The world is on pace to add 593GWM of new solar power capacity in 2024, a 29% increase over the capacity added in 2023, and an installation figure that would put some of the world’s most ambitious climate targets “within reach”.

These are the conclusions from a report published by think tank Ember Climate, which covers this year’s global solar capacity additions, and includes a forecast of the world’s upcoming installations to the end of the year. The headline figures are an encouraging sign for the global solar sector, which added 459.46GW of new power generation capacity in 2023, 245.48GW in 2022 and 185.96GW in 2021, demonstrating the rapid growth in new capacity additions in the solar space.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Unsurprisingly, much of this growth has been driven by China, with China’s 2023 solar capacity additions greater than the world’s total capacity additions in both 2021 and 2022. Ember notes that China is on pace to add 28% more solar capacity in 2024 than in 2023, and, should this figure be reached, China will install 334GW of new capacity this year, making up 56% of global capacity additions.

This would mark the second consecutive year that China has made up more than half of the world’s new solar capacity additions, and China’s massive contribution to global solar installations is demonstrated in the graph above. The graph also demonstrates that, historically, the fourth quarter has seen more new capacity additions than other quarters, and the strong performance of leading markets beyond China, notably the US and India, in the first half of this year are an encouraging sign for the future.

For instance, Ember’s analysis notes that India added more solar panels by May 2024 than it had done in the entirety of 2023. While some of this stems from short-term political changes—notably the reimposition of the Approved List of Modules and Manufacturers (ALMM) in March, which encouraged developers to commission projects before the ALMM was reintroduced—the general trend remains positive.

Ember forecasts the US, too, to perform well in the remaining quarters of this year, expecting both Q3 and Q4 to see record levels of installation for these periods. Last week, PV Tech spoke to a number of industry leaders and experts at the RE+ event in California, where a key discussion point was that, despite the obvious uncertainty arising from this year’s presidential election, states on both sides of the political spectrum had benefitted from, and plan to continue investing in, renewable power projects.

“In fact, most of the Republican states have benefitted much more than the other states,” Sandhya Ganapathy, CEO of EDP Renewables North America told PV Tech.

Market-by-market variance

Ember’s figures also demonstrate that the global solar sector will continue to be dominated by a few critical countries, with three-quarters of the world’s solar installations set to take place in just five countries: China, the US, India, Germany and Brazil. While it is no surprise that these countries dominate the manufacturing of solar products—Ember’s own figures report that China alone accounts for as much as 85% of the world’s solar manufacturing capacity—the fact that this trend has continued into the deployment space is notable.

However, smaller markets have seen increases in deployment figures. Ember’s data shows that Pakistan and Saudi Arabia, neither of which have historically been major solar players, have imported a considerably higher number of Chinese modules in 2024, with both countries importing more than 1GW of Chinese products in July. While some of this no doubt stems from the fact that China is seeking to expand its buyers following the passage of waves of legislation to discourage Chinese imports to the US, both countries have announced ambitious solar projects regardless of US-China relations.

For instance, the China Energy Engineering Corporation (CEEC) signed an engineering, procurement and construction (EPC) contract for the massive 2GW Haden PV project in Saudi Arabia earlier this year, and the facility will be one of the world’s largest upon the beginning of commercial operation, currently scheduled for early 2027.

The graph above shows how capacity additions between January and July 2024 compare to capacity additions between January and July 2023, country-by-country. The countries listed in blue have seen capacity additions increase by more than the global average of 1.3 times, while the countries listed in red are the few to have installed less new capacity in 2024 than in the same period of 2023.

Is it clear, therefore, that in many markets, regardless of size, the world is adding more capacity this year than in 2023, for the most part; massive markets such as China and the US have had their capacity additions covered at length, but even smaller markets, such as Portugal, which added a more modest 1.5GW of new capacity in 2023, have seen considerable growth in capacity additions so far this year.

Conversely, South Africa’s solar installations have stalled, an ominous sign considering the country is planning to operate 30GW of capacity by the end of the decade. The South African energy sector has endured a turbulent 2024 thus far, with state-owned utility Eskom appointing a new CEO in March and the country holding new parliamentary elections over the summer, and greater stability on these fronts will hopefully be of benefit for the South African solar sector.

Meeting global targets

Looking ahead, Ember expects 2024’s strong capacity additions to make a significant contribution to meeting the world’s more ambitious clean energy goals. For instance, the rapid growth in solar deployment will go a long way towards meeting the Global Renewables and Energy Efficiency Pledge, a programme agreed upon at COP28 that includes the tripling of the world’s renewable power capacity by 2030.

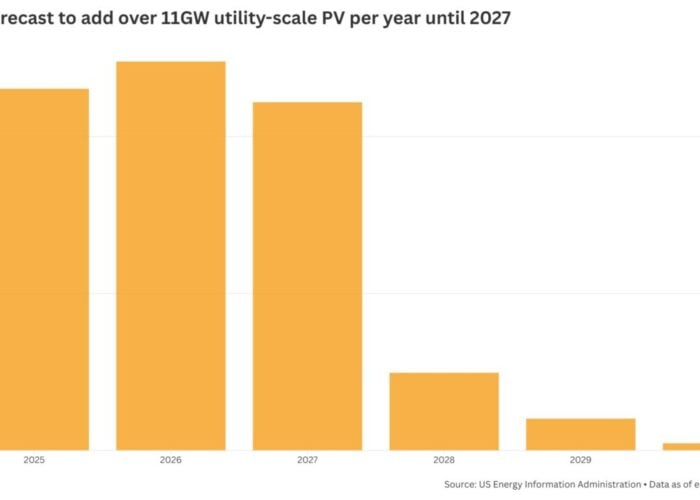

Meeting this goal would mean that solar will have to account for one-quarter of the world’s electricity by the end of the decade, and the world will need to install 6,000GW of solar capacity by 2030. While some forecasts remain well below this total—Wood Mackenzie’s figures expect the world to operate just 4,000GW by 2030—a number of other forecasts now put the world well on pace to meet this target.

Bloomberg New Energy Finance, for instance, expects the world’s installed solar capacity to reach 6,640GW by 2030, while SolarPower Europe’s 2028 forecast of 5,118GW of capacity puts the world on track to meet the COP28 target.

To read more about how Ember’s latest forecasts could affect the UK solar sector in particular, see our sister site Solar Power Portal’s coverage.