SolarCity, the largest residential solar PV installer in the US reported higher than expected installations in the first quarter of 2016, yet weaker bookings in the residential sector led to lowering full-year installation guidance.

Weaker US residential demand would seem to be an overhang from the exit from the Nevada market and the broader implications of other actions by a number of US utilities in recent months – attempting to limit residential solar adoption.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Residential demand in the quarter was also said to have also been impacted by pending regulatory decisions in New Hampshire and Massachusetts as well as California, its largest market.

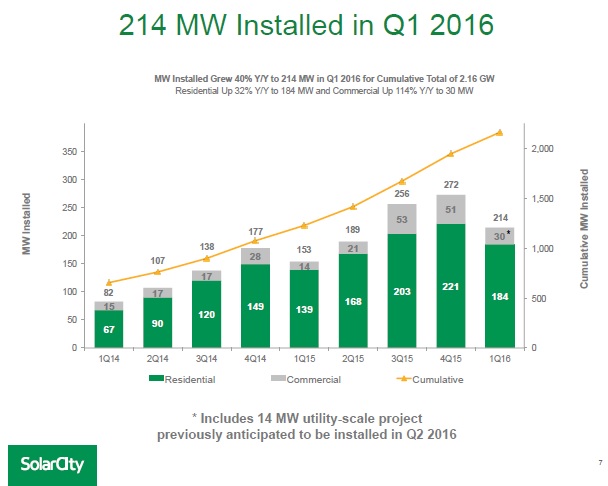

SolarCity reported higher than guided installations in the first quarter, which reached 214MW, 19% higher than expected, primarily due to a large utility-scale project in Maryland being completed one quarter ahead of expected timelines.

However, despite expected seasonal quarter installation weakness, SolarCity noted that its first quarter decline in bookings (160MW) was also due a planned price increase in January 2016.

The company reported first quarter residential installations of 184MW, up 32% from the prior year period but down from 221MW in the fourth quarter of 2015.

Commercial segment installations increased 114% year-over year to 30MW, but were down from 51MW in the fourth quarter of 2015.

Guidance

The weaker residential demand and bookings as well as the utility project completed earlier than expected would mean that total second quarter installations are expected to be around 185MW, compared to 189MW in the prior year period.

With lower bookings in the quarter, SolarCity said that the shortfall was unlikely to be clawed back to meet previous guidance of installations reaching 1.25GW in 2016, which would have been around a 40% increase from 2015 total installs of 870MW.

The company lowered its 2016 installation guidance to be in the range of 1.0GW to 1.1GW.

However, as a result, installations are tracking to be second half year weighted, but would also require installations to exceed 300MW quarterly run rates to meet full-year guidance. This would mean the company would have to achieve new record installation run rates in the second half of the year.