Tariffs on imports will increase the cost of US solar PV and energy storage technologies and slow the rate of project development, according to analysis from research firm Wood Mackenzie.

The White House’s sweeping global tariff agenda will increase costs across the US power sector by introducing uncertainty and raising the price of imported products, Woodmac said in its new report, “All aboard the tariff coaster”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Chris Seiple, vice chairman of Power and Renewables at Wood Mackenzie said: “In a business with 5-to-10-year planning cycles, not knowing what a project will cost next year or the year after is disruptive and causes massive uncertainty for US power industry participants.”

He continued: “As a result, we could see potential delays in project development and rising power purchase agreement (PPA) prices. We will definitely see impacts on power sector capital projects. The severity depends on what scenarios play out.”

Most of Donald Trump’s broad, “reciprocal” tariffs are paused until the start of July. The US Court of International Trade’s ruling that the president overstepped his authority in imposing the tariffs has been temporarily suspended by a federal appeals court. However, levies on steel imports have been imposed.

Tariff costs are almost always paid by importers and passed on to buyers and end consumers through higher prices.

Solar PV

Woodmac said that the current tariff regime would “significantly” increase costs in the US solar PV market. The US already receives some of the most expensive solar modules in the world, thanks to its historic trade barriers against China and changeable, sometimes eye-wateringly steep, antidumping and countervailing duty (AD/CVD) tariffs on products arriving from Southeast Asia.

Donald Trump’s “reciprocal” tariffs, and particularly tense trade relations with China, are set to make US solar even more expensive.

Under its “trade tensions” forecast, which assumes that the effective US tariff rate settles at 10% by the end of 2026, with a 34% rate on China, a US solar project will be 54% more expensive than in Europe and 85% more expensive than the same plant built in China.

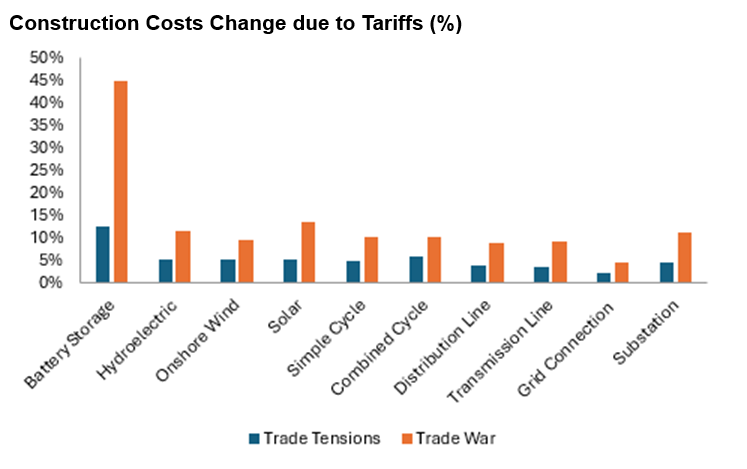

Woodmac’s “trade war” forecast, where the US takes an aggressive tariff line, up to an overall rate of 30% through 2030, the construction cost of a solar project would increase by around 15%, compared with around 5% under the more measured “trade tensions” scenario.

“The tariffs that have been in place on solar modules along with an inefficient transmission policy that exacerbates interconnection costs have made construction costs for solar higher in the US than in most other markets,” said Seiple. “An increase in tariff levels will only worsen this premium US energy consumers need to pay to access renewable energy.

“While the full impact remains uncertain, it’s clear that industry participants need to prepare for increased costs and potential disruptions to their supply chains.”

Energy storage

Woodmac said that the US energy storage market would be hit much harder than any other power sector due to its exposure to China.

While China dominates global solar module production, the US has successfully built domestic manufacturing capacity and can source input products like cells and wafers from other regions of the world. By contrast, Woodmac said that “nearly all” battery cells used in US utility-scale storage projects in 2024 came from China.

The report estimates that cost increases for US utility-scale storage could range between 12% and 50%, depending on the severity of tariffs. Woodmac’s “trade war” forecast (seen in graph above) would impose steep price increases on energy storage, in particular.

Seiple said that, while US battery cell manufacturing is expanding, “it is not expanding at a pace nearly fast enough to meet even a small fraction of battery projects in the US.

“In 2025, we estimate there is sufficient domestic manufacturing capacity to only meet about 6% of demand and, by 2030, domestic manufacturing could potentially meet 40% of demand,” he continued.

Yesterday, our sister site, Energy-storage.news, reported that Chinese firm Hithium and South Korean battery manufacturer LG Energy Solution had begun producing energy storage products in the US. US battery gigafactories have already faced delays and cancellations amid the uncertainty brought about by Trump’s tariff regime; read more of that in a guest post on our sister site, here. (premium access)

A war on two fronts

As well as uncertainty and increased costs from tariffs, the US is facing the rollback of domestic incentives for clean energy deployments and manufacturing.

The US tax reconciliation bill, dubbed “One, Big, Beautiful Bill” by Donald Trump, currently proposes a near-cliff-edge end to Inflation Reduction Act (IRA) production and investment tax credits for renewable energy.

While the bill proposes to maintain the 45X Advanced Manufacturing Credit for domestic factories, its language around “foreign entities of concern” (FEOC) has the potential to hamstring companies trying to access this provision. China would be designated as an FEOC in the bill’s current form, which would prohibit “material assistance” from many Chinese firms and could even extend to Chinese-owned patents for technology. The reconciliation bill needs to pass through the Senate before landing on president Trump’s desk.