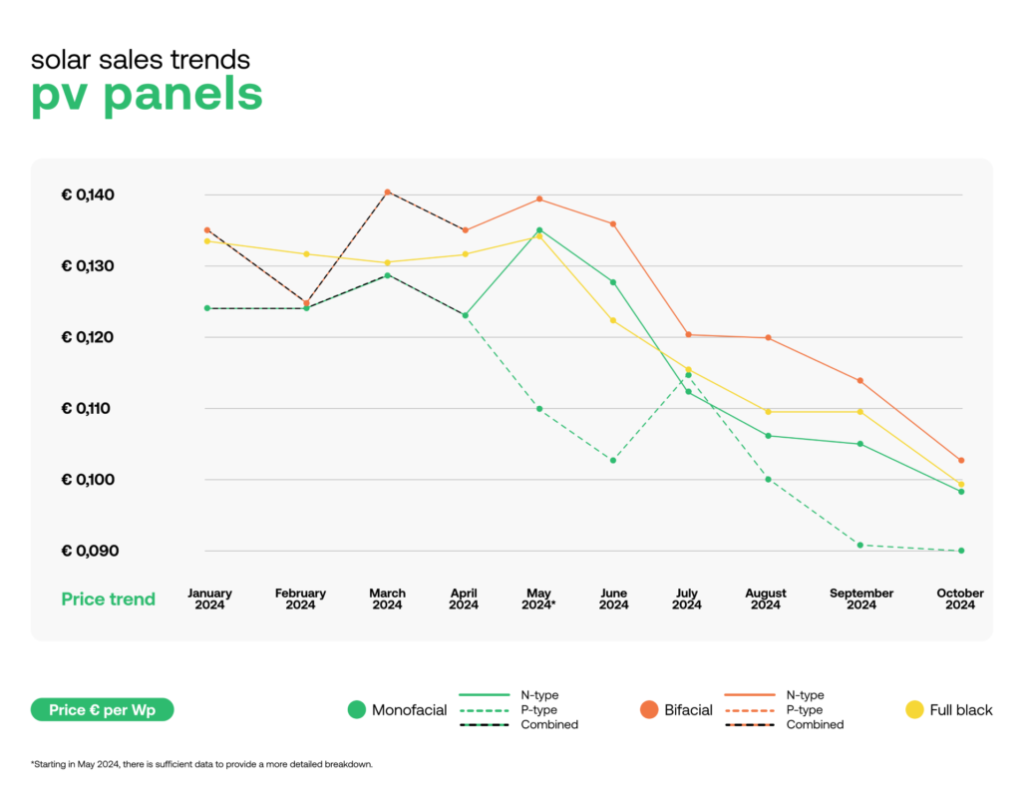

The price of solar panels in Europe has declined for a sixth month in a row, according to the latest pv.index report.

Released by solar wholesaler sun.store, the pv.index report for October showed the biggest price decline in n-type monofacial modules, with a 15% drop from September to an average of €0.098/Wp (US$0.107/Wp). N-type bifacial modules have also had a double-digit decline (10%), from €0.114/Wp in September to €0.103/Wp.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The continued oversupply of solar modules and strong competition among suppliers have led prices to continue their downward trend initiated in May 2024, as shown in the chart above.

“Overall, we saw a continued downward trend in solar component prices across most categories, highlighting a market adjusting to seasonal shifts and inventory dynamics,” wrote sun.store in the report.

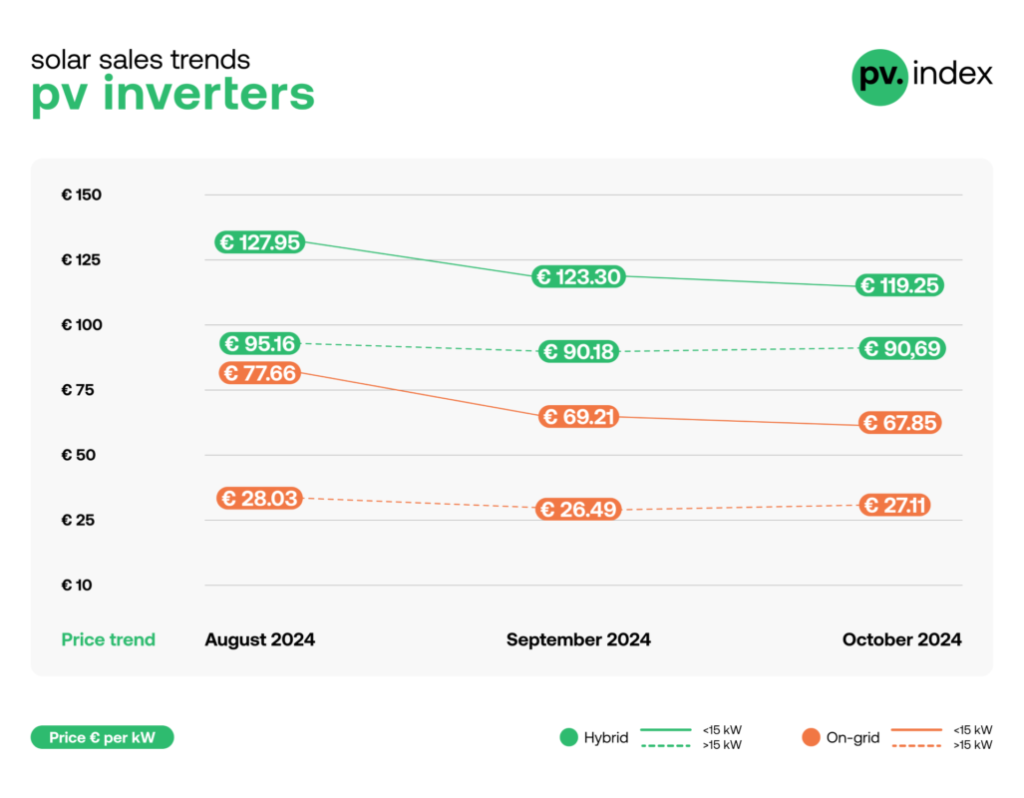

Steady decrease in inverter prices

Included for the first time in its pv.index report, inverters have seen a similar trend to solar modules, with prices steadily decreasing over the past three months. Although larger systems have seen a slight price rise – such as on-grid inverters over 15kW, which saw a 2% rise – driven by a preference towards higher-performance brands. There is a similar trend for hybrid inverters over 15kW, with a shift towards premium brands. Prices for on-grid inverters over 15kW increased to €27.11/kW from €26.49/kW, said sun.store.

A lower-than-expected demand from the residential market, along with constant oversupply, pushed prices down for hybrid inverters less than 15kW. Over the last three months, prices decreased by 7% from €128/kW to €119.25/kW.

Krzysztof Rejek, head of business development at sun.store, said: “The trend of module stock devaluation continues with sellers trying to increase their sales figures. We expect that situation to remain actual especially due to upcoming Black Friday promotions and year-end clearances.

“This trend allows buyers to secure top-quality components much below regular costs, fueling demand and opening up new opportunities for projects across Europe. We anticipate these attractive prices will continue, providing a unique chance for our users to capitalize on some of the best deals of the year.”

Cautious optimism from European buyers

Alongside continued price drops, the pv.index report indicates steady demand with buyers showing confidence and adapting to seasonal shifts. In its PV PMI (PV Purchasing Managers’ Index)—which gauges buyers’ purchasing intentions on sun.store—the rating decreased from 71 to 68. After an increase in September to 71, the PV PMI returned to 68, where it stayed during the months of June, July and August.

As the year comes to an end, buyers are adjusting their purchasing plans, the pv.index said. However, 50% of respondents plan to increase their purchases in November, while 37% will maintain the current levels and only 13% anticipate a decrease in their purchases.

“Seasonal factors, coupled with a reduction in installation activities as winter approaches, have influenced purchasing behavior. However, the industry is still vibrant, and we’re seeing a steady demand for high-quality components,” said Rejek.