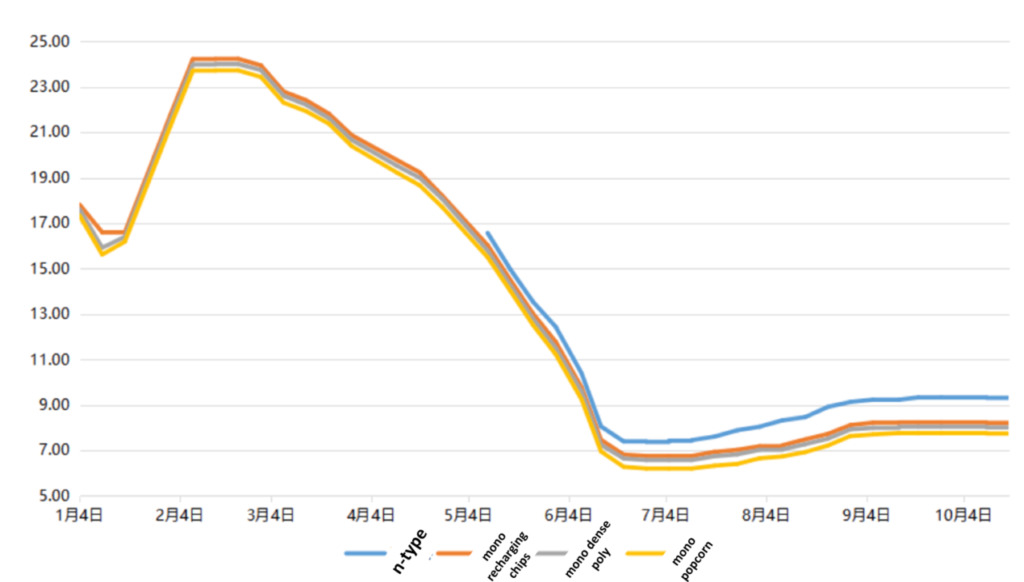

The average price of solar-grade polysilicon has dropped from the peak of RMB240,000-250,000/tonne (US$32,856-34,191) at the beginning of the year to RMB70,000-90,000/tonne.

On 18 October, the Silicon Industry Branch of the China Nonferrous Metals Industry Association released the latest transaction prices for solar-grade polysilicon.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The prices indicate that in the past week:

-N-type material transaction price was RMB90,000-96,000/tonne, averaging RMB93,100/tonne.

-Mono recharging chip transaction price was RMB78,000-85,000/tonne, averaging RMB82,100/tonne.

-Mono dense poly material transaction price was RMB76,000-83,000/tonne, averaging RMB80,100/tonne.

-Mono popcorn material transaction price was RMB3,000-80,000/tonne, averaging RMB77,400/tonne.

With the inventory of silicon materials increasing, there is potential for further price reductions. The industry predicts that silicon material prices will reach a new historical low by the end of 2023.

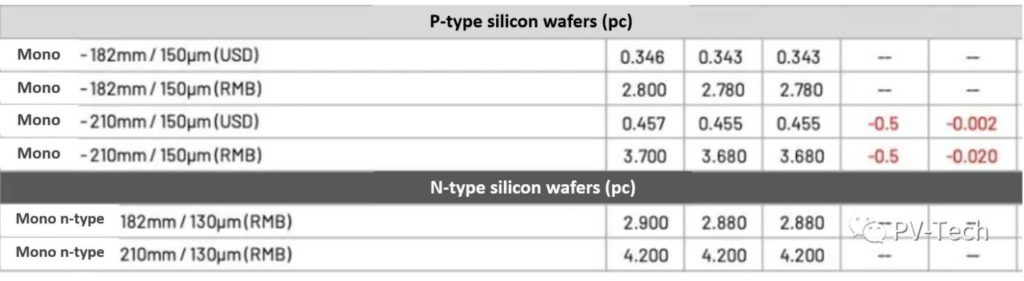

From late September, silicon wafer prices have been rapidly declining due to rising inventory. InfoLink reports that major wafer manufacturers are contemplating production cut plans, and that the overall operation level of the ingot pulling segment in October has dropped to around 82-84%.

Cell transaction prices continue to collapse, with some prices seemingly unavailable for quotation. Manufacturers have been adjusting their prices on a daily basis, and there have been instances of delayed quotations. The pricing disparity between high- and low-efficiency cells continues to be chaotic.

InfoLink’s price monitoring indicates that the transaction prices for M10 and G12 cell sizes, led by top module manufacturers, hovered around RMB0.57-0.59/watt and RMB0.58-0.60/watt last week.

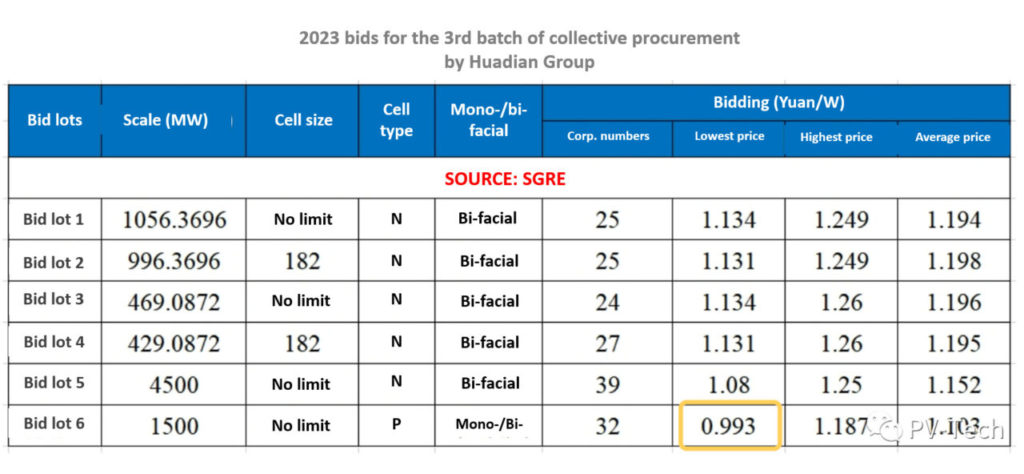

On the module side, on 18 October, with the opening of 2023 bids for the third batch of collective procurement by China’s state-owned Huadian Group, the lowest bid price for n-type modules was only RMB1.08/W, while p-type modules stood at RMB0.9933/W. This was the first time prices have fallen below RMB1/W, heralding the “one-yuan era” for modules.