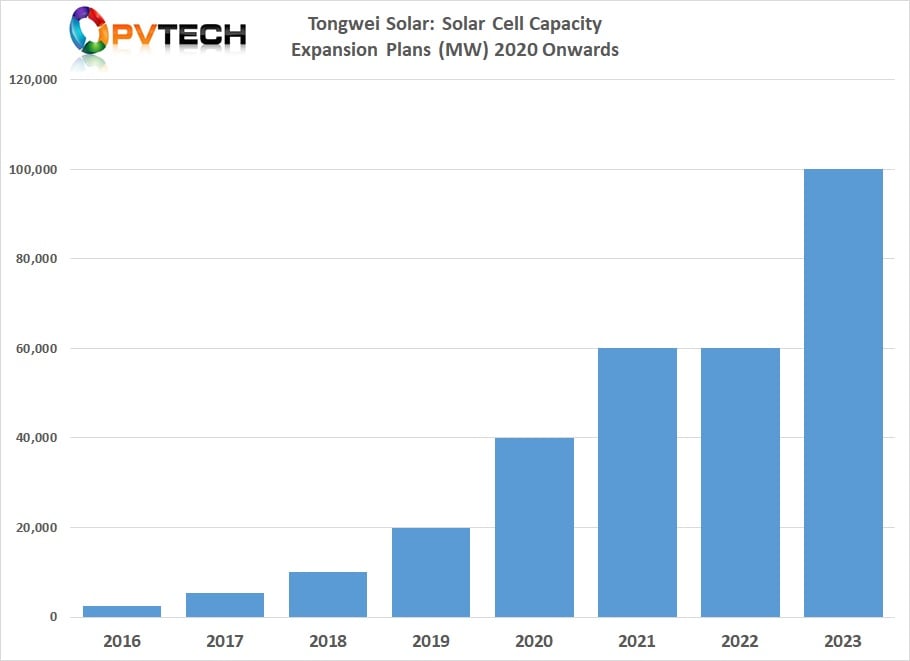

Major polysilicon and merchant cell producer, Tongwei has secured a monocrystalline wafer supply deal from LONGi Green Energy (LONGi Group) that increases its wafer needs by 1 billion wafers to 2.6 billion as the cell producer plans to have more than 40GW of solar cell capacity in 2021.

Previously, Tongwei and LONGi entered into a wafer supply agreement that included LONGi supplying 1.4 billion wafer in 2020, 1.6 billion in 2021, and 1.8 billion in 2022 as part of Tongwei’s ambitions of achieving in-house solar cell capacity of 60GW by the end of 2022.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The significant increase in the wafer supply agreement comes inline with Tongwei’s updated capacity expansion plans outlined in its first half 2020 financial filings. The company noted that its Meishan Plant, Phase I, which is a 7.5GW facility capable of producing all wafer/cell sizes including 210mm had been put into production.

However, two separate cell plants, each of 7.5GW are expected to enter production in 2021, which include the Meishan Phase II plant and the Jintang Phase I plant.

At the end of 1H 2020, Tongwei said it had achieved total solar cell capacity of 27.5GW, which included monocrystalline cell capacity of 24.5GW.

Previously, Tongwei had planned capacity expansions to reach 40GW in 2020, based on market demand, then increasing to 60GW in 2021. Weak demand in the 1H 2020, due to the impact of COVID-19 on operations and global market conditions meant Tongwei experienced cell ASP declines of around 30%, according to the company.

Total solar cell shipments in the 1H 2020 were 7.75GW, a 33.75% increase from the prior year period. However, due to ASP declines, revenue was around RMB 5.84 billion (US$855 million), a 0.22% increase, year-on-year.

In 2019, Tongwei generated revenue of 12.271 billion (US$1.795 billion) from solar cell and PV module sales, a year-on-year increase of 60.56%. The sales volume was 13.33GW, a year-on-year increase of 106.92%, and a gross profit margin of 20.33%.