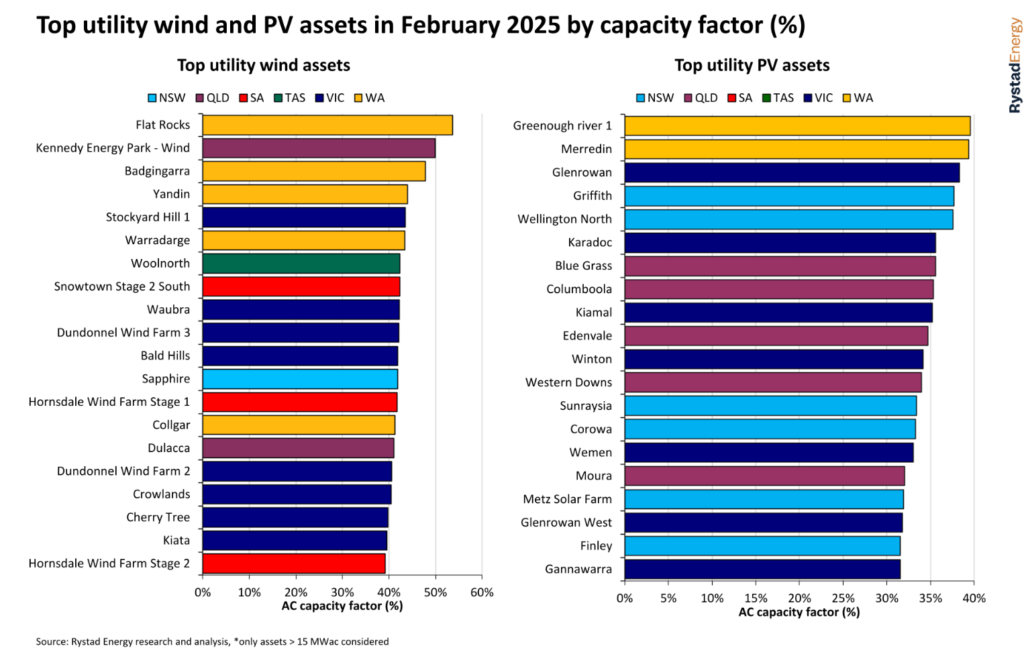

The 40MW Greenough River solar PV plant in Western Australia has been deemed the best-performing utility-scale solar asset in the country, in terms of AC capacity factor, in February 2025, according to Rystad Energy.

This project has helped drive a positive month for renewable energy generation in general across Australia. According to Rystad Energy’s research, all Australian solar PV and wind assets generated just over 4.5GWh of energy, up 14% year-on-year when it reached 3.9GWh.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Owned by Bright Energy Investments – a joint venture between DIF Capital Partners, superannuation fund Cbus and state-owned Synergy – the Greenough River plant has been operational since April 2018. Its development comprised an initial 10MW stage with a further 30MW expansion.

The plant features 450,000 solar PV modules across these two phases. First Solar, a US thin-film module producer, provided the solar PV modules.

According to Rystad Energy’s research, Sun Energy’s 100MW Merredin plant was the second top utility-scale solar PV asset in another win for Western Australia. It is worth noting that the Merredin PV plant ranked second in January 2025.

Rounding off the top five was Victoria’s 130MW Glenrowan plant, owned by CIMIC Group, alongside New South Wales’ 36MW Griffith and 300MW Wellington North solar PV plants, owned by French renewable power producer Neoen and Beijing Energy International (BJEI) Australia, respectively.

The Griffith plant was also the top-performing asset in December and January, while Wellington North, which BJEI acquired from Lightsource bp in 2023, came in second in January 2025.

David Dixon, a senior analyst at Rystad Energy, noted in January that the Wellington North project, alongside Fotowatio Renewable Ventures Australia’s 353MW Walla Walla solar PV power plant, had been a key driver of a New South Wales state record for solar generation that was achieved on 21 January.

Solar PV and wind generate over 4.5GWh in February 2025

Rystad Energy’s figures are encouraging for the Australian renewable energy sector as a whole, with a number of states performing particularly well. At the state level, New South Wales topped the list, generating 1,324GWh split between 813GWh from utility-scale solar PV and 511GWh coming from wind.

In the National Electricity Market (NEM), renewable energy generation, including hydro and biomass, reached 44% of the electricity mix in February—the highest recorded figure for the month. Meanwhile, in the Wholesale Electricity Market (WEM), covering Western Australia, renewable power accounted for 42% of the energy mix, up from the 37% figure recorded last year.

Dixon previously said that renewable energy generation across the NEM and WEM reached 92TWh, or 39% of total generation annually. This is expected to increase to around 43-45% in 2025, with the rise of renewable energy generation projects expected to come online. This will also be aided by a double in battery energy storage capacity to over 6GW by year-end.

Australia’s NEM sees connections pipeline grow 36%

The NEM is anticipated to grow significantly as the country transitions away from coal-fired power and focuses on clean energy generation. As such, at the end of 2024, the Australian Energy Market Operator (AEMO) said that the NEM connection pipeline grew 36% year-on-year to 49.6GW.

Interestingly, battery energy storage systems (BESS) accounted for 18.1GW of this figure, showcasing the need to increase storage capabilities to complement the surge in variable energy generation projects being explored in the country.

Around 36% of this capacity was in New South Wales, 32% in Queensland, 21% in Victoria and 10% in South Australia.

Considering the NEM’s current total generation and energy storage capacity stands at 66GW, adding nearly 50GW of new capacity is a significant pipeline for the future energy supply.

Despite this rise, question marks are being raised around the suitability of the NEM’s design and how this could stifle investment in large-scale renewable energy projects.

Advocacy and engagement platform Clean Energy Investor Group (CEIG) said that the NEM’s outdated design, built around an era of coal and gas power, jeopardises prospective investment in solar PV, wind and BESS. With the ongoing retraction of US policy away from renewable power, the CEIG’s CEO, Richie Merzian, said this now represents an opportunity for the country to attract investment in the energy transition.