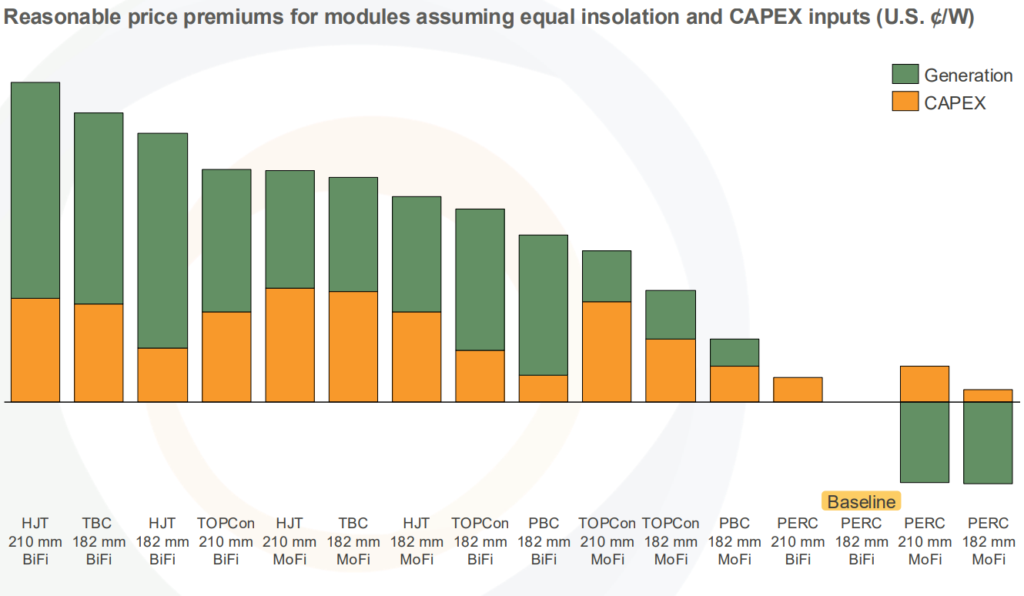

Generation benefits from bifacial modules have gained high price premiums compared with their monofacial counterparts, according to a report from the Clean Energy Associates (CEA).

The report – The PV Supply, Technology, and Policy Report (STPR) – says that 210mm bifacial heterojunction (HJT) modules command the highest price premiums due to their higher energy generation.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

210mm HJT panels are followed by 182mm bifacial TOPCon back contact (TBC) and heterojunction modules, while the industry’s leading technology, tunnel oxide passivated contact (TOPCon) comes fourth with 210mm bifacial modules.

However, the difference between a 210mm bifacial TOPCon module and a 210mm monofacial HJT module is minimal, as shown in the chart above.

The contrast between bifacial and monofacial is that generation produces higher price premiums for the former, while capex accounts for the majority of price premiums for the latter.

Moreover, in terms of encapsulant, although ethylene-vinyl acetate (EVA) has long been the market choice for encapsulant on a PV module, according to the CEA, polyolefin (POE) based encapsulant is gaining traction due to its better reliability and higher corrosion resistance. Most n-type modules are opting for that choice due to additional n-type cell sensitivities to foreign material ingress.

On the other hand, its disadvantages are its cost and is difficult to control its production process.

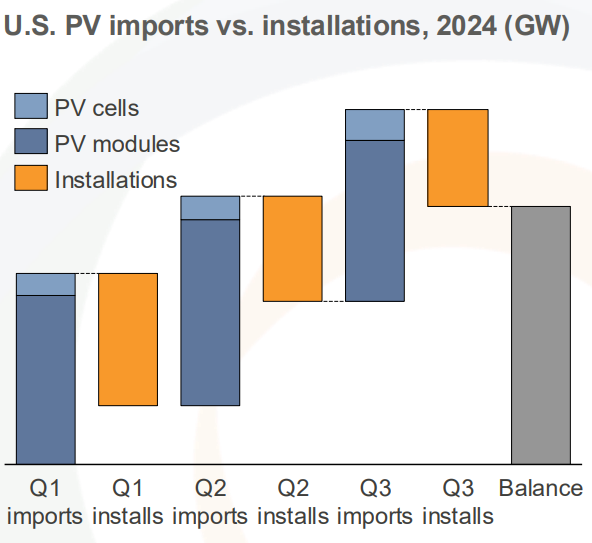

US supply of solar cells and modules more than sufficient

Aside from technological aspects, the CEA report also looks at the state of solar cells and module imports to the US.

Solar PV products availability remains sufficient in the US to support the development of projects with both module and solar cells imports outweighing quarterly deployment figures in the first three quarters of 2024, as show in the chart below.

The challenge for the solar industry in the US lies with the procurement of transformers, due to restrictions on utilities to procure non-Chinese equipment.

According to the CEA, most foreign firms are conservative in their expansions, with transformers being “labor-intensive and highly customized per order”.

“Transformer suppliers have now announced significant expansions for new manufacturing in the US, but it will take several years for new manufacturing to come online to support demand growth,” said the report.

Another possible bottleneck for the solar industry would be the lack of engineering, procurement, and construction (EPC) jobs to cover the increase in solar PV project construction.