Aiko Solar has been celebrating its 10th anniversary in 2019 and has become the largest merchant solar cell producer in the last few years, focusing on high-efficiency cells, notably mono-PERC (Passivated Emitter Rear Cell] production, and is the first-tier producer of this cell type in 2018.

Aiko Solar also stands out in the merchant cell market for being a major supplier to the vast majority of the ‘Solar Module Super League’ (SMSL) in and outside China and many other module manufacturers around the world.

The company has expanded rapidly in recent years, notably due to the shift by Chinese PV manufacturers away from fully-matched capacity, which started with de-integration of capital intensive polysilicon and wafer production towards ‘asset-lite’ emphasis on in-house PV module production, while limiting in-house cell production as confidence in China-based merchant cell producers, such as Aiko Solar, increased exponentially.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Business cooperation has been formed with the likes of LONGi Green Energy, supplying monocrystalline wafers and being returned as high-efficiency cells for LONGi Solar, which has followed the asset-lite formula with higher in-house module assembly capacity, compared to in-house cell capacity.

With SMSL members as customers, Aiko Solar is uniquely positioned to understand and inform on key trends in the upstream manufacturing sector, not least on significant larger wafer transition underway but also on emerging cell technologies such as bifacial cells.

PV Tech readers should also be familiar with Aiko Solar’s vice general manager, Michael Ho, whom has been interviewed by PV Tech several times in recent years. A veteran of the semiconductor industry and now the PV industry, Mr Ho is a calm and collected executive that does not need to hype topics under discussion and proved to be an expert presenter at Aiko Solar’s anniversary customer dinner at SNEC.

PV Tech recently sat down and discussed a number of topics with Mr Ho, some printable, some not so but all interesting, nonetheless.

Where is Aiko Solar with mono-PERC and bifacial customer demand?

Michael Ho: “Our G1, M4 and M6 [wafer size] cells are highly valued by our customers for producing modules above 400Watt peak. Since the second quarter of 2019, our solar cell shipments exceeded five gigawatts with PERC (Passivated Emitter Rear Cell) bifacial cell shipments of over two gigawatts, enabling us to become the largest supplier of PERC bifacial cells.

We are expected to continue a major shift from monofacial PERC cells to bifacial through the end of the year, accounting for over 70% of capacity as supply and demand continues to grow for PERC bifacial products.

The ratio of our overseas bifacial cell shipments will increase significantly in the second half of the year to focus on demand in Europe and Asia for a number of customers with bifacial projects being built.”

The company announced major long-term cell capacity expansion plans a few years ago. Could you provide an update on those activities?

“In the second quarter of 2019 we have the production launch of our next generation of advanced PERC cells at the Phase 1 of the Tianjin facility with a nameplate capacity of 3.8GW.

Total cell capacity, including the Tianjin facility is 9.2GW. In 2018, we shipped around 3.9GW of cells, giving us 167.6 percent growth. Based on expected demand our shipments are forecasted to upwards of 6.6GW in 2019, giving us around 70% growth year-on-year.”

Potential adoption of bifacial and bankability issues remain but your description of market growth indicates adoption rates in Europe maybe slower but overall adoption rates are increasing strongly?

There are three major end-markets (applications) for PERC bifacial cells. The first one is glass/glass modules. In the United States and South America and the Middle-East, will be the product of choice in utility-scale projects. Harsh environments, overall long-term performance are some of the key factors.

The second market is ‘single’ PERC cells with backsheets, major PV manufacturers such as JA Solar and Trina Solar have heavily transitioned cell production to bifacial cells still being used in monofacial module applications, giving them cost advantages due to the scale of bifacial cell production. These type of modules have all been qualified and certified as single cell modules.

However, not every module supplier can pass all the type testing and certification of this module type. JA Solar is leading in the field.

A third application is PERC bifacial cells with a transparent backsheet, led by JinkoSolar with some initial projects in some overseas countries. This product received an innovation award at this year’s Intersolar Europe, believed to be the first time a Chinese module manufacturer received an innovation award for PV modules. We at Aiko Solar collaborated with JinkoSolar’s R&D department for this module.

“On a geographical basis our PERC cell shipments go to Japan, South Korea, parts of Europe and North America. Increasingly, shipments will be bifacial cells in the second half of the year as customers such as JA Solar have strong demand for these products. Bifacial PERC cell shipments will be over 2GW and mono PERC cell shipments will be over 3GW this year.

We expect the overall split [2019] between mono PERC and bifacial to be a 60 to 40 percentage split, respectively.

At our Guangdong facility we retrofitted 1.6GW of multicrystalline cell capacity to Mono PERC to meet customer demand. Only a few months after this shift some former multi cell customers shifted to the mono product.

At Yiwu, eastern China plant expansion is 3.8GW. Phase two and three expansions in Yiwu are under construction with plans for Phase two to be in production in Q1 2020. We hope Yiwu Phase three expansion can be ramp in the second half of 2020.

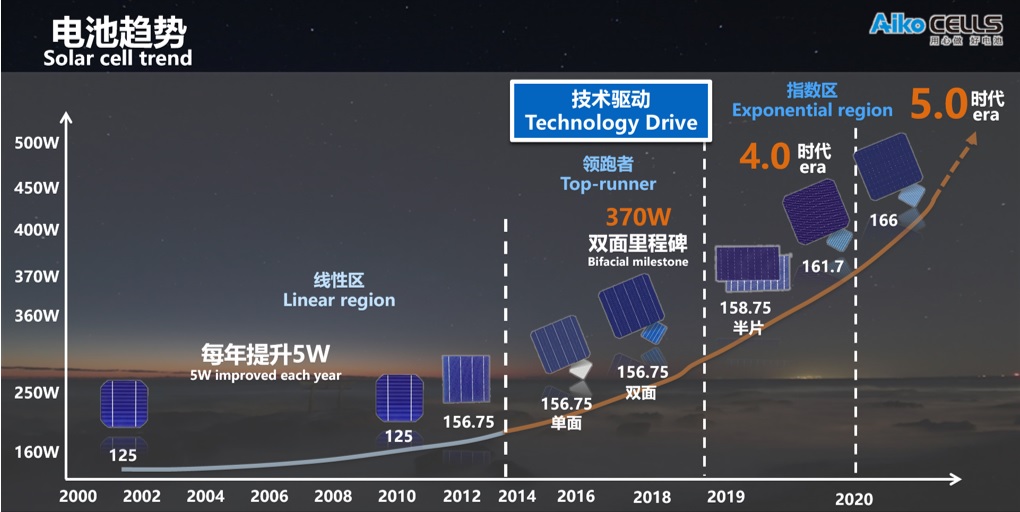

Mono PERC cell efficiencies are a key driver of demand as we have achieved high efficiency cells with high-volume with efficiency of 22.5%. We have seen the likes of Trina Solar, Jinko Solar, JA Solar, Canadian Solar, Hanwha, Longi, Suntech and other major module companies demonstrate and release modules well above 400Watt and some a 450Watt, which is huge.

With the rapid transition to larger wafer sizes, how is this affecting the company when a number of your customers are using a range of larger wafer sizes?

Companies like JA Solar are producing inhouse wafer size of 158.75mm pseudo square wafers, however they prefer us to supply cells in full-square configuration and are expected to go to the M4 (161.75mm) wafer size. Several others such as Trina will shift to G1 and M6 while Hanwha will shift to M4. We are therefore transitioning production to M4 wafers and to multi-busbar technology in Q4 this year.

With respect to LONGi Solar, they are using the 166mm wafer size, while the likes of Canadian Solar will use the 166mm wafer size but this will be with p-Type multicrystalline cells as well as and also monocrystalline cells.

hat means that our Tainjin base will be focused on 166mm cell production, dedicating production plants to different wafer sizes. The Yiwu base will become dedicated to wafer sizes above 158.75mm, while Guangdong base is used for M2, G1 and M4 wafer sized cell production.

The larger 166mm wafer size and above will use new furnace tools to accommodate the larger wafer dimensions with the expansions of Phase two and three at the Yiwu base. Process deposition uniformity wafer to wafer and batch to batch are reasons for this approach with new tools. We also discovered in development that we can achieve tighter specifications and improved cell efficiencies over M2 wafers, for example, something we didn’t initially expect, yet greater purity is also being offered with the larger wafer sizes.

The goal for cell conversion efficiencies by year-end will be 22.8% with a 158.75mm full-square wafer with multi-busbar technology. We also have high-expectations for the G1, M4 and M6-based half-cut cells.

An area we haven’t discusses with the transition to larger wafers is automation. What automation strategies are you adopting?

One example is that we are using automated wafer carriers for buffering tool to tool. At our Yiwu base we have around 300 AGVs (Automated Guided Vehicles). Other plants such as Tainjin have even more advanced AGVs. Such facilities are designed for automation as there is a learning curve to achieve higher levels of automation. And, of course we are adopting Industry 4.0.