In 2025, there was considerable discussion, much of it on these very pages, about the impacts of US President Donald Trump’s sudden policy shifts away from renewable energy incentives and imports of goods from overseas. From a swath of cutbacks to the Biden-era Inflation Reduction Act (IRA) tax credit support to tighter permitting rules for renewable energy projects, and looming uncertainty over the upcoming Section 232 polysilicon ruling, 2025 in US solar has been characterised by these dramatic policy shifts, and the responses of the industry.

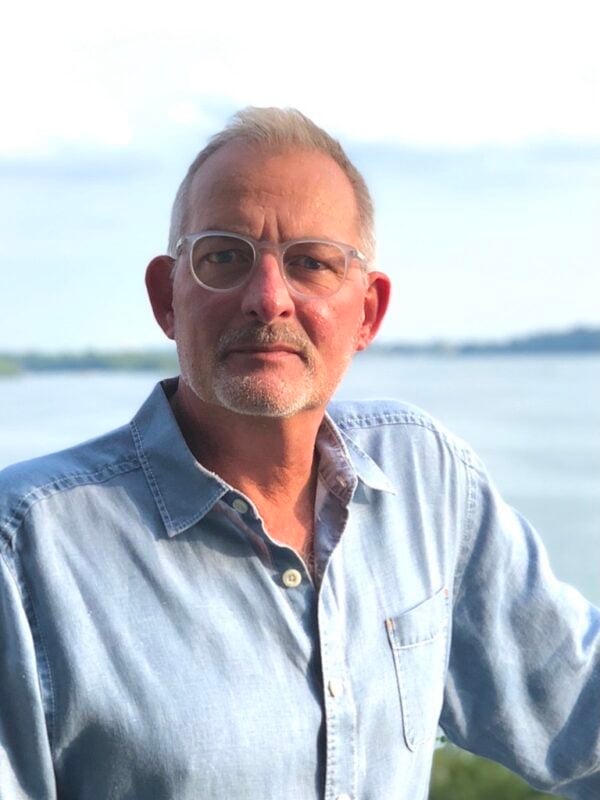

As part of its year-in-review series, PV Tech spoke to Marty Rogers, GM of North America at inverter manufacturer and energy management solutions provider SolarEdge, about his company’s work in the US in 2025, how policy rulings and policy uncertainty have affected its activities and what 2026 could bring.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

PV Tech: What were some of the highlights for your organisation in 2025? What did you do well that you think you can take into 2026?

Marty Rogers: 2025 was a year of strong growth for the North America team, marked by turbulence and legislative hurdles. However, the market remained strong throughout the year, with notable gains in residential and commercial solar growth, as well as storage, characterised by high attachment rates and VPP alignment, in which we are actively participating.

What challenges did you face this year, and how did you overcome them? How can you take the lessons learned from these experiences into the new year?

Most challenges stemmed from market uncertainty—planning became an issue, as well as the interpretation of market dynamics and the challenges we foresee in 2026. With challenges on foreign entities of concern (FEOC), changing incentives, and a general shift among some installers, we needed to spend time interpreting and adapting.

The market is adjusting to the challenges in federal policy; business needs to find new avenues to success. Strong third-party owners (TPOs) will gain positions, and new financial tools will enable businesses to continue moving up and to the right. Yes, there are challenges, but solar and storage are critical to our nation’s energy plan. We are a key component in keeping energy costs in line, adding electrons to the grid. Once the dust settled, the industry focused on realigning with clarity on what needs to be done.

Are you generally optimistic about what 2026 will bring?

Overall, we are optimistic about the opportunities in 2026; the deadlines are at least well-known, so businesses will adjust and are adjusting. FEOC is a challenge that all of us face, but with our local manufacturing footprint, we are well-positioned for the future.

We have new products, new software, a growing manufacturing footprint, and strong market positions in both residential and commercial sectors. The storage attachment market is growing, and virtual power plant (VPP) opportunities continue to expand. Overall, we are a part of the energy equation, and that keeps me very optimistic as we see rates and demand continue to increase.

What would be the single most significant thing that could happen in 2026 that would advance either your own organisation or the wider market, or both?

The realisation that everything we add to the grid is needed to supply the demand and increasing utility rates makes our offer more competitive in more areas. Storage attachment is growing exponentially. Our new offers are spot on in helping reduce installation costs and improve overall operational efficiency.