Earlier this week the US National Renewable Energy Laboratory (NREL) published its 2021 Annual Technology Baseline (ATB) document, detailing the continued reduction in the levelised cost of electricity (LCOE) of the country’s core generators.

It highlighted that by 2030, the LCOE of utility-scale solar in the US could be as low as US$16.89/MWh, cheap enough to be the lowest-cost source of low carbon power in the country. By the end of this decade, all but the most expensive utility-scale solar PV projects in the US will be cheaper than mid-range onshore wind, a feat which could herald in a new era of solar proliferation in North America.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

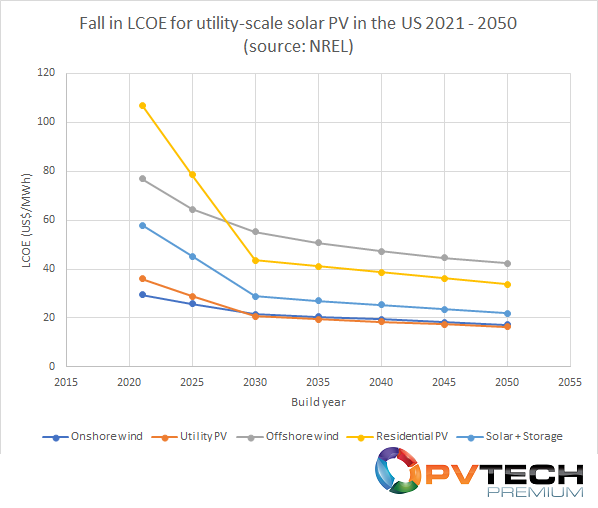

NREL’s ATB provides project classes for each generation technology, ranging from ‘class 1’ (the cheapest) to ‘class 10’ (the most expensive). A mid-range ‘class 5’ is also given, indicating a median LCOE cost of each technology. The below graph charts the ‘class 5’ LCOE projections of the mainstream renewable energy generation technologies from 2021 to 2025, including options for both residential solar PV and utility-scale co-located solar and storage.

As the graph illustrates, the cost of solar PV is expected to fall dramatically across the board over the next decade, driven by ongoing maturation and enhancement of solar technology, economies of scale driven by larger project sizes and reduced soft costs. By the end of this decade, utility-scale solar PV looks set to beat onshore wind on price, a feat which continues out until 2050.

Cost reductions are most stark for residential solar PV, which sees its LCOE plummet nearly 60% from around US$106/MWh this year to US$43.59/MWh by 2030. By this point residential solar PV in the US would provide cheaper grid electricity than offshore wind, a considerable feat for the US considering how cheap offshore wind is expected to become in markets outside of the US.

Meanwhile, cost reductions in solar and energy storage technologies will combine to make co-located solar-storage drastically more cost competitive by 2030. It will also see its cost of generation fall at a quicker rate than other technologies over the next two decades, falling 20% between 2030 and 2050 to around US$21.88/MWh.

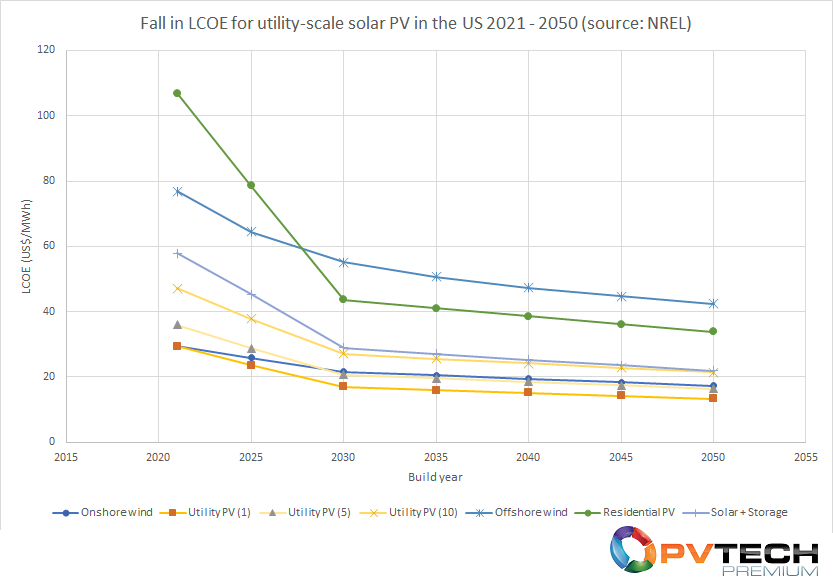

But taking into consideration the different classes of utility-scale solar PV illustrates the variance in LCOEs out to 2050. The graph below adds so-called ‘class 1’ and ‘class 10’ utility-scale solar PV to the above chart, portraying the range in costs and just how competitive utility-scale solar PV could be in the US by 2030 and 2050.

The cheapest utility-scale solar PV projects in the US will be cheaper than mid-range onshore wind projects by 2025, bringing forward that inflection point by some five years. But not only will mid-range solar projects be cheaper than onshore wind throughout the 2030s and 2040s, but the most cost-effective projects stand to be considerably cheaper than their onshore wind counterparts. Throughout the two decades from 2030 until 2050, power generated by ‘class 1’ utility-scale solar PV projects stands to be ~22% cheaper than ‘class 5’ onshore wind.

However the most expensive utility-scale solar PV projects – those in ‘class 10’ – could be beset by an increasingly cost-competitive co-located solar and storage asset class.

This year, co-located solar and storage projects are expected by NREL to have an LCOE of US$57.86/MWh, around 18% more expensive than the LCOE of even the most expensive utility-scale solar projects in the US, which are expected to have an LCOE of around US$47.14. But by 2030 the gap between the two technology classes closes considerably. By 2030 that 18% gap in LCOE closes to just 6.4%, and by 2050 the gap between the two LCOEs is just US$0.47c/MWh, equivalent to around just 2%.

Evidently, utility-scale solar PV of all but the most expensive asset classes will be cheap enough to beat every other renewable generation technology by the mid- to late-2020s, but in certain circumstances co-located solar and storage will be supremely cost effective in the US by the 2040s, indicating the potential for such projects to come forward.

The dataset used for the above analysis can be found below, while the full interactive ATB dataset can be found here.

| Year | Onshore wind | Utility PV (1) | Utility PV (5) | Utility PV (10) | Offshore wind | Residential PV | Solar-storage |

|---|---|---|---|---|---|---|---|

| 2021 | 29.47 | 29.39 | 35.98 | 47.14 | 76.83 | 106.84 | 57.86 |

| 2025 | 25.82 | 23.55 | 28.83 | 37.77 | 64.5 | 78.51 | 45.25 |

| 2030 | 21.58 | 16.89 | 20.68 | 27.1 | 55.15 | 43.59 | 28.96 |

| 2035 | 20.47 | 15.96 | 19.54 | 25.59 | 50.63 | 41.08 | 27.1 |

| 2040 | 19.37 | 15.06 | 18.43 | 24.15 | 47.28 | 38.61 | 25.3 |

| 2045 | 18.3 | 14.19 | 17.37 | 22.75 | 44.63 | 36.17 | 23.56 |

| 2050 | 17.23 | 13.35 | 16.34 | 21.41 | 42.45 | 33.76 | 21.88 |