New Chinese government policies and supply-side production cuts will drive a significant increase in solar and storage component costs from the fourth quarter of this year onwards.

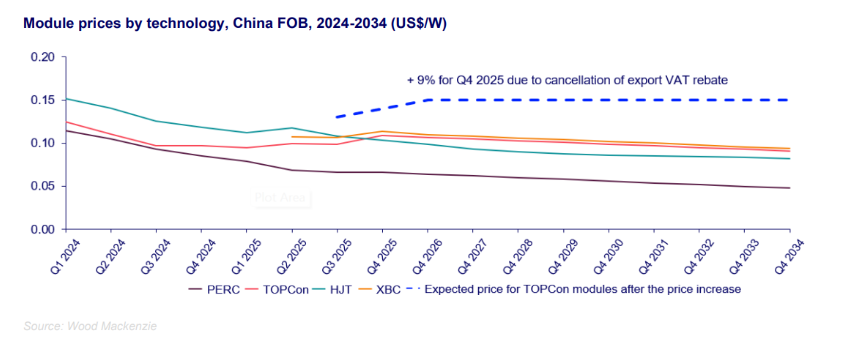

This is according to a new report from analyst Wood Mackenzie, which notes that a combination of Chinese government policy and company activity will likely put an end to low module prices, which have spiralled downwards for the last 18 months. The analyst reports that solar module prices reached “historic lows” of US$0.07-0.09/W in 2024 and early 2025.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Sustained oversupply of modules and components from Chinese manufacturers – both for the domestic and overseas markets – has led Chinese manufacturers to slash prices in an effort to stay ahead of their competitors. But this race to the bottom has led to significant losses for many of the key industry players. Last month, China’s top four solar manufacturers announced losses of US$1.54 billion in the first half of the year, following months of sustained price drops across the industry, as shown in the graph below.

The graph also shows how the FOB (free on board) price of TOPCon (tunnel oxide passivated contact) modules is expected to quickly stabilise. Wood Mackenzie suggests this is due to three factors: market consolidation, supply-side cuts and new VAT policy.

Market consolidation consists of Chinese polysilicon manufacturers being ordered to limit utilisation of manufacturing facilities under “voluntary-compulsory” guidelines, which has led leading producers to cut utilisation rates by 55-70%, according to Wood Mackenzie. This has already triggered a 48% increase in FOB price since September 2025, and helped stabilise Chinese product prices in the months prior.

In the summer, there were reports that a group of China’s leading polysilicon producers, including GCL Technologies and Tongwei, were planning to buy up and shut down around one third of the country’s polysilicon production capacity

Similarly, supply-side cuts consist of reductions in manufacturing output, and has seen operating rates for leading solar module manufacturers fall by as much as 60% by the end of the first half of this year. This has particularly targeted passivated emitter rear contact (PERC) technology, which Wood Mackenzie described as “obsolete”, as Chinese manufacturers look to phase out PERC production lines in favour of newer technologies, such as TOPCon.

Perhaps most strikingly, the cancellation of a 13% rebate previously applied to VAT paid on exports of solar modules and storage systems will “directly impact benchmark pricing globally,” according to Wood Mackenzie.

“Module manufacturers have already warned international customers to expect approximately 9% price increases in Q4 as a result of the VAT rebate cancellation,” said Yana Hryshko, senior research analyst and head of Global Solar Supply Chain at Wood Mackenzie. “With no possibility of alternative supply in the short term, developers will have little choice but to absorb these higher costs.”

“This shift will ultimately benefit the industry’s long-term health,” added Hryshko. “For manufacturers, it represents a welcome opportunity to reinvest and innovate. For developers globally, it means adjusting procurement expectations. And for policymakers, it’s a timely reminder of the risks inherent in concentrated supply chains.”