Under the REPowerEU scenario to install 750GWdc of solar across the European Union (EU) by 2030, the bloc will require 1 million solar workers, double the numbers from 2021.

According to the 2022 EU Solar Jobs report from trade body SolarPower Europe (SPE), reaching 1TW of installed solar in the EU by 2030 could add an additional 500,000 jobs.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, a major bottleneck in several member states is a lack of installers to satisfy the increasing demand for solar power, both from citizens and businesses that are “desperately looking for rapid and tailored protection against skyrocketing power and gas prices”, according to the report.

Even in countries with fewer administrative barriers, Europeans have reported waits of up to one year to install solar rooftop systems, which increase even further if coupled with battery storage or heat pumps.

Nonetheless, the EU’s solar industry employed 466,000 full-time employees in 2021, a 108,000 increase from 2020, with the majority of the jobs (79%) linked to deployment. This year the industry could see jobs increasing by 30% to 606,000, if installed capacity reaches 40GW.

Both manufacturing and operations and maintenance (O&M) contributed 9% last year, while decommissioning and recycling remained a minor source of employment with a 3% share.

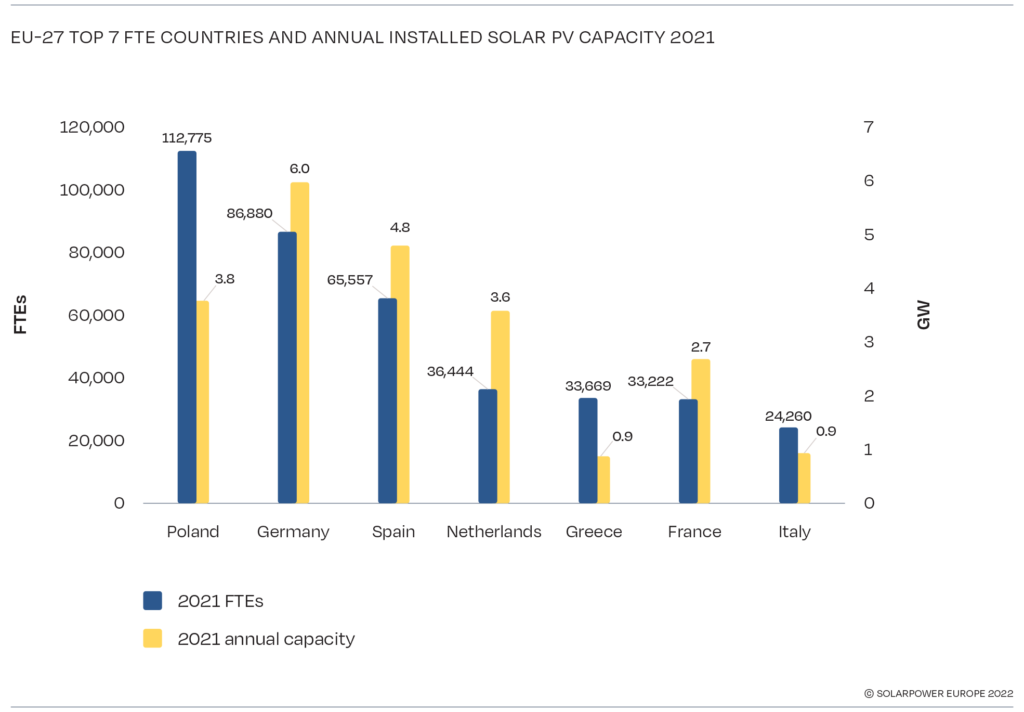

Poland was the largest provider of EU solar jobs, with 113,000, due to the high share of positions coming from the residential PV segment, which accounted for 90% of solar jobs in the country.

Germany had the second highest number jobs in the EU, with nearly 87,000, while Spain had almost 66,000 jobs – most of which were in the utility-scale segment.

The other top countries with the most jobs in the solar industry were the Netherlands, Greece, France and Italy, in that order.

In its five-year outlook, the report puts Germany in the lead in terms of solar jobs with more than 203,000, while Poland would lose some of its workforce in the coming years but still remain second with 103,000 solar jobs.

SPE’s projections for 2026 could see Romania have the seventh-highest number of solar jobs in the EU, with almost 43,000.

Rafaele Rossi, head of market intelligence at SolarPower Europe, said: “We expect the Romanian market to reach the gigawatt-scale by then, and a relevant share of rooftop PV system and the availability of labour costs, compared to other EU markets of similar size, will make it to join this group [of top seven].”