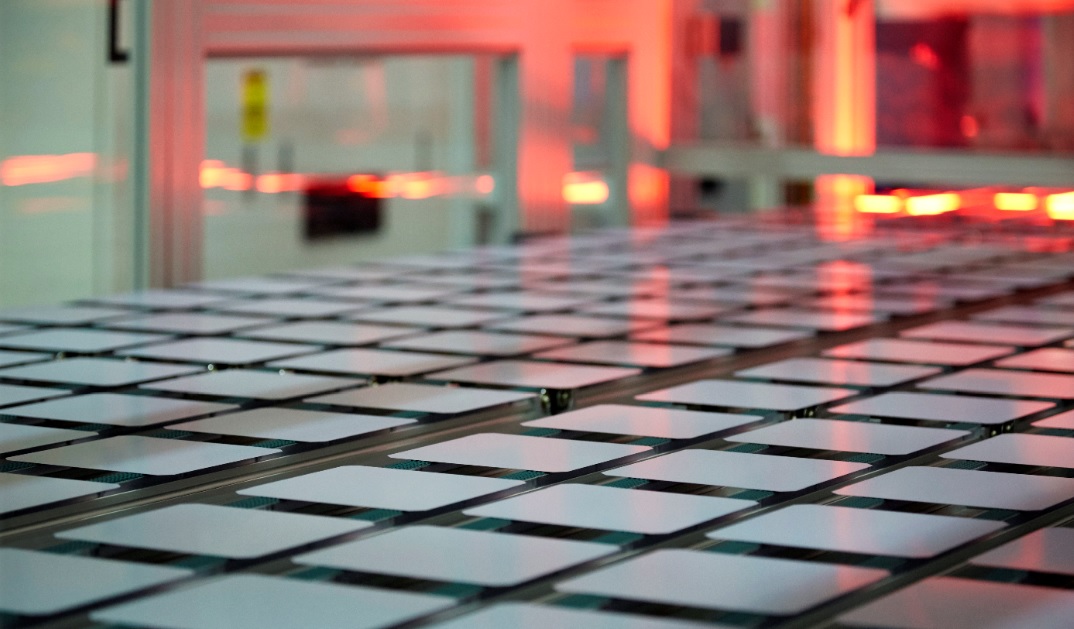

Manufacturing delays and supply chain constraints in China, caused by the coronavirus outbreak are starting to impact both upstream PV manufacturers and downstream installers in countries such as South Korea, India and Taiwan.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Hanwha Solutions

In a statement given to PV Tech, Hanwha Solutions Corporation (Q CELLS) has temporarily shut down its two major module assembly plants in South Korea, due to raw materials and component shortages, usually purchased from China-based suppliers.

Hanwha Solutions stated; “Given the ongoing uncertainty caused by the Coronavirus outbreak, Hanwha Solutions Corporation has taken measures to temporarily shut down solar module manufacturing activity at its two production facilities in South Korea. The Jincheon Factory will pause production between February 12 and February 23, with plans to partially restart some operation between February 17-20, depending upon the supply of some raw materials. The Eumsung factory will pause production between February 18 and February 23.”

However, Hanwha Solutions’ Qidong manufacturing plant, located near Shanghai in the Jiangsu province of China has resumed production after the extended the New Year’s holiday as planned on February 11.

Overall, Hanwha Solutions said that it expected to resume normal production activity soon, without providing further details. Korean language news reports also claimed that Hanwha Solutions manufacturing operations in the US were not affected by supply chain issues in China.

Sterling & Wilson (India)

In releasing 2019 annual financial results, leading global PV EPC firm, Sterling & Wilson noted that some of its key suppliers in China have yet to commence production after the extended break are not expected to commence manufacturing operations until the end of February.

As a result, Sterling & Wilson stated; “As most material was expected to be shipped in February / March 2020 there is likely to be a significant impact.”

The company added that it was constantly evaluating the current situation in China, which would impact its business in the near term.

Taiwan

According to Taiwan-based market research firm, TrendForce the supply of key equipment such as modules and inverters for PV power plant projects planned in Taiwan would be impacted the most from the coronavirus outbreak in China.

TrendForce noted that PV manufacturers in Taiwan sourced a large variety of raw materials and components from China, such as silicon wafers, EVA sheet, aluminium frames, and PV glass.

Taiwanese manufacturers’ stockpile of raw materials from pre-Chinese New Year is expected to last until the end of February, at best, according to TrendForce.

However, the knock-on effect is expected to lead to downstream project delays.

TrendForce said that in the first quarter of 2020, Taiwan was expected to have the lowest quarterly installation capacity for the year. The shortage of modules and inverters would delay the installation schedule of these projects and subsequently postpone Taiwan’s goal of 2.2GW total installation capacity in 2020.