US solar and storage projects totalling 116GW could be at risk from political disruption, according to new analysis from the Solar Energy Industries Association.

Data compiled by the US solar trade body reveals that over 500 power projects planned in the US through to 2030 could be under threat from political pushback, accounting for almost half the new generation capacity in the pipeline.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

SEIA said that at a time when demand for power was “skyrocketing”, the US administration was “using every tool at its disposal to slow down solar and storage projects”.

Solar and other clean energy technologies have faced growing political headwinds from president Donald Trump’s government, with the so-called One Big Beautiful Bill passed over the summer scaling back the availability of tax credits brought in under the previous government. This is despite solar and storage being widely regarded as the quickest to meet the burgeoning demand for power from AI, data centres and manufacturing.

Based on an analysis of data from the US Energy Information Administration, SEIA stated that 73GW of solar and 43GW of planned storage projects had not yet received all necessary federal, state, and local permits to proceed and thus faced being stuck in “limbo”.

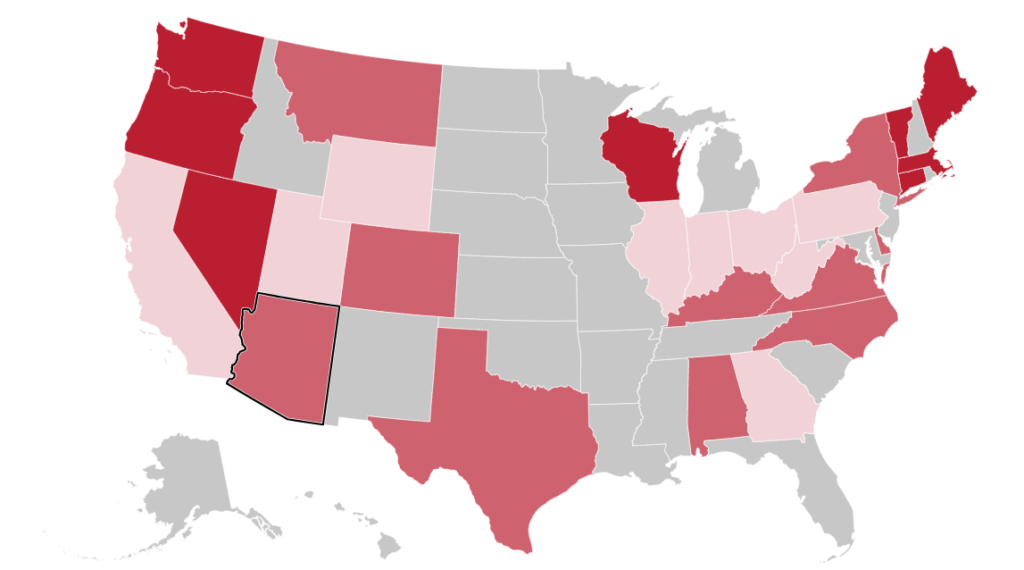

It said that 18 states have over 50% of their planned electricity capacity at risk of being blocked. Many of these states, including Texas, Virginia, Arizona, and Nevada, are expected to lead the country in data centre growth. For example, in Texas, SEIA said over 44GW of solar and storage projects are at risk between now and 2030, accounting for nearly 40% of the country’s at-risk projects.

“Despite declaring an ‘energy emergency’, this administration is threatening half of planned power from reaching the grid. America’s solar and storage industry is ready to build, save customers money, and strengthen the grid. We just need Washington to get out of the way,” SEIA said in a statement.

SEIA stated that actions by the administration, including enhanced federal permitting rules, the cancellation of grid upgrades and the creation of uncertainty in the American energy market, meant projects were being cancelled or facing extensive delays. Notably, one of the US’s largest solar projects, the 6.2GW Esmerelda project in Nevada, was cancelled last month after the Bureau of Land Management scrapped its environmental review, a key part of the permitting process.

“Under Washington’s new energy permitting bureaucracy, projects large and small are being trapped in limbo. And this extends well beyond projects on public lands. Many solar and storage projects located partially or entirely on private property are now being entangled in a myriad of federal reviews,” SEIA said.

The trade body said that developers who have already secured local zoning approvals, completed environmental studies and worked closely on projects with nearby communities are finding they are unable to move forward because their projects must still consult with federal agencies before construction can begin.

“This federal overreach erodes private property rights and local decision-making, inserting Washington bureaucrats into projects that landowners and communities want to host,” SEIA said. “It sends a chilling message to landowners, farmers, ranchers, and private investors that even if you play by the rules, the federal government can still pull the plug. This federal red tape also undermines the energy security and policy certainty that businesses need to plan for the future.”