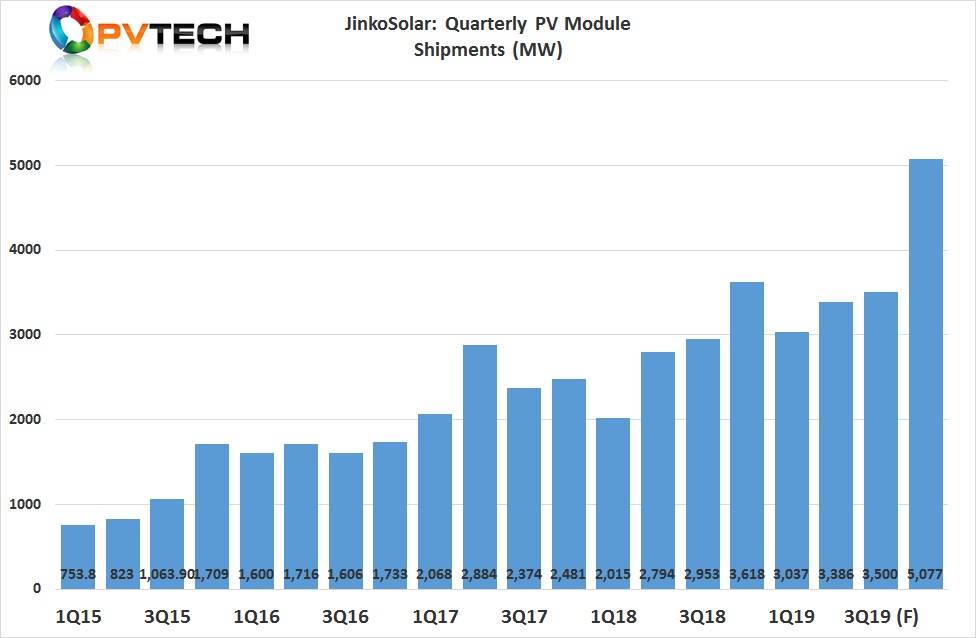

The SMSL reported second-quarter PV module shipments of 3,386MW, an increase of 11.5% from 3,037MW in the first quarter of 2019 and an increase of 21.2% from 2,794MW in the second quarter of 2018.

For the third quarter of 2019, JinkoSolar expects total solar module shipments to be in the range of 3.2GW to 3.5GW. With total solar module shipments in 2019 set to lie in the range of 14GW to 15GW, JinkoSolar is indicating fourth-quarter shipments could smash its current quarterly record of 3,618MW set in the fourth quarter of 2018, shipping between 4GW to 5GW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

By the end of 2019, JinkoSolar still expects nameplate module capacity to reach 16GW, indicating capacity constraints into 2020, without announcing further expansions.

Kangping Chen, JinkoSolar's Chief Executive Officer said, “We are accelerating the expansion of our high-efficiency mono production capacity to meet growing demand globally. This is mainly being driven by our new production facility in Leshan, the mono production capacity of which is expected to reach 5GW by the end of 2019 and 16.5GW once the second phase of the capacity expansion is complete.”

“As of June 30, 2019, our in-house annual silicon wafer, solar cell and solar module production capacity reached 10.5GW, 7.4GW and 12.6GW, respectively. By the end of 2019, we expect our in-house annual silicon wafer, solar cell and solar module production capacity to reach 15.0GW, 10.5GW and 16.0GW, respectively, including 11.5 GW of mono capacity, 9.7 GW of PERC cell capacity and 800 MW of N-type cell capacity,” Chen added.

The company confirmed in the earnings call that its total capital expenditures in 2019 would be in the region of US$450 million and cover planned expansions.

Although the company shipped over 90% of modules in the second quarter of 2019 overseas, JinkoSolar noted in its earning call that it expected PV installations in China to reach around 40GW in 2019, with strong demand for modules through the rest of the year. With PV projects being bid close to fossil fuels, JinkoSolar expects China's demand will continue to grow steadily in 2020.

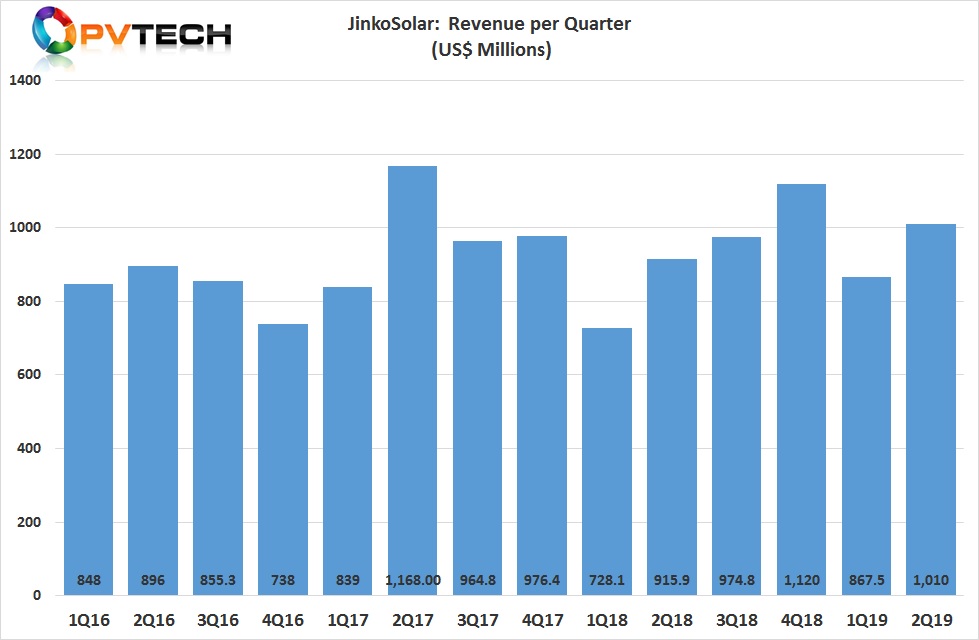

Financials

JinkoSolar reported revenue of US$1.01 billion in the second quarter of 2019, an increase of 18.7% (US$867.5 million) from the previous quarter.

Gross profit in the second quarter of 2019 was US$166.6 million, compared with US$143.7 million in the previous quarter. The company benefited from an increase in shipments, coupled with lower production costs as in-house large-area wafer production expanded, which was partially offset by a decline in the average selling price of solar modules in the second quarter of 2019.

The SMSL reported second-quarter gross margin of 16.5%, compared with 16.6% in the first quarter of 2019, primarily due to further module ASP declines.

Income from operations in the second quarter of 2019 was US$37.9 million, compared with US$35.1 million in the first quarter of 2019. Operating margin in the second quarter of 2019 was 3.8%, compared with 4.0% in the first quarter of 2019 and 1.6% in the second quarter of 2018.

Guidance

JinkoSolar expects third quarter 2019 revenue to be in the range of US$980 million to US$1,070 million.

Total solar module shipments are due to be in the range of 3.2GW to 3.5GW, while gross margin for the third quarter is expected to be between 18% and 20%.