Major polysilicon producer Daqo New Energy expects polysilicon demand to outstrip supply for at least the next 18 months, due to the lack of new polysilicon capacity and strong demand as a growing number of ‘Solar Module Super League’ (SMSL) members continue to add in-house monocrystalline ingot and wafer production.

Record low polysilicon selling prices over the last two years have led to the shutdown of production facilities belonging to high-cost producers and severely limited the capital expenditure capabilities of others to invest in new, high-purity polysilicon facilities as the PV industry continues to transition towards p-type and n-type mono products.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Longgen Zhang, chief executive officer at Daqo New Energy noted in the company’s second quarter 2020 earnings call that some of the major PV module manufacturers, such as JinkoSolar were continuing to invest in in-house mono ingot/wafer production, matching PV module capacity expansion needs. The Daqo executive believes other major players will follow the same vertically integrated path, pushing up demand for high-purity polysilicon when only around 100,000MT of new capacity could be onstream not much sooner than the next 18 months.

“As the wafer, cell and module segments continue to vertically integrate, I don't think the [ASP] fighting will continue. But the situation, I just said, within [the] next 15 months to 18 months, we don't see any polysilicon production coming, even let's say after 15 months to 18 months, noted Zhang in the earnings call. “I think Tongwei’s two plants plus Asian Silicon’s one plant product line come in, still cannot meet the demand.”

According to Zhang, the estimated demand for polysilicon by the end of 2021 is around 800,000MT, indicating that polysilicon ASPs will continue to increase and could be in the range of US$15/kg until demand falls or new capacity helps level-out peak pricing. Average ASPs have been in the range of US$12/kg in Q2, after being in the US$6.0/kg range last year and during Q1 2020, due to weak demand as result of COVID-19.

Financial results

As the lowest cost polysilicon producer, Daqo reported that its polysilicon average total production cost was US$5.79/kg in Q2 2020, compared to US$5.86/kg in Q1 2020. Daqo’s polysilicon ASP was US$7.04/kg in Q2 2020, compared to US$8.79/kg in Q1 2020.

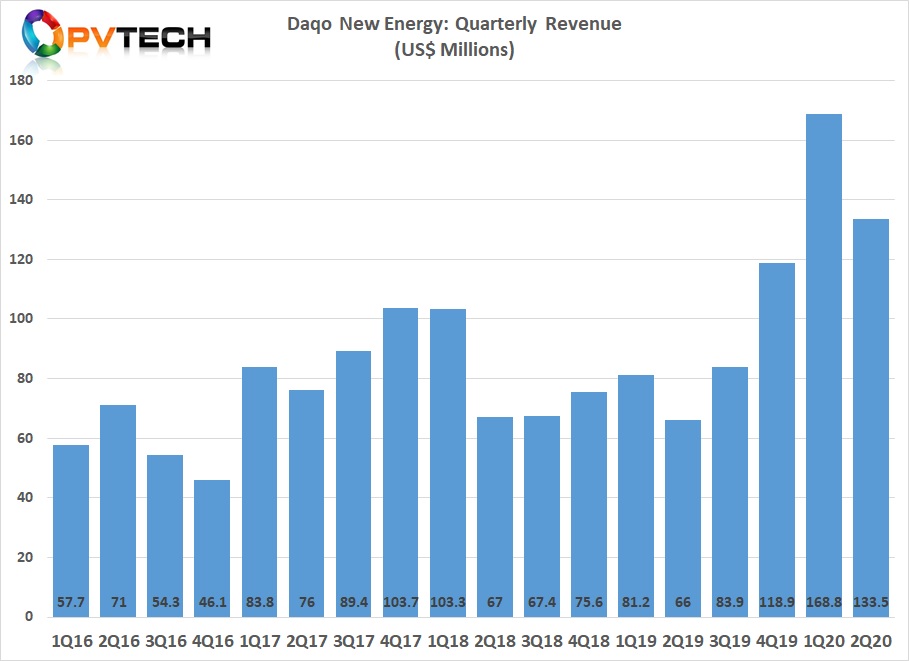

As a result of production disruptions including maintenance downtime, Daqo reported Q2 2020 revenue of US$133.5 million, compared to US$168.8 million in the previous quarter.

Zhang commented, “The second quarter of 2020 was a particularly challenging time for the polysilicon industry. Beginning in late March, the global spread of COVID-19 and related lockdowns, particularly in the US, Europe and certain emerging markets, resulted in significant disruptions to demand for solar PV products. End-market customers delayed module orders and shipments due to uncertainties about the duration and economic impact of the pandemic, as well as logistical challenges.

“This led to short-term market uncertainty and volatility across the entire solar PV industry during the second quarter. This abnormal market environment, with its sharp and sudden drop in demand, resulted in significant negative impact to polysilicon pricing for the quarter. Fortunately, the impact was temporary, and the market began to recover in May with orders and demand normalizing in June, supported by a strong end-market in China and abroad. We are pleased that despite such challenges faced by the industry during the period, Daqo New Energy was able to generate positive net income for the quarter, further demonstrating the strength and resilience of our business model and our proven low cost structure.”

Gross profit was US$22.7 million in Q2 2020, compared to US$56.6 million in Q1 2020. Gross margin was 17.0% in Q2 2020, compared to 33.5% in Q1 2020.

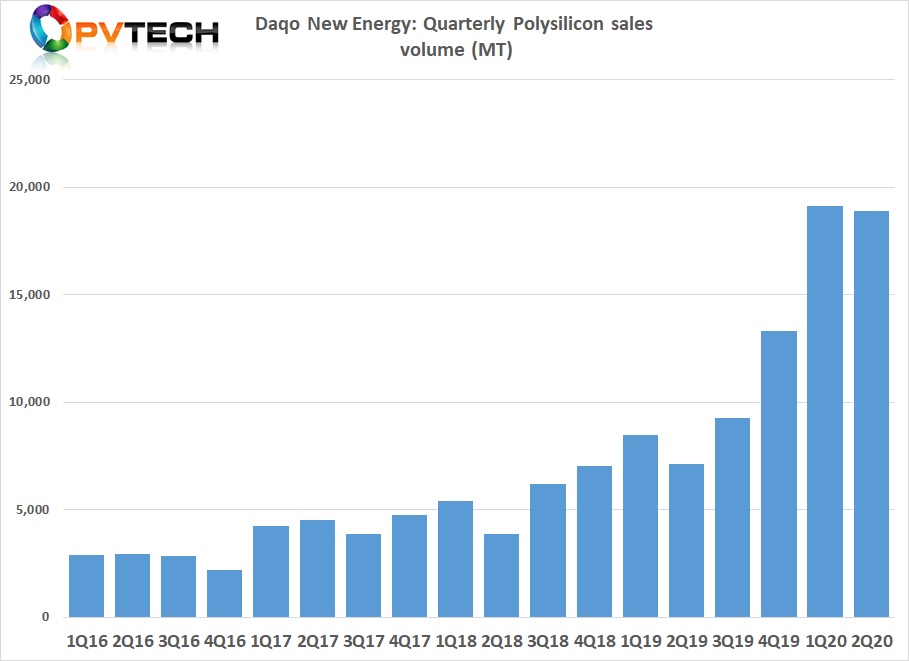

Polysilicon sales volume was 18,881 MT in Q2 2020, compared to 19,101 MT in Q1 2020.

Daqo said it expected to produce approximately 17,500MT to 18,000MT of polysilicon and sell approximately 17,000MT to 17,500MT of polysilicon during the third quarter of 2020.

For the full year, production guidance was unchanged at approximately 73,000MT to 75,000MT of polysilicon.