Buyers in the European solar sector remain positive about the future of the industry, despite fluctuations in solar module prices over the last few months.

This is according to data from the latest pv.index report, published by trading platform sun.store, and which covers the European solar sector until May of this year. The stability in market sentiment follows concerns over supply, which caused an upwards creep in module prices in April, but sun.store’s PV Purchasing Managers’ Index (PV PMI) metric suggests that this has not dampened appetite for new investment in European solar projects.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The PV PMI is a composite of purchasing intentions collected from a sample of more than 900 sun.store customers, and reflects general market sentiment in Europe, which has been broadly positive for over a year now.

According to sun.store, a PV PMI figure above 50 reflects an industry that is expecting growth in the coming months, and that buyers are keen to purchase more modules. For the last three months, the PV PMI has sat at a steady 70, a shade lower than the peak of 73 reported in February of this year, but still higher than the figure of 68 that reflected market sentiment in seven months of 2024.

Indeed, PV PMI has not fallen below 70 this year, and this trend is shown in the graph below. The graph also reflects how 53% of buyers expected to purchase more modules in the coming months, compared to just 13% who expected to buy less.

However, all of these survey responses – “more”, “less” and “the same” – all returned a month-on-month change of one percentage point every month since March, reflecting longstanding stability in the opinion of European solar product buyers.

Notably, this sentiment has remained strong amid financial fluctuations in the industry. According to sun.store, the average price of p-type monofacial modules increased by 10% month-on-month, to reach €0.086/Wp (US$0.098/Wp) in May, while full black modules saw a similar price increase to €0.103/Wp.

“The recent price increases reflect dwindling stock across the EU,” explained sun.store head of partnerships and trading Filip Kierzkowski, whose comments suggest that fluctuating module prices is not likely to translate to a decline in solar deployments across Europe.

“Distributors with limited but in-demand inventory are gaining pricing power, while larger stockholders are reducing prices,” Kierzkowski continued. “Full black modules, in particular, saw spikes driven by the residential segment and the seasonal surge in installations.”

Optimism among uncertainty in European solar

This stability is positive news for European solar. At last month’s leading trade show Intersolar Europe, held in Munich, Germany, the general sentiment among attendees was one of increasingly complexity; Elena Donzelli, power purchase agreement (PPA) transaction manager at Pexapark, told PV Tech Premium bluntly that “everything is so complicated” in the industry at present.

The fluctuations in module prices are compared to stability in the PV PMI in the graph below, with PV PMI figures expressed in orange bars and on the axis on the left.

The pv.index report also notes that inverter prices have remained far more stable, “offering welcome relief to installers”. The average price of a hybrid inverter fell just 2% month-on-month, while the price of on-grid inverters fluctuated by less than 1%.

Perhaps unsurprisingly, small-scale on-grid inverters, those smaller than 15kW, have remained the lowest-cost inverter for close to a year, although the gap between these inverters and larger on-grid inverters has almost halved, from a difference of €49.63 to a difference of €27.65 between August 2025 and May 2025.

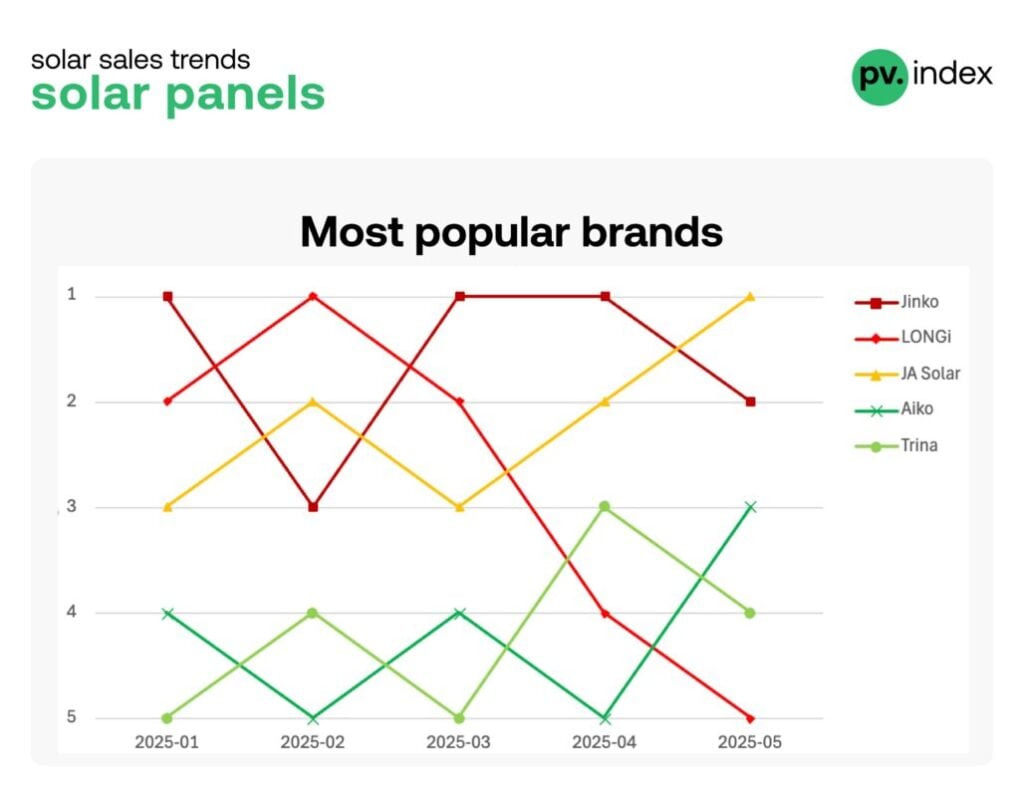

This month’s edition of the report also includes a new section, dubbed “Top Brand Trends”, which ranks brands by the transaction value of their sales across the three products tracked by sun.store: panels, hybrid inverters and on-grid inverters.

Unsurprisingly, the rankings are dominated by leading Chinese manufacturers, with JA Solar taking the top spot for module sellers in May from Jinko, which fell to number two in the rankings. Meanwhile, LONGi has seen a sharp fall in popularity, falling from the second-most popular brand in January, to a peak atop the rankings in February, to fifth place by May.

The inverter rankings were similarly led by Chinese majors, with a few notable exceptions. US brand SMA Solar was the third-ranked on-grid inverter brand, while Austrian manufacturer Fronius was the fifth-most popular brand for both on-grid and hybrid inverters. The presence of a European manufacturer will likely be greeted positively by the European solar industry, which has long grappled with the financial and logistical challenges of building manufacturing capacity in Europe, and was another topic of conversation at this year’s Intersolar event.