The US market is expected to see a strong uptick in overall module supply, both domestic and overseas, in 2023. Alongside this will be a range of different module technologies, making the US market the most differentiated from a technology standpoint this year.

As the US hurtles towards a post Inflation Reduction Act (IRA) existence, is the current landscape of PV modules simply the parting shot from a bygone age, or a blueprint of what to expect once domestic manufacturing takes grip?

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In this article, I explain the module technologies that will make up the US solar market this year and why these technologies are so prevalent this year.

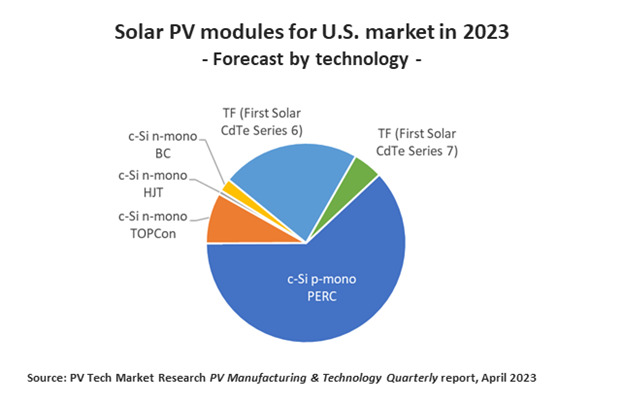

The past few years has seen a somewhat prescriptive technology split for modules used in the US, with the choice being p-mono PERC (rooftop or ground-mount, with the ground-mount using the bifacial cell features), First Solar’s Series 6 (thin-film CdTe) products, or Maxeon’s n-type back-contact (BC) panels (supplied in the US exclusively for part of SunPower’s DG installer business).

Until now, First Solar has supplied US demand from either its US or Southeast Asia manufacturing sites. On the silicon front, mono-PERC modules were mostly from Southeast Asia or various other final assembly sites (Canada, Mexico, EMEA or South Korea). Back-contact cells have been made in Southeast Asia by Maxeon and shipped overseas for assembly, before entering the US market.

However, this year, the US will see a far broader spread of modules being supplied. This is being driven by several factors.

First Solar will roll out its new Series 7 panels later this year, with the US being the first location to come online meaningfully. TOPCon will become as ubiquitous a word as PERC was in the past; an impending technology-change juggernaut that will impact the US in part this year (but in way greater numbers in 2024). And n-type heterojunction (HJT) modules will see significant growth, largely through contributions from Meyer Burger (dominated by shipments from Europe in the meantime).

As a result of this, the module supply technology landscape in the US in 2023 will look more differentiated than any other end-market region in the world. In fact, the US becomes even more unique in also being one of the few end-markets to have a substantial residential market – something that drives different module formats, in comparison to the utility segment.

During 2023, there are about 40 ‘genuine’ PV module suppliers serving (circa. 98%) of the US market. By ‘genuine’, I mean companies that make the module, not entities that distribute or simply trade in the US as importers; or, at best, only test or label a final product made by someone else.

To fully understand the technology being supplied to the US this year, it is important to remember that not all of the 40 module suppliers have a say in this matter. When it comes to US shipments, 22 of the 40 suppliers only assemble modules (buying cells from third-party sources). So we have to remove these companies as being the ones ‘driving’ technology change in the US today.

Of the remaining 18 companies, 12 can make the cells and modules, while 6 are value-chain integrated (ingot to module, or thin-film). And lastly, if we want to zone in on US modules needing ideally a non-China supply-chain audit, about 3 or 4 suppliers to the US right now can say with relative certainty that none of the key production components for US shipments comes from China.

All said and done, here is the graph that shows the technology mix (by capacity) of all the PV modules I expect to be shipped for US end-market use in 2023.

Clearly, the US market is dominated today by First Solar and p-mono PERC module suppliers. In terms of the trends for 2024, the key metric to track will be the share taken up by TOPCon modules and how fast mono-PERC module types will vanish from the market. Interestingly, this raises some interesting questions for existing contracts placed in the US for long-term module supply.

Over the past couple of years, the fear of having no modules available has spooked the investor/IPP community. For the first time in the PV industry, this has resulted in long-term buying, securing contracted module deliveries out to as far as the end of 2027.

The risk to such long-term buying is obvious (in terms of supplier default), but what about the risk of committing to the wrong technology, or not having good enough wording written into the contracts to prevent delivery in 3 years of an inferior product with yesterday’s spec? A bit like opening up your new Apple smartphone and seeing you’ve been sent an iPhone 5.

By the end of 2027, the industry is likely moving to a mainstream technology that does not even have an acronym of widespread notoriety today. It is a fascinating dynamic and one that will surely come back to haunt people in a few years. Or taken to an extreme, what happens if there is a 10X change in module performance during this delivery period?

The other factor that will impact on US module supply availability in the next few years will be dictated by how and when the Inflation Reduction Act (IRA) takes shape. Will new investments simply be based on choosing whatever is c-Si mainstream in 2023? In which case, all the new module fabs in the US are TOPCon in the next few years. Or will the positive vote of confidence by Meyer Burger and ENEL start a domino effect in Europe and the US to aggressively ramp up tens of GWs of HJT cell and module capacity?

Currently, these are two different things. There is the here-and-now and ‘who is the best supplier for my requirements in 2024 and 2025’. Longer term, it is all about how the IRA changes the US manufacturing landscape, independent of Asian-owned technology benchmarks.

In terms of the here-and-now (and buying modules in the short-term) PV Tech will host PV ModuleTech USA 2023 in Napa, California on 6-7 June 2023. The two-day event was a success last year when it launched. This year, the focus is very much on who these 40 module suppliers are, and which ones are going to be at the core of ongoing PV module supply to the US in 2024 and 2025.

How can we understand the risk associated with each of the 40 main module suppliers? Are their supply-chains ‘secure’? Which ones have excess volume to deliver this year or in 2024?

PV ModuleTech USA was sold out last year. To register to attend the event in Napa on 6-7 June 2023, please follow the link here.