding notice for the centralised procurement of photovoltaic modules and inverters throughout next year. For the PV modules there has been a change in the size stipulated, with 166mm becoming the lower limit, the change leaning towards mainstream modules featuring 182mm-size wafers and above.

| POWERCHINA 2021 Solar Projects Centralized Procurement | Bids to close on Dec. 3, 2020 | |

|---|---|---|

| Total Module Capacity | 5GW | 166 becomes the size for cells in the invitation for bids |

| No. of Package | Project Name | Cell size (mm) |

| 1 | Polysilicon Module | N/A |

| 2 | Monosilicon Single Glass Module | 166 |

| 3 | Monosilicon Single Glass Module | 182 and above |

| 4 | Monosilicon Double Glass Module | 166 |

| 5 | Monosilicon Double Glass Module | 182 and above |

In previous centralised purchasing bids issued by the China Power Investment Corporation, the size requirement of 180+ + also appeared. It is expected that, in 2021, we will see more state-owned developers release centralised purchasing bidding based on larger-sized modules.

The market share for large-size modules will be determined by the ability of mainstream companies in each tier to secure orders. Jinko, LONGi and JA have each already started to ship 182mm modules.

At the end of October, the first batch of JA's DeepBlue 3.0 modules was delivered to the station site in Tongchuan, Shaanxi province, a project by SEPCOⅢ.

According to JA Solar’s Huang Xinming, the company currently produces nearly 1GW of 182mm modules per month and recently supplied to a 100MW power plant project in South East Asia. Coincidentally, Dennis She also also confirmed the completion of those 100MW+ projects adopting LONGi 182 modules.

Additionally, at the end of October, the first batch of Tiger Pro series modules were officially shipped from Jinko Solar's Yiwu Plant. It is claimed that 2GW of orders have been signed since the release of the Tiger Pro series in May of this year. Jinko is, at the same time, also supplying 182mm modules to overseas markets, Qian said.

Capacity expansion plans suggest the competition caused by different sizes is already underway. Against a backdrop that there will be only fair-price or even low-price projects, instead of competitive pricing projects, next year in China, it remains to be seen which size will gain the early advantage.