Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) has revealed that large-scale solar PV capital costs have fallen by 8% in Australia for the second year running.

Detailed within the organisation’s GenCost draft report, which provides an annual assessment of Australia’s future electricity generation costs used in infrastructure planning, variable renewable energy generation technologies such as solar PV and wind continue to lead the country’s energy transition, with these being the fastest-growing energy sources in the country.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

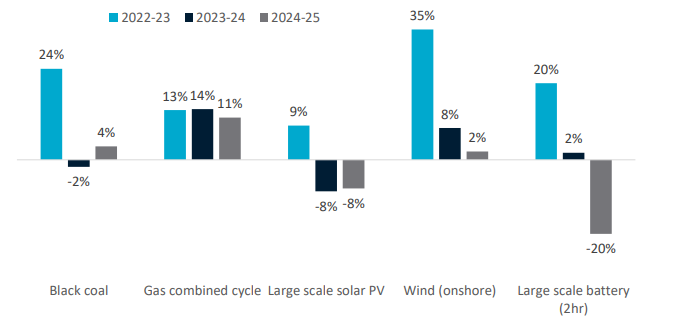

CSIRO said that due to supply chain disruption and freight costs following the COVID-19 pandemic, the 2022-23 editions of the report observed an average 20% increase in technology costs. In the 2023-24 edition of GenCost, there has been a general decrease in capital costs for key enabling technologies for the energy transition, solar PV and energy storage.

Large-scale solar PV has fallen 8% for the second consecutive year, whereas large-scale battery energy storage systems (BESS) costs improved the most in 2024-25, falling by 20%.

The levelised cost of energy (LCOE) for variable renewable energy generation technologies are now the lowest of all new-build technologies in 2024 and 2030, with the cost range overlapping with the lower cost range for coal and gas generation.

This provides another boost to large-scale solar PV, which, according to the think tank Climate Change Authority, has previously been identified as the fastest technology to deploy in the net zero race.

The Climate Change Authority report details that development can take two to three years for utility-scale solar PV projects, with construction taking an average of one and a half years. A rooftop solar PV system can be installed in two to three days.

With this in mind, solar PV is the quickest renewable energy generation technology that can be developed in Australia at the time of reporting. Onshore wind, for instance, has an average development phase of around three to five years, with construction taking two and a half years. Offshore wind has an average development timeframe of over seven years, with construction taking six years.

For utility-scale BESS, development can take an average of one to two years for a one or two-hour duration system, with construction taking one and a half to two years.

Another interesting finding within the report correlates to the use of nuclear energy in Australia, something that is currently banned but has become a focal point for the impending federal election next year.

According to the GenCost report, CSIRO has said that modelling nuclear’s long operational life factor across all new-build electricity generation technologies presents “no unique cost advantage over other technologies”.

CSIRO chief energy economist and GenCost lead author Paul Graham said the draft report found no unique cost advantage in nuclear technology.

“Similar cost savings can be achieved with shorter-lived technologies, including renewables, even when accounting for the need to build them twice,” Graham said. “The lack of an economic advantage is due to the substantial nuclear re-investment costs required to achieve long operational life.”

The draft report found GenCost’s previous analysis of nuclear’s capacity factor range of 53% to 89% fair and remains unaltered based on verifiable data and consideration of Australia’s unique electricity generation sector.

The report indicates that global median nuclear construction times have risen from 6 years to 8.2 years over the past five years, resulting in a total development timeframe of approximately 12 to 17 years. Based on this analysis, GenCost has determined that the total lead time for nuclear development in Australia will be at least 15 years.