PV module prices dropped in Europe in December 2024, while the European PV sector remains optimistic about the industry’s long-term growth.

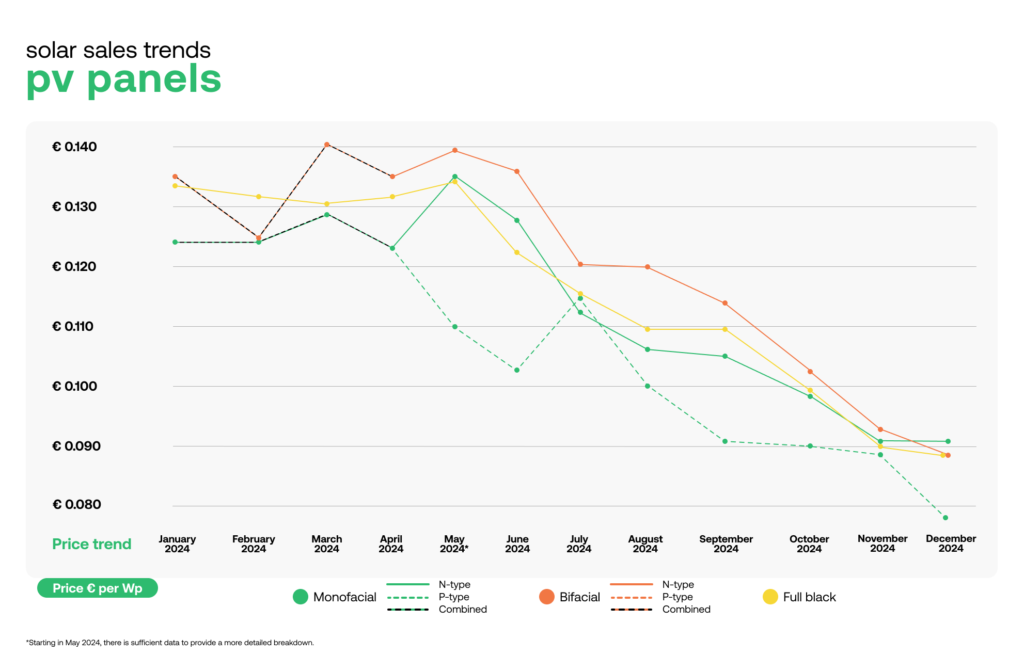

These are the key takeaways from sun.store’s latest pv.index report published last week, covering pricing trends and industry sentiment in the European PV sector. Compared to November 2024, module prices remained consistent or fell in December 2024. P-type monofacial modules saw the largest price decrease, falling 13% month-on-month to €0.077/Wp (US$0.080/Wp), as shown in the graph below.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

While p-type monofacial modules have been the cheapest panel type per watt in Europe since August 2024, the decline in prices is notable compared to other module types. N-type monofacial modules, for instance, saw prices remain steady at €0.091/Wp, while bifacial n-type modules and full-black modules saw price declines of 5% and 2% respectively, both reaching €0.088/Wp at the end of the year.

According to sun.store, this reflects a “buyer’s market” in Europe, with the wholesaler expecting the combination of low-cost products and a high demand for solar modules to drive greater product sales in the early part of 2025.

While this is good news for buyers, concerns have been raised that the rapidly declining prices across the European solar sector have led to a severe oversupply of products. Daniel Schmitt, CEO of Bavaria-based equipment supplier Memodo, said at last year’s Intersolar event that the price collapse in Europe has become “crazy”.

Fluctuations in inverter prices

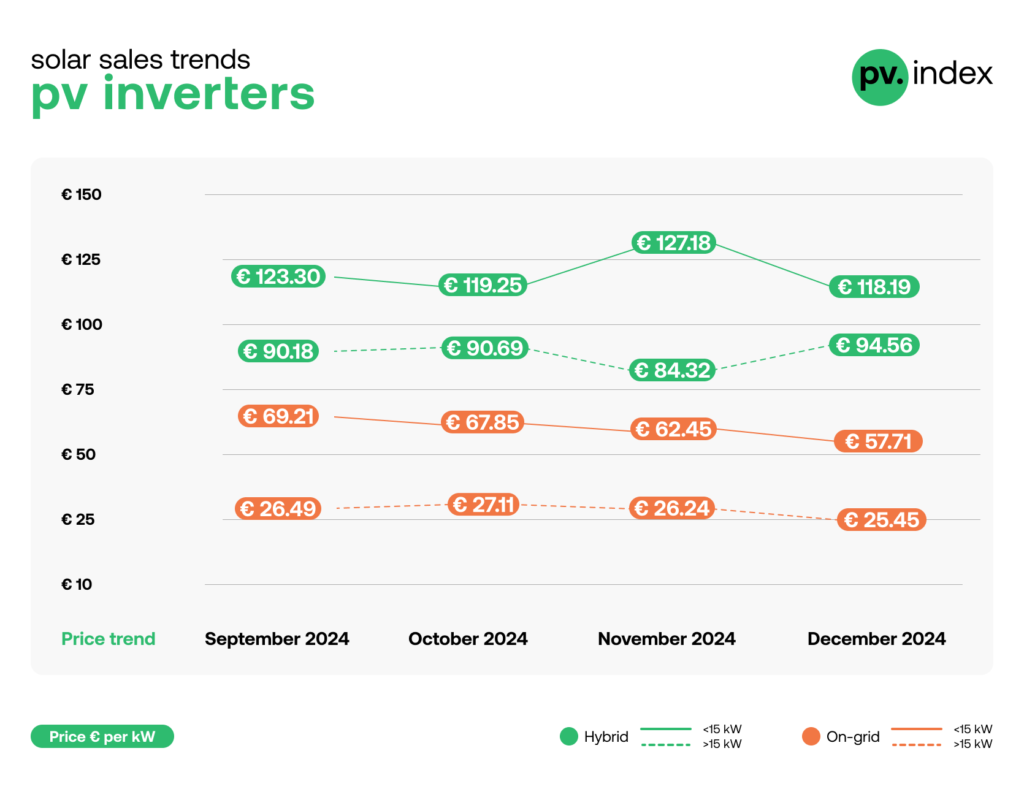

There is a less clear trend in the inverter sector, with sun.store reporting both increases and decreases in inverter prices from November to December. Hybrid inverters smaller than 15kW, for instance, saw prices decline by 7%, to €118.19/kW, while inverters larger than 15kW saw prices increase by 12% to €94.56/kW, which sun.store notes reflects a shift towards buyers looking for larger inverters.

These prices are the lowest and highest respectively in the last four months, as shown in the graph below. The graph also shows how, in the on-grid inverter sector, prices have been more consistent, with three consecutive months of falling prices for both sizes of on-grid inverters, with inverters smaller than 15kW reaching an average price of €57.71/kW and larger inverters reaching an average price of €25.45/kW.

According to sun.store, the relative stability of price declines for on-grid inverters reflects sustained interest in the residential sector, where smaller inverters are more common, and the utility-scale and larger commercial and industrial (C&I) fields, where larger inverters are more frequently used.

The wholesaler also noted that, across Europe, Sungrow was the most popular manufacturer of smaller inverters, while Huawei was the most popular manufacturer of larger inverters. JA Solar products led the panel market, sun.store said.

Storage to feature in a growing industry

The general sentiment in the European sector is largely positive, according to sun.store’s PV Purchasing Managers’ Index (PMI), which compiles purchasing intentions from the company’s database of more than 20,000 users. A score greater than 50 indicates that the sector broadly believes the industry will continue to grow in the coming months, and the PV PMI for December reached 67, a slightly decline from the 68 reported in November.

Notably, the PV PMI has remained above 50 throughout the year, despite concerns surrounding module oversupply, the “very fragile situation” of European manufacturing and the well-documented struggles of leading European solar companies, such as Meyer Burger. This is shown in the graph below, alongside a breakdown of the percentage of respondents to a sun.store survey as to whether they expect to buy more, less or the same number of solar products next month.

The graph shows that in each month of 2024 at least half of respondents expected to buy more solar products in the following month, and that the PV PMI was above 50 for the entirety of the year, positive developments highlighted by sun.store’s leadership.

“The slight decline in PMI is expected during the holiday season,” said Filip Kierzkowski, head of partnerships and trading at sun.store. “However, the consistent level of demand underscores the strength of Europe’s solar market. December’s activity indicates that buyers are strategically preparing for a robust start to 2025 by capitalising on competitive year-end deals and securing high-quality components.”

Looking ahead, sun.store co-founder and CEO Agata Krawiec-Rokita said that she expects there to be “a greater focus on energy storage solutions and hybrid systems” in European solar, in part to combat well-documented challenges with the continent’s grid systems. Over the Christmas period, Krawiec-Rokita spoke to PV Tech in greater detail about the prospects for European solar in 2025, including these grid challenges, negative energy prices and uncertainties regarding the global supply chain.

Solar Media will host its annual Solar Finance & Investment Europe event in London on 4-5 February 2025. This event annually attracts infrastructure funds, institutional investors, asset managers, banks and development platforms at the forefront of European renewables; the vast majority of which are responsible for billions in active and prospective investments in the Europe’s energy transition. For more details, visit the website.