Solar manufacturer Canadian Solar shipped 7.9GW of modules in the second quarter of this year, a 14% quarter-on-quarter increase, driving gross profits of US$505 million.

Of its module shipments, 672MW were shipped to the company’s own utility-scale solar projects. While its module sales are down 4% year-on-year, the quarter-on-quarter growth helped drive improved revenues. Net revenues hit US$1.7 billion in the second quarter of this year, up 42% quarter-on-quarter and 4% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company’s financial performance has improved significantly from the first quarter of this year, when it posted gross profits of just US$140.5 million amid growing uncertainty regarding the viability of importing modules into the US as president Trump has ratcheted up protectionism in US trade policy. This uncertainty particularly affected CSI Solar, Canadian Solar’s manufacturing subsidiary, which posted income from operations of US$1.8 million in the first quarter.

In response, Canadian Solar has shifted its focus to battery manufacturing. Between the first and second quarters of this year, CSI Solar’s revenue from battery energy storage systems (BESS) almost tripled, from US$155.3 million to US$432.4 million, and made up more than one-quarter of the company’s revenue in the first quarter of this year.

By the end of the second quarter, CSI Solar’s income from operations jumped to US$120.7 million, significantly higher than the US$1.8 million posted in the first quarter of the year.

“Despite tariff headwinds, e-STORAGE achieved one of its strongest quarters,” explained Yan Zhuang, CSI Solar president. “With solar supply chain pricing trending higher and storage margins normalising, we expect margin pressure in the second half.

“We remain focused on strategically managing module volumes to less profitable markets and growing our storage volumes globally.”

The company expects to shift its manufacturing emphasis to batteries even further in the coming months. Between June and December, CSI Solar expects to reduce its cell and module manufacturing capacities from 36.2GW to 32.4GW, and from 59GW to 51.2GW, respectively, while adding 5GWh of new storage system capacity to its operations over the same period.

In May, Canadian Solar also mulled the prospect of moving its manufacturing facilities to avoid some of the tariffs imposed by the US government, suggesting that it would move solar and battery manufacturing plants to the US, but has not provided a further update on this move.

Recurrent Energy posts greater losses

Canadian Solar’s project development arm, Recurrent Energy, meanwhile, has endured more difficult times. The subsidiary posted losses from operations of US$74.4 million in the second quarter, down from losses of US$11.9 million in the first quarter, with the company’s operating expenses exceeding its revenues.

Canadian Solar looks to have shifted its focus to markets outside of the US in terms of deployment, with growing project pipelines in other regions; the company now has a project pipeline of 8.4GW in Europe, the Middle East and Africa, plus a further 6.9GW pipeline in Latin America, both of which are larger than its North American pipeline.

The same is true of its storage portfolio, with 39GWh of storage projects in development in Europe, the Middle East and Africa, compared to 22GWh of projects in North America. The majority of the projects in the former market are in “early-stage development” – 31.7GWh – which the company describes as “in the process of securing interconnection”.

Indeed, Recurrent Energy’s revenue from solar and storage asset sales fell quarter-on-quarter, from US$72.2 million to US$48.1 million.

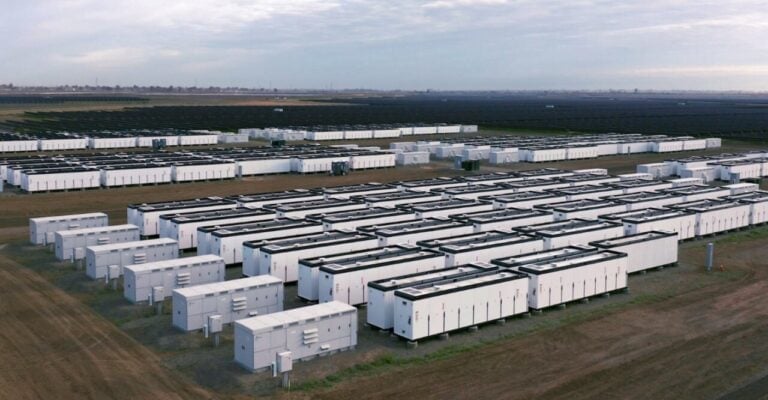

However, the latter figure is still notably higher than the US$12.8 million reported in asset sales in the second quarter of 2024, suggesting there is still money to be made in US-based project deployment. In the second quarter of this year, Recurrent Energy closed financing for its 94MW Blue Moon Solar project in Kentucky, and started commercial operations of its 1.2GWh Papago storage project in Arizona.

Looking ahead, the company expects module shipments to fall, but total revenues to increase. Canadian Solar expects module shipments in the third quarter to fall to 5-5.3GW, but total revenue to hit a peak of US$1.5 billion. The company also expects to sell up to 2.3GWh of batteries in the third quarter, and as much as 9GWh of batteries for the full year, as batteries become an increasingly integral part of the company’s operations.