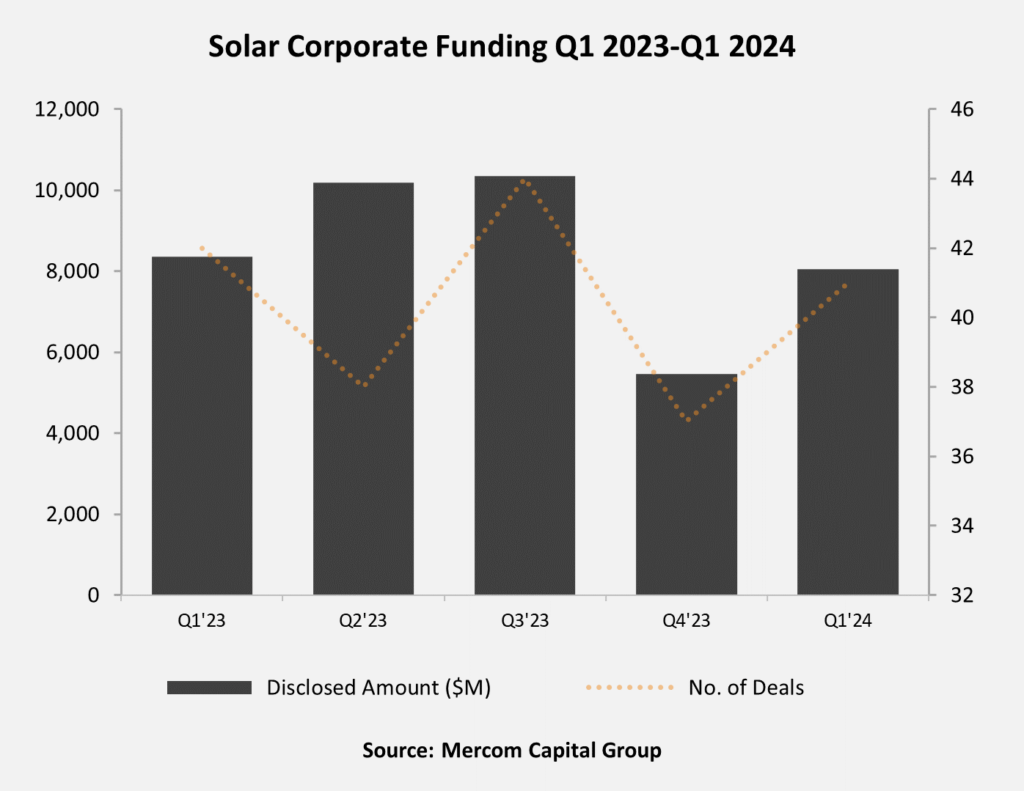

Corporate financing in the solar sector reached US$8.1 billion in the first quarter of 2023, according to market analyst Mercom Capital.

Overall private-sector financing for solar fell by 4% year-on-year (YoY), compared with US$8.4 billion in Q1 2023. However, it rose by 47% sequentially from Q4 2023, up from US$5.5 billion.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The sharpest YoY decline was in the venture capital (VC) funding sector, which reached US$401 million across 13 deals. This compares with US$2.1 billion across 18 deals in Q1 2023, an 81% YoY decline. VC funding also fell 68% sequentially, from US$1.3 billion in Q4 2023.

70% of all VC funding for the quarter went to downstream solar companies; US$283 million in 10 deals. This reflects and expands on a trend reported in Mercom’s results for the first nine months of 2023, where downstream companies accounted for US$3.8 billion of the US$5.7 billion total VC funding.

Mercom suggested that the contraction in upstream VC spending is a result of low module and component prices and overcapacity, particularly in China. This echoes a Bloomberg New Energy Finance (BNEF) report from earlier this year that said investment in solar manufacturing had already exceeded the level needed to meet demand through 2030.

Raj Prabhu, CEO of Mercom Capital Group said: “Although a crash in Chinese module prices has spurred demand, it has made investments in manufacturing projects unattractive, even with incentives. VC investments were down, and M&A activity continues to be subdued. Given the current market conditions, it wouldn’t be surprising if the recovery is delayed further in conjunction with rate cuts.”

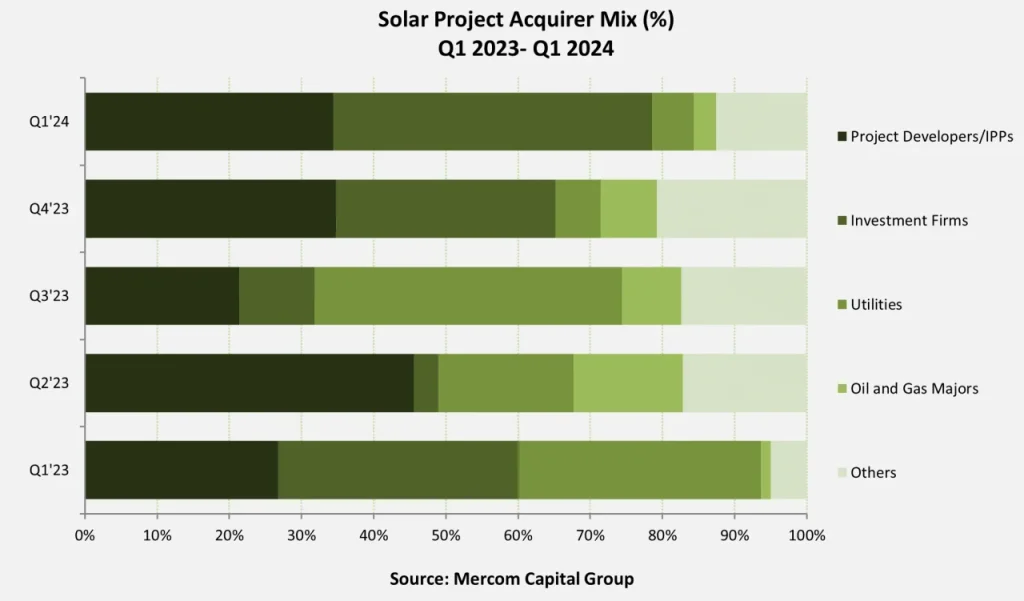

The number of merger & acquisition (M&A) deals stayed level from Q4 2023 but dropped by around 22% YoY. 21 deals were signed in Q1 2024 representing almost 10.8GW of project capacity. Of the M&A deals, 18 were signed with downstream companies, one with a balance of system company, one manufacturer and one service provider.

Of the parties active in solar acquisitions from January through March 2024, investment firms and funds were the most active with 4.4GW of projects taken on board. Project developers and independent power producers (IPP) came second with 3.5GW, followed by electric utilities (1.3GW) and oil and gas majors with 309MW.

Public market financing reached US$1.4 billion across six deals in Q1, down 39% YoY from US$2.3 billion in Q1 2023. Compared with Q4 2023, public market financing rose more than six times over from just US$195 million.

Prabhu said that the general downward trend for the sector in Q1 was a result of global inflation and supply chain issues. He said: “The solar sector is experiencing peak uncertainty and a challenging investment climate. The sector is grappling with multiple hurdles, including the likelihood of prolonged high-interest rates, higher labour and construction costs due to inflation, and supply chain issues, coupled with trade disputes and tariffs.”