The Chinese government has released a range of policy measures to strengthen intellectual property (IP) protections in the country’s solar PV industry.

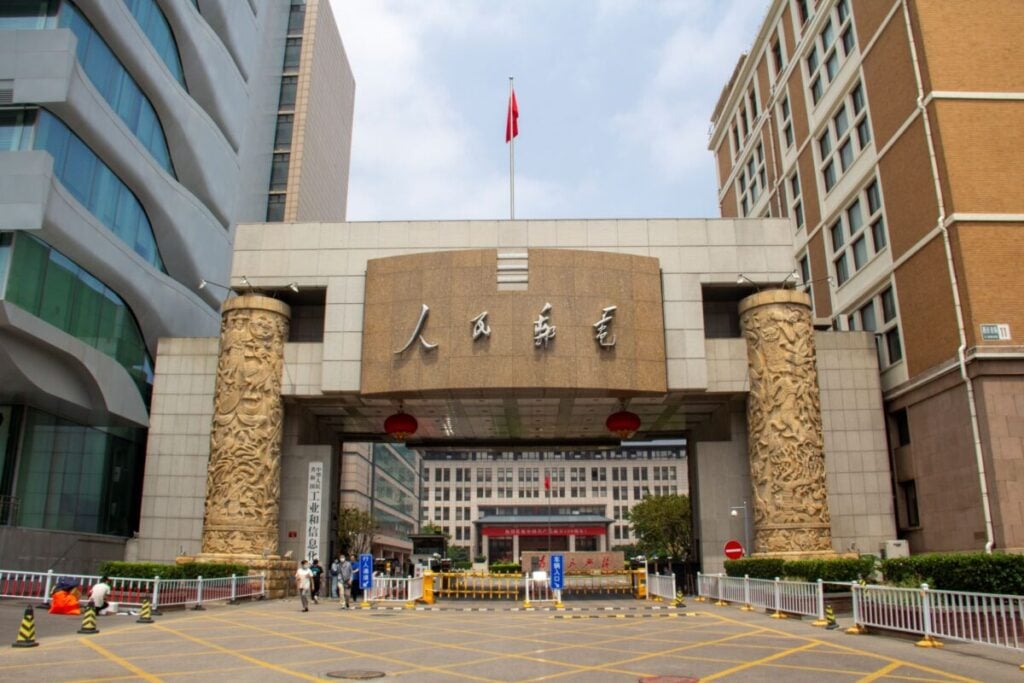

The Ministry of Industry and Information Technology (MIIT) and National Intellectual Property Administration (CNIPA) have released 11 policy proposals designed to create a “fair and orderly” market and promote the “healthy development” of the Chinese solar PV industry.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The proposals encourage solar manufacturers to accelerate R&D investments and patent filings for advanced technologies, including tunnel oxide passivated contact (TOPCon), back contact (BC) and heterojunction (HJT), and to reserve “basic patents” for cutting-edge technologies like perovskite and tandem products.

It also calls for greater patent curation and innovation across upstream and downstream sectors, ranging from raw materials to solar and energy storage integration and operations and maintenance systems.

Other points cover both domestic patent support and stronger protections against infringements. The former includes accelerating pre-examinations and examinations for patents and leveraging a “green channel” for priority patents, as well as collaboration between Chinese industry players.

On the other side, the document proposes introducing a “full-chain intellectual property infringement risk monitoring mechanism” encompassing the production line from raw materials to module assembly. This would monitor IP risks and litigation, including the “transfer of core technology patents to foreign entities”.

Point nine in the proposal specifies “Strengthening Overseas Intellectual Property Risk Response”, including greater risk prevention “for photovoltaic enterprises in international exhibitions, product exports, and overseas investments.”

The CNIPA said the measures would aid the “healthy development” of the PV industry by 2027, which has been experiencing a sustained period of low prices and fierce competition between manufacturers, driven largely by oversupply in upstream industries. It said it seeks to avoid “involution” competition, where a society, group or industry begins to complicate its internal processes instead of evolving, growing or stabilising.

Last August, Beijing convened six ministries to discuss greater regulation on the Chinese PV industry to curb the extreme competition and sustained low prices. The sector’s leading manufacturers have struggled to turn profits over the last two years, even as their total product sales have continued to rise, a situation illustrating the challenges China’s PV industry faces.

The document concludes with a commitment to establish coordinated and strengthened IP guidance in China’s PV industry, with plans to hold consultations and establish dedicated “think tanks” for solar IP.

As mainstream solar technology has shifted towards n-type TOPCon technology, industry IP battles have become more common. As well as stabilising the industry, Beijing’s push for stronger IP protection looks to be a defensive move to shore up its industry against future technological changes and growing competition in global markets like India and the US.