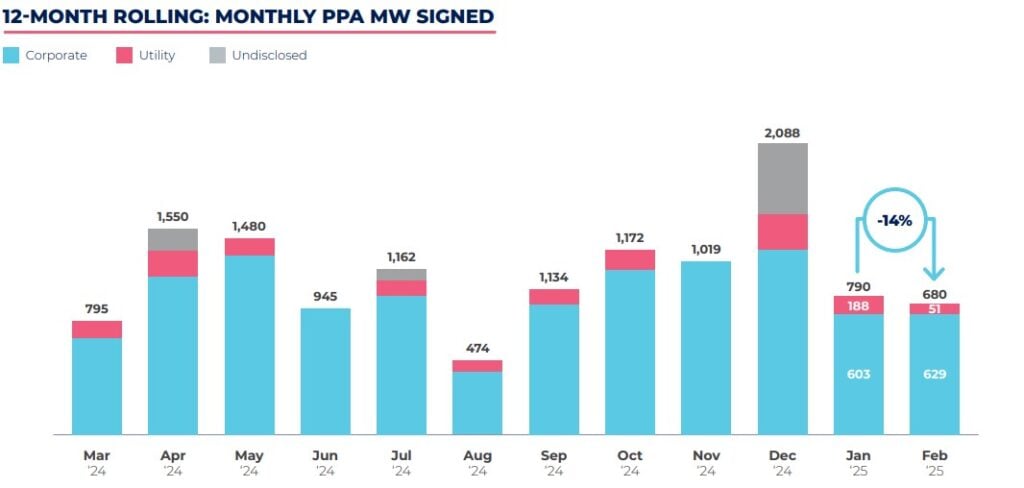

Europe saw a 4% month-on-month decline in number of power purchase agreements (PPAs) signed in February 2025, alongside a 14% month-on-month drop in the total capacity of power generation signed for.

This is the second consecutive month that both figures have fallen, and is a key conclusion to be drawn from Swiss consultancy Pexapark’s latest monthly ‘PPA Times’ report, which covers the European PPA space in February. In total, European companies signed 24 publicly announced deals, for a total of 679.8MW of electricity generation capacity.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This slowdown in dealmaking has been driven by a generally more conservative outlook among European energy investors and offtakers, which was reflected in many of the discussions at this year’s Solar Finance & Investment Europe event, held in London in February. Two of the event’s attendees, James Pinney of Cubico Sustainable Investments and Kevni Iljazovski, general counsel at St. Jørgen, spoke to PV Tech Premium in the days following the event, and Pinney pointed out that “significantly rising interest rates” and market contraction had encouraged investors to be more careful with their capital.

This is particularly evident when comparing February 2025 to February 2024, where Pexapark reported record figures for both the number of deals signed, and the total capacity for which agreements were struck. From February 2024 to February 2025, the number of deals fell by 55%, while the total capacity contracted fell by 73.5%.

Falling average PPA prices

This decline is mirrored by a similar fall in the average power price agreed upon within these PPAs. Pexapark’s EURO composite figure for the continent saw average PPA prices of €50.25/MWh (US$54.35/MWh), a 4.3% month-on-month decline from January of this year. In January, Pexapark reported a slight month-on-month increase in composite PPA prices, but this trend has now been reversed, due to what the company calls “mild temperatures” and a “bearish gas market” throughout the month.

There was also considerable regional variation in the average PPA prices being signed, with Portugal seeing a 10.9% month-on-month decline in average PPA prices. Pexapark noted that this is partially due to the methodology used to collect pricing data – the consultant points to a “calibration” of PPA reference prices based on “the latest price evidence collected” – that has seen the average PPA price for all solar PV deals lowered.

Still, this is a significant month-on-month decline, and Portugal was just one of several European regions to see a fall in average PPA price. The only region to see an increase was the Nordics, which reported month-on-month growth of just 0.6%, following a January period in which mild weather and strong hydropower generation pushed prices lower.

The report also notes two key milestones seen in February. One is the signing of the longest-term PPA in history, with developer Innova signing a 40-year deal for a 15MW Welsh solar portfolio.

The other is that, since multi-buyer PPAs were first tracked in 2016, Pexapark has now recorded 21 such deals taking place across Europe. The increasing popularity of such agreements reflects another topic discussed by industry leaders earlier this year, the need for financing structures to be more flexible, and that they have taken on greater complexity, in an investment environment that is more cautious than in previous years.

PV Tech’s publisher Solar Media will host the Renewables Procurement & Revenue Summit on 21-22 May 2025 in London. The event will explore meeting Europe’s energy demand, the role of data centres in the energy transition, the outlook for European power and PPA prices and more. For more information, go to the website.