Policies in the EU and US to impose a carbon price on imported materials and goods will inevitably hit solar manufacturers. Corrine Lin and Sherry Hsu assess where these costs will land and how the industry should be adapting in preparation.

The EU’s Carbon Border Adjustment Mechanism (CBAM) and the US’ Clean Competition Act (CCA) have gradually come into the spotlight in the solar industry amid the world’s increasing commitment to the low-carbon transition. Despite having had little impact thus far, some businesses are actively gearing up for the potential impact of the two policies.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

CBAM: Heading towards new challenges

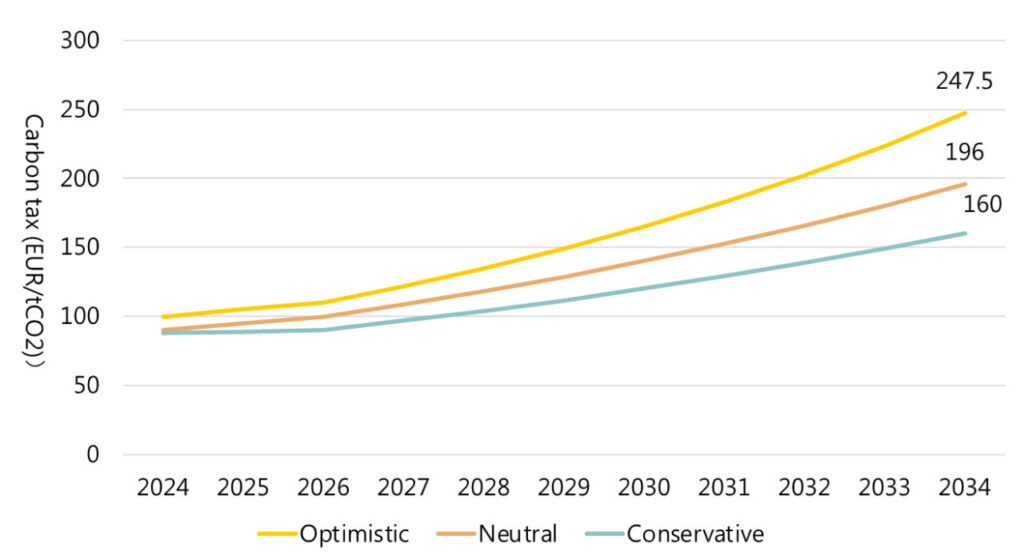

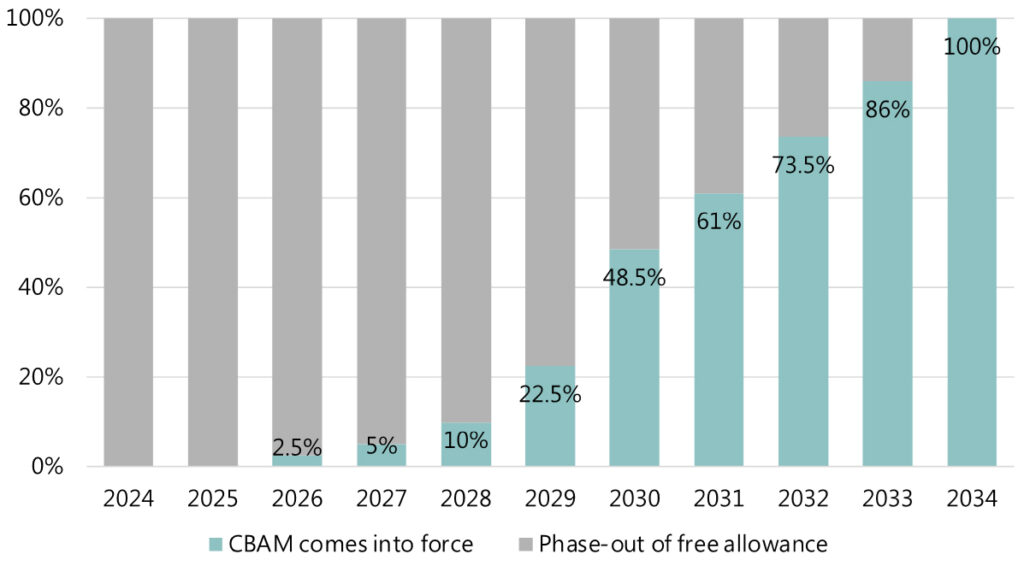

The CBAM regulation will enter into force on 1 January 2026, regulating the cement, steel and aluminium industries. Companies importing the covered goods will be required to pay a carbon price via CBAM, while the phasing-out of free allowances under the EU emissions trading scheme will take place in parallel. Although the EU’s carbon tax does not cover the solar industry, the policy will still impact the industry in the long run. The graph below presents the CBAM carbon price trend until 2034, which is expected to come in at €160/tonne at the lowest under a conservative scenario. If factoring in the possibility of regulation becoming stricter, more industries being covered, and allowance-driven demand, carbon prices could hit €200/tonne at the highest. It’s also worth noting that free allowances will be phased out completely in 2034, meaning that companies in the future will bear full responsibility for their emissions. Against this backdrop, it’s critical for companies to manage carbon cost risks.

Although the full scope of CBAM regulation has yet to come into force, several companies have started optimising their manufacturing processes and improving the carbon efficiency of their products in response to potential requirements on solar products by CBAM. A new generation of low-carbon modules is on the rise, which with a higher efficiency and lower carbon footprint will not only comply with the new regulation, but also meet market demand for clean energy. Meanwhile, the implementation of CBAM will make carbon price fluctuation even more sensitive, thereby affecting the costs of solar products. Therefore, enhancing carbon risk management will ensure the competitiveness of companies.

Clean Competition Act: Welcoming advanced solar technology

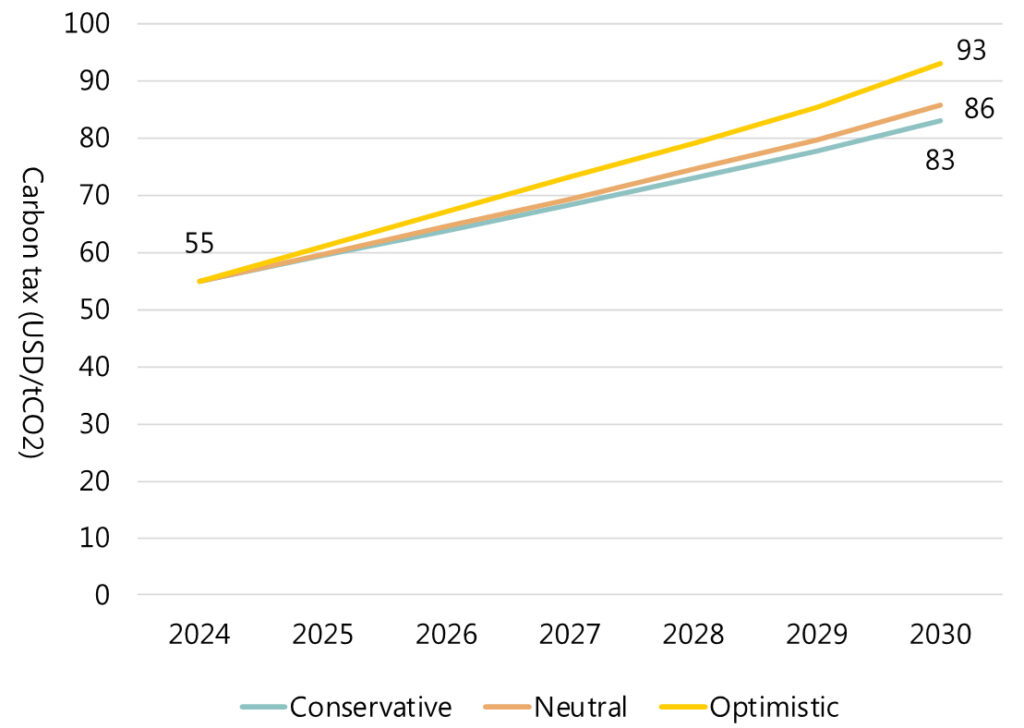

While it remains uncertain the real impact of CCA, the US’ policy direction for the low carbon transition is quite clear, meaning that the solar industry has to prepare for the impact. In contrast to CBAM, CCA provides a longer notice period and covers wider industries. Moreover, the US policy does not offer a free allowance, which will create more shocks to imports to the US in the early stage. The graph below shows the forecast for carbon tax from 2024 to 2030. The initial price is set at US$55 per metric ton of CO2 equivalent starting from 2025 and would increase at 5% above inflation per year. The calculation is based on the 2% inflation target of the Federal Reserve System, and it’s expected that by 2030, carbon prices will reach US$80/tonne under a conservative scenario and may exceed US$90/tonne in the future.

To reduce carbon costs caused by emissions, it’s more feasible and effective to invest more efforts in cutting carbon emissions from products. Some pioneering solar companies have invested in technology R&D and production processes, such as higher efficiency cells, advanced manufacturing processes and environmentally friendly materials. Such technology upgrades not only help companies comply with regulations but also give them a more competitive edge to stand out in the market.

Impact of CBAM and CCA on solar product costs and profits

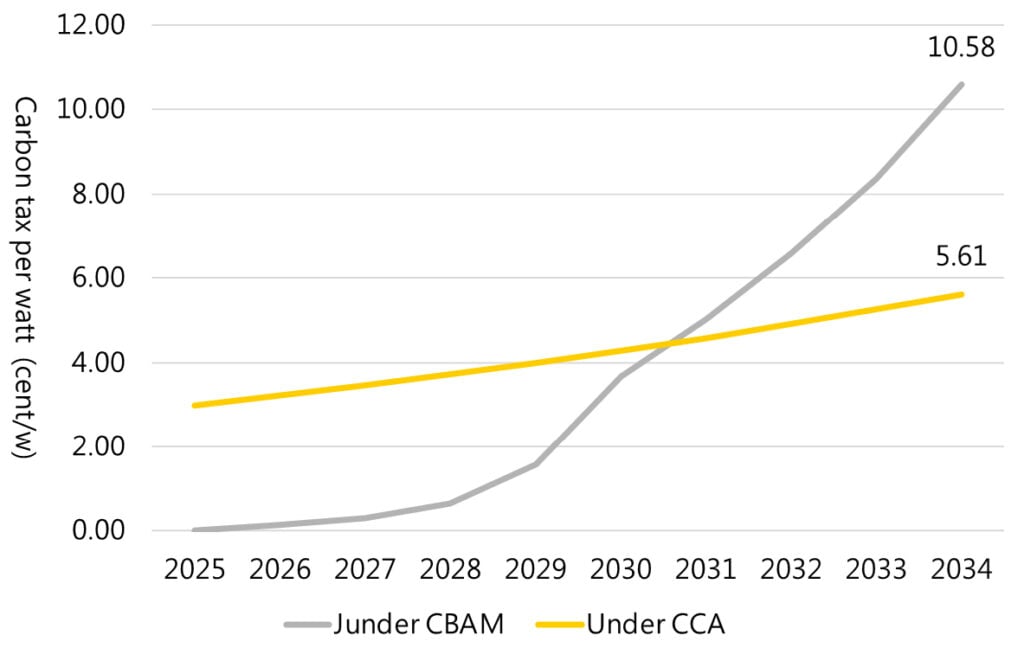

From a policy-making perspective, CBAM and CCA are highly likely to have a direct impact on different products, meaning that the carbon tax will directly add production costs to products. Based on the carbon footprint statistics of modules from different countries, the current carbon footprint of products is around 500kg of carbon dioxide per kilowatt, which is used as the index for the following calculation. The graph below presents the additional cost for each watt under the carbon tax regime and the calculating parameter includes a carbon tax that will increase annually, a free allowance that will decrease gradually, a policy that will become stricter and a gradual improvement in module efficiency. The figure shows that the impact of CBAM will manifest significantly from 2030 but before that, the impact of CCA is more profound, which brings an additional cost of US$0.04 per watt.

The reason why there’s such a difference is that most climate targets are set for 2030, which is expected to see the EU making big adjustments to the policy by then, as more industries will be covered, carbon prices become higher and the free allowance is cut by 26% (see the graph below). As a result, it’s expected that carbon tax will bring an additional cost per watt of US$0.10 by 2034. In the long term, module cost structures may consist of mainly carbon emissions instead of production costs.

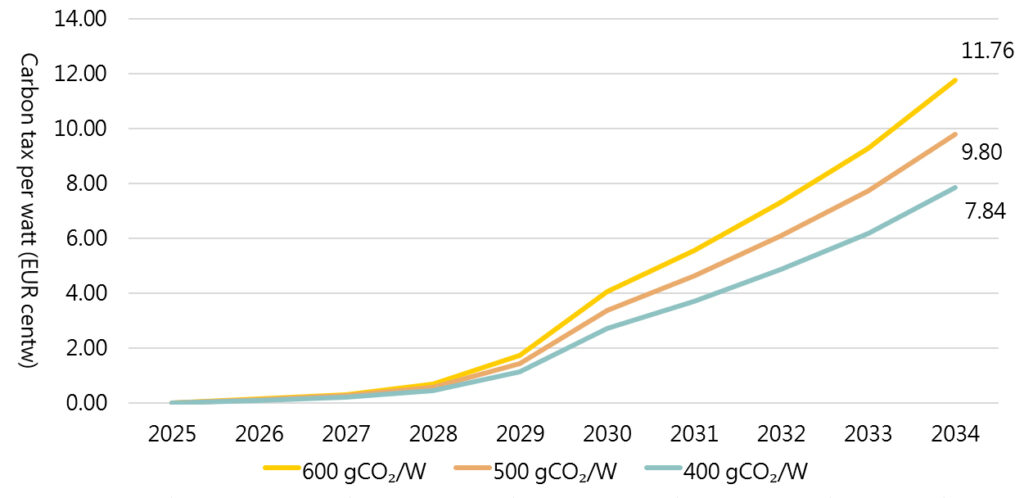

Examining the impact of a carbon tax on different products, the graph below shows the cost changes under CBAM for modules with different carbon footprints (600g CO2/W 500g CO2/W; and 400g CO2/W). It can be seen that the gap in carbon tax cost between modules with 400g CO2/W and those with 600g may reach nearly €0.04/W by 2034, which means that products with lower carbon emissions receive less impact from the carbon tax, and thus low-carbon products will enjoy a significant advantage in the future.

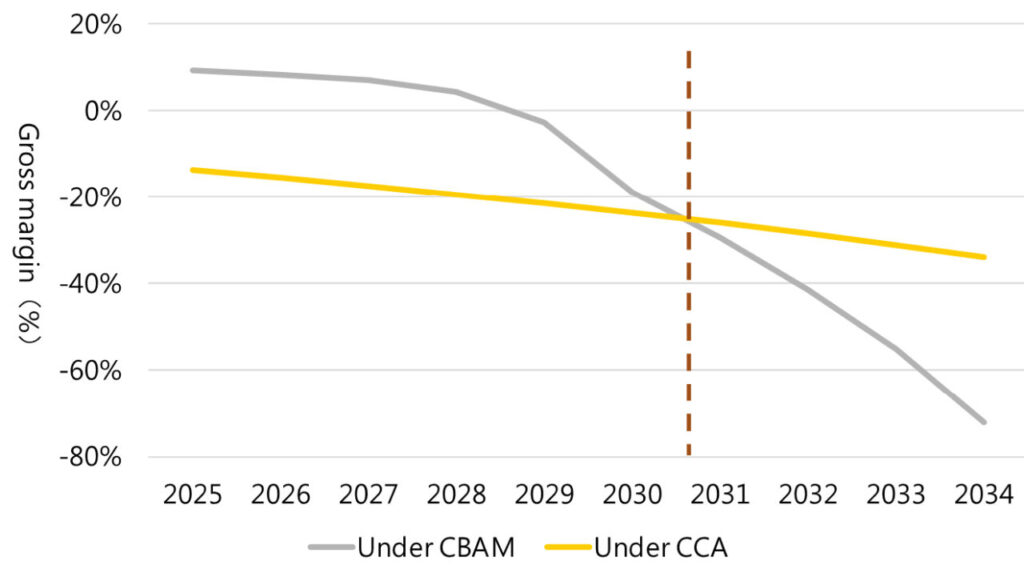

Looking at product profitability, the graph below shows the impact of the carbon tax on modules’ gross margin. The calculation here is based on the condition of fixed costs and prices. It can be seen that the impact of CCA will become pronounced from 2025, with carbon costs significantly affecting the gross margin of solar products. Businesses should prepare actively for the impact. Under the CBAM regulation, 2030 will become the cross-over point for the two, where the impact of CBAM on gross margin will surpass that of CCA significantly and widen with time. In light of this, manufacturers will be put in a dilemma between lowering costs or raising product prices in the future.

Looking ahead: Low-carbon solar era

As carbon policies across the globe have yet to have a direct impact on the solar industry, most solar companies have little experience in carbon management. However, carbon taxes, regardless of which mechanism, will impact the profitability of solar products in the coming years. Factoring in carbon emissions, carbon trade, or increasingly stricter policy, a carbon cost is inevitable. Solar companies should start planning for carbon management by making an inventory of their product lifecycle, including polysilicon, glass and aluminium frame materials, as well as their manufacturing process, transportation, usage, disposal and recycling to track the embedded carbon footprint and work towards producing low-carbon modules with less than 400g CO2/W. The following are some of the most discussed issues in the industry currently:

Green factory design

The large profits of solar manufacturing and the rapid increase in solar installation in recent years resulted in the enormous growth of solar capacity between 2022 and 2024. China and Southeast Asia saw numerous new factories, while solar manufacturing started increasing in the US. Green factory design is one key element of green manufacturing. Manufacturers can factor in basic infrastructure including building, lighting and equipment, as well as the energy for powering the factory and environmental emissions in the early design stage of the factory. For instance, manufacturers can cut the carbon footprint of their products significantly in the future by using renewable energy for polysilicon and ingot growing segments that take up a higher share of electricity consumption, or consider emissions factors when selecting factory sites.

Some are also exploring how to use renewable energy effectively by integrating energy storage and pairing it with micro-grid technology to make the whole manufacturing park low carbon. As the application of energy storage needs to factor in the existing energy system and the condition of energy usage, it will be more cost effective if manufacturers could consider these factors in the early design phase.

Re-examination of raw materials use

Currently, polysilicon accounts for more than 50% of the total emissions of mainstream bifacial modules, followed by glass at 10%. Since granular silicon produced using Fluidised Bed Reactor (FBR) technology performs better in terms of carbon footprint, leading FBR manufacturers have been ramping up capacity in recent years, driving up the market share of granular silicon during 2023 and 2024, from 5-10% to potentially hitting 15% this year. Manufacturers could reduce their carbon footprint further if they manage to increase the proportion of granular silicon in the ingot growing process in the future. The industry is also engaging in R&D in thinning glass and wafers.

The aluminium frame also accounts for higher emissions embedded in modules, sitting at around 8%. Manufacturers are also exploring other low-carbon materials for replacement, such as compound material frame technology.

Process optimisation

Wafer-thinning technology has advanced markedly as polysilicon prices skyrocketed in recent years. The mainstream thickness has been thinned down from p-type’s 170μm to the current n-type’s 130μm, making a significant contribution to carbon reduction. In addition, n-type TOPCon has replaced PERC in the second half of 2023 to become the next generation of mainstream cell technology; TOPCon’s higher efficiency can also improve products’ carbon emissions. In terms of low-carbon modules that have achieved mass production, most of which use low-temperature processes, theoretically HJT has greater potential for thinning wafers further in the future.

Product recycling

While solar recycling is in its infancy and has yet to form an industrial chain, the topic has been increasingly discussed since 2023 as the volume of waste modules has increased along with rapidly growing solar installations for over a decade. At present, the EU has formed a committee to assist members with dealing with waste modules. China and Southeast Asia, the manufacturing hubs, are expected to follow suit to increase the ratio of waste module recycling. Meanwhile, the industry needs to form professional recycling units for hazardous waste.

To gain competitiveness through low-carbon solar, manufacturers must also consider transportation as well as products with a lower proportion of embedded emissions since every ton of emissions would be reflected in costs in the era of carbon prices. Manufacturers must cut emissions in all aspects to optimise product effectiveness.

Corrine Lin is chief analyst at InfoLink Consulting. She has spent more than six years conducting in-depth research and analysis on the solar PV supply chain, technology trends, and capacity utilisation.

Sherry Hsu is a researcher at Reccessary, a media platform focusing on renewable energy and carbon market information and trends in the Southeast Asia region.