Turn back the clock to 2012, and the PV sector had gone through an initial growth-related technology shake-out that can largely be seen today in c-Si technologies having 95% of market-share, and only one viable thin-film supplier (First Solar).

After the 2012 PV stock-market crash, the industry went into cost-reduction mode and then product optimization. This optimization phase centred on utility-scale modules moving from 60-cell to 72-cell as the norm, and module design moving from legacy 2-busbar to 5 busbars.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In terms of product variation across the c-Si segment, things were relatively stable and designers of PV plants could choose between 60 and 72-cell module suppliers without having to worry too much about form/fit/function. In reality, plant design for c-Si modules could be left to decide on final supplier-of-choice when construction began.

The major concern for developers, EPCs, O&M’s, asset managers and portfolio owners, at this time, was mainly based around the liquidity of the various module suppliers offering these 72-cell products to the market; would the supplier be around in 25 years to honour the warranty?

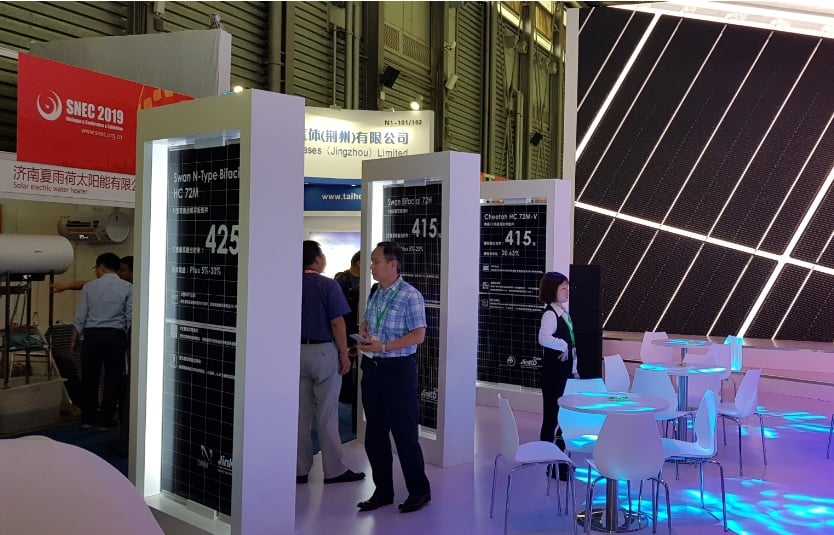

Fast-forward to 2019, and the landscape for c-Si modules could not look more different. This article discusses how PV module supply has now become a marketing and trade-show related game of numbers (specifically, a Watt-peak DC bragging-rights platform); what is driving this, and why is it perhaps causing more concern to the very grouping it is meant to impress – the end-user.

The c-Si upgrade frenzy

The introduction of PERC cells – and the move from multi to mono as the cell substrate standard – has undoubtedly been the catalyst behind the plethora of process line changes across ingot-to-module stages that leads us to the extreme diversification in c-Si modules being offered to the market today.

The range of options is not just in looking at the different companies offering products to the market, but can be seen through the growing module types offered by any one of the multi-GW c-Si module suppliers dominating the industry today.

It is almost impossible to keep track of the c-Si module options being supplied today, and if anyone does manage this somewhat academic feat now, everything is likely to change again before the end of the year.

Being an investor today into large-scale utility-solar sites has never been more challenging and risky.

Rear surface passivation (PERC) was the first major process flow change to be implemented by the c-Si cell segment for over a decade. For many of the c-Si cell producers active in 2015-2019, it was the first process flow change they had ever undertaken, and the first they had owned, since cell lines were constructed using equipment suppliers that were tried and tested by the industry. For the new entrants in this time period, new lines were by default PERC (if installed as mono).

The immediate success of PERC (and the obvious efficiency gains seen compared to Al-BSF) basically gave Chinese cell producers the confidence to do anything else that would add to the Watt-peak figures printed on datasheets; and there was no shortage of options waiting to be unleashed, on both front and rear sides of the cells.

Furthermore, we need to add in the shift to bifacial variants, half-cut cell designs, and cell/module changes including multi-busbar arrangements. One could go on and on. Anything that adds to the module power rating is now fair game.

The results have been extremely impressive. Back in 2013, the world was full of 240W 60-cell p-type modules, and rooftops and fields alike utilized this mainstream supply channel. Today, state-of-the-art p-type and n-type designs are trending in the 400-450W range plus.

The focus is certainly on Watt-dc powers at STC, and much of the extra push for power is coming not from real cell efficiency gains, but by simply increasing the size of the module (larger wafers or more cells). Therefore, the real monetary gain is less pronounced, and in many cases, costs are simply then passed on to the balance-of-systems side of things.

Indeed, changes can also affect the role tracker companies play in this respect, as they need to ready for variations in modules and how this impacts on their unique supply-chains.

However, change in manufacturing comes with its own set of challenges, not simply by the manufacturer in having to ramp up new tools every few months, but most notably in the bill-of-materials employed and control of sub-contractors and OEMs that have been critical for module shipments targets of almost all leading c-Si players today.

c-Si PV module BoM’s, specifications and suppliers seem to change more often than cell phone offerings these days. However, while cell phones have a shelf-life of 2-3 years at most, PV modules (especially for utility-scale sites) are meant to be warrantied for 25-plus years. Outlined in this way, one can see instantly that change is not always good – especially if the customer is not ready for it, or it simply causes them problems.

If things were bad enough, the industry is currently undergoing a wafer-driven change mechanism that is potentially complicating things even more (the push to larger wafer sizes). Coupled with the half-cut cell design growth (6-inch cells are cut in half and then assembled as 144 half-size arrangements), this is now causing packaged module dimensions to become a non-standard parameter.

From an installer standpoint (rooftop or ground), this is certainly not good news. If module dimensions are staring to creep up, then where do I stand in 3-5 years if I need that form/fit/function to replace faulty product? Structure providers are also impacted, with the unenviable task of adapting to different non-standard module sizes and multiple interfaces on a regular basis.

Product availability therefore now becomes the gating factor in the warranty, and even more than the risk associated with module suppliers being in business 10+ years down the line. The chances of any PV module supplier having a hidden stash of warranty-ready PV modules covering the myriad of types supplied in the past 3-5 years is not reality. The buck will stop with the site owner, and any third-party stakeholder that is mandated to sustain site yields at agreed levels.

This characterizes the reality of the wafer size debate ongoing today. For further background, have a read through the article on PV-Tech recently, Why are monocrystalline wafers increasing in size? Larger wafers ultimately do force module producers to increase dimensions of panels. The use of half-cut cells also allows cramming more cells (over and above 144) onto a single panel, again changing module dimensions. The days of standardized 72-cell modules appear to be well and truly in the past.

The snowball effect

It would seem we are now into a vicious circle of module-power bragging-rights taking priority over practical reality and long-term investment returns, and this is entirely a manufacturer-driven phenomenon, from wafer size to cell design to module production and supply.

Let’s restate the main issue at play here: investors want to maximize returns over 25-30 years with minimum risk. It is all about maximizing returns, not appearing to save a few pennies on capex during site build based on a higher-spec module.

Ask any bank or solar site investor if they would trade 10W on a 400W panel for audit-trail security in BoM’s used across multi-stages of a 500MW site, drop-in replacement availability in the future, and product testing/validation that minimizes the risk of failure or underperformance, and they would bite your hand off. Experienced players have learned that manufacturing stability and reliable and durable products are the key drivers behind long-term degradation and minimizing total cost-of-ownership over plant lifetimes.

However, the nameplate power spec game appears to be growing today, with everyone joining in. The fear I guess is that a 380W panel will simply look outdated, if all competitors are pushing 420W-plus equivalents? In some ways, one can sympathise with the sales teams and the need to supply what appears to be market-competitive product at any given time.

If quality could be benchmarked, the world would be a different place.

Module quality and reliability should always be ranked above module power ratings. It seems such an obvious thing to say, and no-one that has ever purchased a PV module would dispute this for one second. So what is the problem?

Perhaps it all comes back to quality having no clear industry-accepted metric (like module power rating), and therefore quality is something that can be interpreted, marketed and benchmarked in many different ways. Just look at the 50-plus module suppliers claiming to be on one of the Tier-1 type listings these days, and thinking this means they have quality product that is bankable?

Indeed, during the past couple of months, since PV-Tech introduced the PV ModuleTech Bankability Ratings, one of the most-asked questions by the industry was: How do you measure module quality? Can suppliers be benchmarked on quality?

It is an extremely difficult parameter to benchmark, as quality is by nature qualitative, and has no scoring mechanism to fall back on. Firms performing quality audits and reliability testing have bespoke means of ranking suppliers, but it is often fab or BoM or module type specific. Such schemes may work, if fixed supply chains existed with limited varieties of modules. However, as discussed earlier, the opposite exists within the industry today.

Therefore, quality and reliability testing becomes case-specific and valid for one product at one point in time. As soon as anything changes (materials supply for manufacturing, process tooling, wafer or cell supply channels, assembly location), then everything needs to be started again from scratch – or should be!

This is the real problem for institutional investors. Undertake any due-diligence and risk-mitigation process for site supply at any point in time, and it is valid almost only for that project, or indeed the first phase of a mega-sized, multi-phase-build project.

Move 3-6 months on in time, and the entire exercise has to be done again, as more than likely, the makeup of the modules from the same supplier will have changed – albeit with higher power ratings being claimed.

One can only imagine the cost element to all of this. Constantly engaging with IE’s; factory audits per phase of project; certification and testing every time module parameters change. Surely this is not ideal, particularly if the modules won’t be around in 2-3 years if anything needs to be replaced on-site?

In some ways, this explains why factory auditors, reliability and testing laboratories, and certification houses have never been so busy.

PV ModuleTech 2019 full of talks on all these themes

The PV ModuleTech 2019 meeting in Penang next week (22-23 October 2019) will consist of talks covering all the issues above, and will hear from companies driving module changes, those trying to qualify and inspect them, new materials and suppliers feeding the factories, and – most importantly – developers, EPCs and investors that are trying to make sense of everything.

In contrast to the talks from c-Si module suppliers relating to these themes, First Solar will also present on the company’s manufacturing approach that is unique now within the industry being a single-product offering that avoids almost all of the issues discussed in this article for c-Si module supply.

There is still time to attend the event next week. Click on the link here to register to attend.